A lot of work goes into finding a good development site.

Our Melbourne property development consultants can help you with a detailed feasibility study, but before you progress to that stage, you’ll want a quick method to rule properties in or out.

So, which sites are viable for further consideration? And is the house you're living in a property development goldmine?

Here are the resources you can use to find out.

The first and most important question to ask is ‘What is Possible on the Block?’

You can largely answer this question with information freely available online.

Let’s assume that you’re searching in the right areas, where near-term capital growth is most likely, and you’ve found a property that might suit.

The online advert features an aerial view of the block, the property looks tired, the copy includes references to development (like STCA or Subject to Council Approval), and the price is in your range.

So, what do you do then?

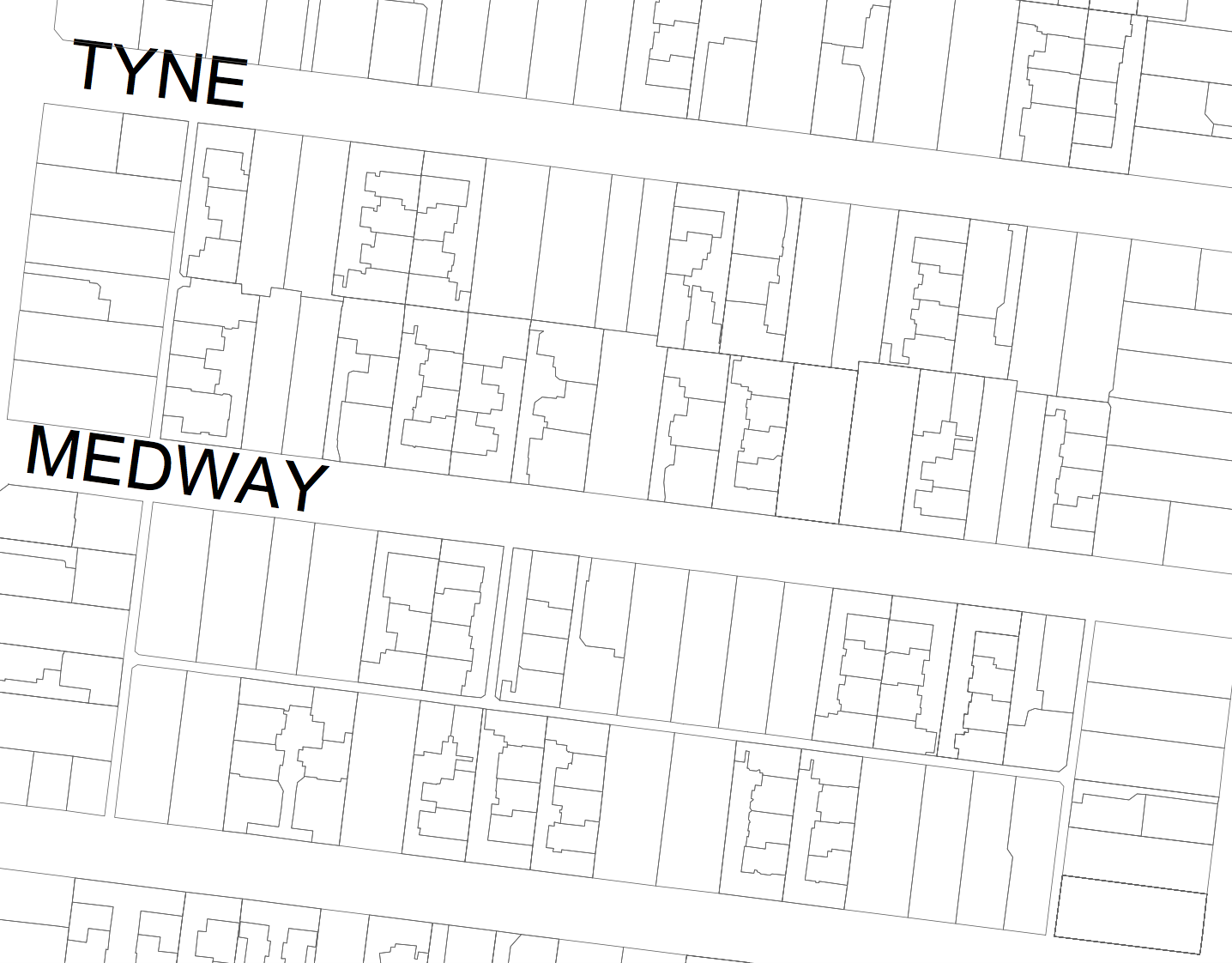

Head to the Victorian Government's Property and Parcel Search website and enter the residential address or parcel details. From here, you can download a Planning Report PDF, which contains a lot of the information you need to determine site potential.

Another useful resource is the VicPlan website. Using this website, you can view information on different blocks in map form, letting you quickly swap between nearby development sites of interest. If you’re wondering how two near-identical properties just 3 blocks apart could sell for dramatically different prices, this mapping tool can often provide the answers.

Your free property report can tell you a lot about zoning and how it pertains to a site's development potential.

Every council is different in how they apply each Planning Zone, but generally speaking:

As well as your Property Report, The VicPlan website also highlights each residential zone with clickable links. Follow the links to learn more about each residential zone and how it is applied by the local council.

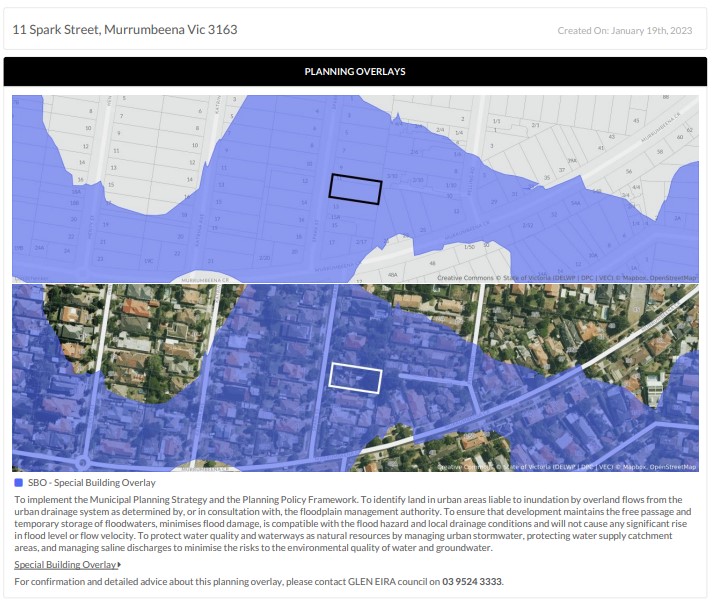

Think of Planning Overlays as a second, more detailed layer. Multiple Planning Overlays can exist on a single Planning Zone, and they’re unique to specific neighbourhoods within each zone (e.g. one block within a GRZ1 area may have a Planning Overlay on it, whereas another block up the road within the same GRZ1 may not). There are plenty of Overlays to be mindful of, but a few more prevalent ones that are particularly relevant to development include:

Once again, you can learn more about planning scheme overlays per council by searching your property on VicPlan and following the links.

If the property you’re considering passes your first few quick tests around Planning Zones and Planning Overlays, I would recommend viewing the property and visiting the neighbourhood.

Carve out 5-10 minutes to walk the streets in search of newly built developments, properties currently under construction, and sites with council advertisement signs in front. Take down the addresses and visit Council Planning Offices to talk specifically about them.

Plans are often available to view, and you can ask whether the local council or VCAT approved the plans. Compare the size and orientation of these blocks with the one you’re considering, and ask if you’re missing anything (e.g. any reason you can’t do this on your block?) Are there any aspects of the design that the Planner would have changed if he had input into the design?

This is a simple way to determine precedent - the likelihood that your development will be approved based on past approvals of similar projects in the same area.

There have been a lot of changes imposed by the state government over the last few years that have affected development opportunities, but logic would suggest that if a similar development has been approved recently, yours can be too!

If you ultimately purchase the site you’re thinking about, visiting similar development sites will come in handy for other reasons. You can contact the architect, builder, and/or real estate agent to get their insights into the project and potentially strike up some professional relationships!

It’s very easy to get lost in all the information mentioned above, and that's before looking at the information mentioned below!

When in doubt, call the Council Planning Office or visit in person to talk directly with a knowledgeable public servant.

You won't receive much in terms of development advice (e.g., how many units can I put on this block), but these contacts are useful in helping you understand all of the publicly available information.

I always talk in detail with Council prior to purchasing a development site for myself or a client. While I'm pretty knowledgeable about zones, overlays, neighbourhood characteristics, etc, I often attend Council offices in person to get the most information possible.

If I still reckon there's something in the site after visiting local council and looking at zones, overlays, and surrounding developments for myself, then I will begin a Project Feasibility Study.

So, now you know about Planning Zones, Planning Overlays, and Precedent. But there are many more features that a property developer should consider when choosing a site. I'm not going to run you through the complete feasibility process, but here are some factors to consider.

You need to know the exact dimensions of the site (length x width). Also consider:

You already know that location is crucial to all development and investment opportunities. We're assuming that you've already chosen the right location for your property development project. If you need help narrowing down your Melbourne development site, you can speak to a buyers advocate serving Brunswick, Kew East and the surrounds.

However, as well as the location fundamentals, there are also other development-specific considerations and concerns.

It should go without saying that the best development sites offer excellent Return On Investment and a strong rate of return.

Before you buy a development site, you should determine the estimated value of the dwelling and the land in its current state. If the value of the dwelling exceeds the value of the land, it is already over-capitalised and may not be suitable for development at this time.

If your property has good development potential, it will tick many of the boxes we've already discussed. To maximise its value, you need to think about how your site should be subdivided and what type of dwellings you want to build (detached houses, semi-detached townhouse projects, etc.)

One way to get a feel for potential return on investment is to look for similar developments and land parcels in the area that have sold recently. What have they sold for, and can you replicate those results? While there's more to it than that, this is essentially what's known as a Comparative Market Analysis.

If you already own the property you want to develop, think of money in terms of equity. Have you paid off your mortgage, do you have a small mortgage, or is your loan still around 80% of the property value?

If you still have a large mortgage but want to take advantage of development potential, you might consider selling your property to a willing developer and pocketing the profits that come from the sale.

If you have little to no mortgage, you can use your equity to fund the property development project. In this case, you might be the ideal candidate to partner with a developer like Property Analytics in a joint venture.

As well as the money you can make, you also need to consider development costs and cash flow, including:

To learn more about how you can make money from property development, click here.

Does your property hold development potential? Let's take a look at a few examples of potential development sites, starting with Nicky.

Nicky owns two neighbouring double blocks in Croydon North, totalling over 5400 square metres.

The land size is huge, and each block is rectangular. This is great because not too much land will be ‘lost’ during the design phase (think about how unusable the three points of a triangular block are when plotting a house).

The amount of vegetation on the site is a bit of a concern, given that large tree protection areas can impact where new dwellings can sit, and how big they can be built.

There’s also a significant slope across the site, which complicates design and increases build costs.

Additionally, the zoning and overlays are really restrictive.

The location also has pros and cons.

Nicky already owns both blocks and has a small mortgage against the property, meaning some of the development finance can be secured against the equity held in the property. This suits me as a Joint Venture partner.

As mentioned above, if Nicky had a larger mortgage, it would make more sense for her to sell to an interested developer who could develop it themselves and keep all the profits.

Despite their challenges, Nicky's blocks have great potential for a high-end, low-density development of large, detached houses. Projected profits for the development would be around $1.4m in addition to the original market value of $2.2m.

I was not able to partner with Vicky as she was not in a position to spend 24 months on planning, permissions, and construction. However, I did assess the property on behalf of a suitable developer client who would be willing to buy. This would allow Vicky to move on from the property as desired, and the new owner could enjoy a profitable development project - a win-win!

Frank approached me about developing his 4600 square metre blocks in Frankston.

The huge, flat blocks have 2 separate frontages and have minimal vegetation to contend with.

The zoning is currently Commercial 1 (C1Z), but Council has approved rezoning to Residential Growth (RGZ1). This will allow for dwellings up to 4 stories in size as opposed to commercial property. There are no Garden Area requirements, and side/rear/front setbacks will be minimal. In short, the proposed rezoning will allow for Medium Density development.

The location is great – within walking distance of shops, transport, and parks/beaches. But, while the immediate surrounds are residential, an industrial area is nearby, which will affect resale values.

Lastly, Frank has very little debt against the property, so the value of the land can go some way to supporting debt attainment, which is appealing to Joint Venture Partners.

The site clearly has good development prospects for multi-level townhouses.

If you think you might be sitting on some potential, or you're shopping around for development sites, do a bit of research into block size, shape, features, zoning, overlays, location, nearby sales, precedent, and other factors.

Also think about finances, whether that's the current ownership status (Loan to Value Ratio), or how you're going to fund all the acquisition, planning, construction, and development costs.

There are no black-and-white rules about what makes for a good development site, so if you think you could be sitting on a development opportunity, please ring me to discuss. Having done this work for 12+ years, I can size up development potential pretty quickly over the phone. I’ll gladly provide some free advice, and if there’s something in it as a Joint Venture development, I'd love to catch up to discuss it further in person. Coffee's on me!

Alternatively, if you're looking for a suitable site for profitable property development, that's exactly what I do as a buyers advocate serving Northcote, Kew and the surrounds. As a property investment advisor in Melbourne, I can help you find properties with future development potential and land that is ideal for developing now, including sites where the plans are already approved!

My name is Andrew Stone from Property Analytics. Click here to learn more about me, and how Property Analytics can help you meet your financial goals through real estate.