If you’re looking for the fastest way to generate huge profits through the real estate market, look no further than property development.

As an investment strategy, property development requires you to navigate significant risks and pony up a large amount of money – probably more than any other method. Property development also involves working to strict timelines and having strong plans in place.

But if you can pull all this off, the result will be one or more properties that have significantly increased in value and the ultimate reward of potentially life-changing wealth!

As property development consultants in Melbourne, my team and I offer an end-to-end service for residential developments. From planning and project feasibility to securing a profitable development site to finalising the planning, design, permits, and tender documents, we do it all.

Property Analytics knows how to do it, and now you can too. Here is our introduction to how you can make money through property development.

What Is Property Development?

Property development is the process of acquiring a block of land, looking past the existing structure, and developing that block to help it reach its full potential as a wealth-generating investment. Property developers use three basic strategies to add value and increase profits.

The first two are subdivision and construction. By subdividing the right block of land, you create multiple lots that you can sell for a greater price per metre squared. And by constructing residential properties on each block that homebuyers will pay a premium for, you generate even more value.

For example, a common approach to property development includes buying an old house, knocking it down, subdividing the land into smaller lots, and building anything from a side-by-side duplex to 12 separate townhouses.

As well as subdividing and building, renovating is the third value-adding tool that property developers use. For example, some developers will retain the existing dwelling and renovate it to add value. This is usually paired with a strategy where the land is subdivided, and a new property is built next to or behind the newly renovated dwelling.

Not every property development project is about turning a single block into as many lots as possible. Rather, property developers seek to understand the needs of an area and select a block and development strategy that will provide maximum value – all while considering the impact of zoning constraints, easements on the land, purchaser demand, market values, and more.

Property development projects can be as simple as subdividing a block of land, but the most successful projects usually combine at least two of subdivision, construction, and renovation.

In the example above, Property Analytics secured the property and the client rented out the existing dwelling while we subdivided the back portion and later sold the vacant block.

Property Development vs Real Estate Investing

A real estate investor is someone who purchases one or more properties with the goal of selling them in the future when capital growth has skyrocketed. Some investors will aim to positively gear their investment properties by renting them out for income. Others will be happy to simply retain the property and enjoy the tax benefits of negative gearing.

A property developer is someone who aims to actively value-add to their asset through the processes of subdivision and construction described above. There is a lot of skill in developing a property to its full potential, and the process usually comes with tight timeframes and small margins for error.

So, in essence, both developers and investors are aiming to generate profits through real estate, but a developer is much more actively involved in increasing the value of their asset.

Of course, there is plenty of crossover between the two. A developer will choose to leverage their completed properties for equity, high rental returns, or a profitable sale – just like any other investor. And while investors often rely on passive asset appreciation to generate capital gains, a good investor will know when to put on their renovator or developer hat and actively add value to their investment.

Here’s How Property Developers Make Money (It’s Simple… In Theory)

Just based on what I’ve told you so far, it’s easy to see how property developers make money. Turning one $800,000 block of land into five subdivided blocks worth $300k each is a profitable undertaking.

Similarly, taking an old house in a good neighbourhood and turning it into two modern, double-storey townhouses – like in the plans below – can more than double the value of your investment…

So, what do you need to make this happen?

5 Things You Need As a Property Developer

1. You Need Money to Get Started (and to understand every cost)

There’s no getting around it – you need a base of funds and some cash flow to get into property development. This could come from cash savings, pooling funds with someone you trust (but only someone you trust) or equity from your home or another investment property.

The harsh reality is that you’ll need to spend at least $1 million to make $200k+ in profit in the Melbourne property development market.

Just some of the funds you will need include:

- 25-35% deposit for your development loan

- Funds for stamp duty on the property purchase and other professional and government fees/charges

- An allocated budget per block of land you want to create

- Legal funds (conveyancing)

- Money for construction costs and consulting fees

- Cash to pay rates and taxes

- Significant extra funds if you go over budget during the development process (your buffer/your contingency funds).

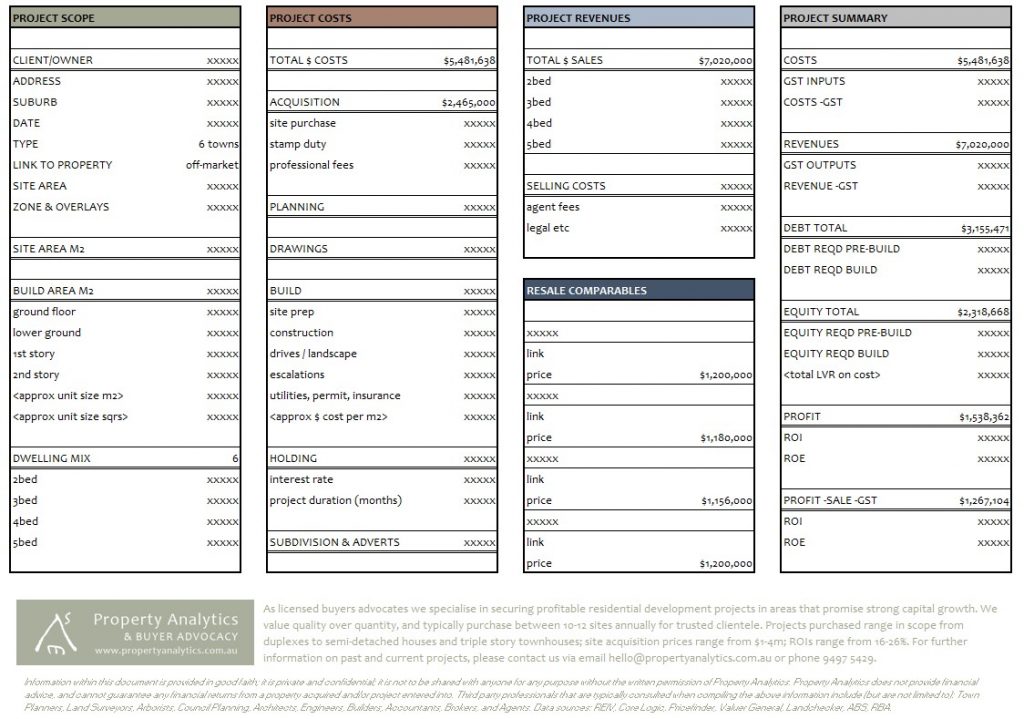

It’s hard to talk exact numbers without understanding your current financial position and development objectives. When you partner with Property Analytics, you can be sure that all costs have been detailed thoroughly prior to purchasing your development site. This includes the costs you care about most – the profits you can expect for rental income, sales, and future capital growth.

2. You Need a Trusted Team Around You

The best way to lose money in a property development project is by trusting the wrong people to help you with the process or by trying to tackle everything yourself.

Or in other words, it takes a village.

For example, you will need a buyers advocate in Northcote or any of Melbourne’s other 400+ suburbs you are targeting. These experts can research, shortlist, and secure the property that’s ideal for your property development project.

You will need tax and financial advice in relation to Capital Gains Tax (CGT), Goods and Services Tax (GST), holding costs, development costs, and forecasted profitability.

You will need a mortgage broker or development loan expert to help you secure and structure a loan that’s best suited for your project, and you will need someone to deal with local councils, navigate zoning complications, and more.

Some other professionals that will be important on your developing journey include:

- Architects/home designers

- Town planners

- Lawyers

- Accountants

- Engineers

- Contractors

- Quantity surveyors

- Project managers

- Real estate agents (a necessary evil)

As you can see, assembling the right team is hard enough – and that’s before you’ve put anyone to work.

That’s why your property development consultant is the most important professional in your network.

Property Analytics not only does the hard yards to select the right property for your project, but we also help you establish the relationships that are crucial for property development success.

3. You Need a Development Plan Backed By Feasibility Reports

Minimise risk. Maximise ROI. These are the goals that you must keep in mind when planning a development project.

A property development plan lays out your financial position, your borrowing power, and your development objectives. Essentially, it creates the brief that your development advisors and buyers agents can follow to create a concept of what your development might look like.

Once you have this concept, you need to measure it against reality. That’s where a feasibility report comes in. For every potential project site, you need to ask yourself:

- What are the costs? Including acquisition, holding, construction, council fees, planning costs, etc.

- How much equity/funds are required?

- What kind of debt will you be required to take on for the project?

- What are the tax implications of the development?

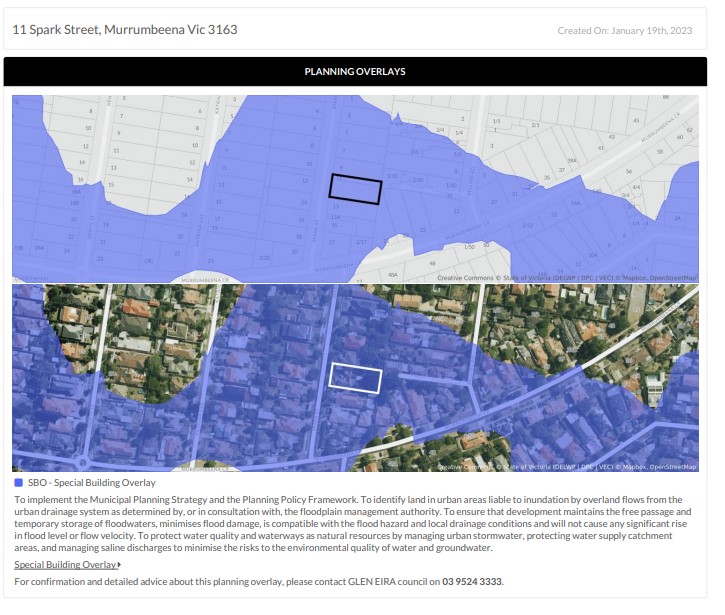

- What restrictions are there, including overlays, covenants, and easements on the title?

- How long will the project take to complete and what is the market going to do in that time?

- What is the projected profitability of the project based on the development plans?

Development planning and feasibility are all about giving yourself as many facts as possible before jumping in. You need to know what you want to achieve; you need to understand what you can achieve, and you need to secure the right piece of real estate to make your development as seamless as possible.

4. You Need the Right Block of Land in the Right Location

Land has always been a fundamental aspect of property investment, but it becomes even more important when you’re planning to actively develop the land.

How large is your block, what zoning constraints does it have, and what easements, covenants, and overlays are on the title? Is the block flat or sloping, what trees and vegetation are on the land, and are you allowed to remove these trees?

These are just some of the land-related questions you need to ask before buying a block.

Many developers recommend buying a block that can be turned into at least three properties because there is a lower profit margin for dual occupancy projects. But it’s also important to work within your limitations and towards your goals. Going bigger on your development isn’t always the easiest move, especially if you could achieve similar results with multiple smaller-scale development projects. With this approach, you can also take the equity or funds you generate from your first development to more easily fund your next one.

When it comes to location, I don’t need to tell you how important it is to pick the optimal suburb for your development.

Let’s put it this way. You could have two identical blocks of land with the same features and the same restrictions. One could be a development disaster and the other could be a roaring success, just because they’re in different postcodes! This could be due to differences in demand from end buyers, the strength (or weakness) of the market in your chosen suburb, and a range of other factors.

Different locations also come with different local councils, which could make your intended development a nightmare or a breeze depending on how they view your plans.

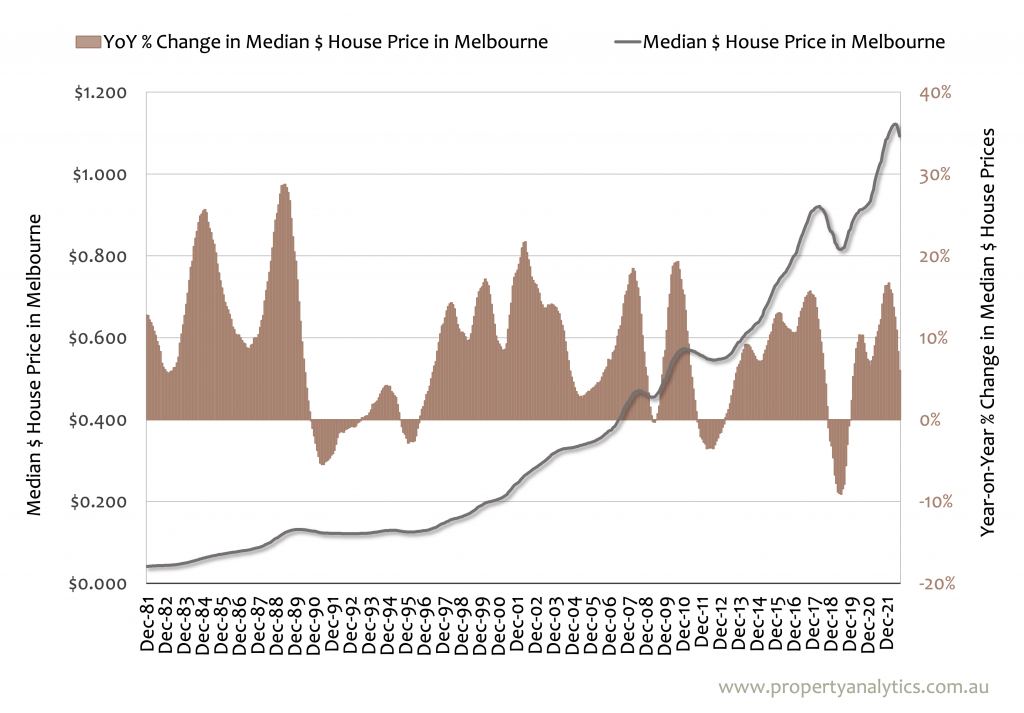

5. You Need to Know When to Buy

Knowing when to buy isn’t always quite as important as knowing where to buy, but it can make or break your development project, so it definitely shouldn’t be discounted!

Broadly speaking, Australia’s property markets are cyclical, especially in capital cities and major metropolitan areas. Your goal should be to buy when the market is at a low point, complete your development on a strict timeline, and sell your properties when the market reaches its peak. Property markets typically experience up to 10 years of steady growth at a time followed by 3-7 years of retraction, and hundreds of fluctuations occur within these periods of growth and retraction.

Of course, you can still make money at any point in the cycle because you’re actively adding value to your purchase, and that’s the beauty of property development. But nobody wants to buy at the peak, blow their development budget, and sell when the market is at its lowest!

Timing the entry and exit of your property development can help you compound your capital growth even further, protect yourself against unexpected costs, and maximise your profits.

The Property Development Process

Before You Buy

We’re at the very beginning of the process. It’s time to determine your savings, your borrowing capacity, and your equity position. You can then apply for pre-approval to buy your development site.

At the same time, your property development consultants can begin planning your development concept and shortlisting sites that suit your vision. Feasibility studies can be completed to determine every site’s development potential and outline all your costs and projected sources of revenue. This part of the process also includes checking the contract of sale and attaining advice from a range of consultants, from arborists and architects to town planners, project managers, and the local council.

Once you’ve settled on the perfect development site, it’s time to act.

Sealing the Sale

If your development site is as good as you think it is, you won’t be the only interested party. It’s time to edge out the competition and get the best price for your development site through expert negotiation.

The best development consultants should also be expert buyers advocates. For example, if you partner with Property Analytics for your development project, we can act as your buyers advocates in Brunswick, Kew, and across Melbourne. Our team will shortlist properties and help you negotiate the best price through private sale or auction.

This goes a long way toward ensuring the profitability of your development project.

Planning and Approvals

With the preferred property in your possession, you can finalise your plans. This is the time when you polish up your designs and submit development applications in line with council guidelines. It’s also time to confirm title boundaries and draw up your plans to subdivide, as necessary.

With the due diligence that was completed pre-sale, this process should come with few surprises, although additional requests, objections, and delays may emerge during the process.

Some of the experts you will consult with at this stage include architects, town planners, and land surveyors.

Documentation and Drawings

With everything approved, you can have working documents and drawings written up and get started on the building contract. Depending on the scale of your project, you may need to consult with a quantity surveyor at this stage of the process. To finalise the working documents, you may need to consult with various engineers, including structural, civil, and soil engineers.

Before You Build

Everything is set in stone, and everyone is on the same page. If you haven’t already secured a builder, now is a perfect time. You should also finalise financing for the construction phase of the project. Your builder will want to see the building contract, and you will need to agree on everything from pricing and payment structures to the scope of the development, the responsibilities of each party, and timelines for completion.

Provide the builder with all your drawings, calculations and specifications, and ensure that your contract states that all work must comply with these approved plans, as well as all other relevant regulations.

Construction and Completion

If you have partnered with Property Analytics, our team has project managed your development from planning to design all the way through to tender documents. We’ve partnered with our preferred team of consultants – from town planners to architects to engineers – and we’ve left you in a position where you’re ready to build.

Now it’s time to watch all those plans come to life. The construction process can typically be completed in around 12 months, and after paying a deposit, payments come at various stages throughout the process (base stage, frame stage, lock-up stage, fixing stage, and project completion).

Once the project is in its final stages, you can submit your subdivision plans and obtain separate titles for each property. After this, you must decide what to do with your completed development project.

To Sell or Not to Sell… That Is the Question

At this point in the process, you’ve got your completed development project and you’ve spent a lot of money. But if you’ve done it right, you’ve also set yourself up for a handy return on investment.

I always say that a beginner developer should shoot for 12-15% ROI while experienced developers should aim for 20% Return on Investment. Whether that number is closer to 10% or 20%, you will gain invaluable skills and experience to make your next development even more profitable.

When it comes to cashing in those profits, you can sell your properties for an immediate profit or hold onto some of them as investments. Some people will complete a side-by-side development to live in one and sell the other. Many developers choose to sell it all and cash in, while others choose to hold onto all their properties for long-term gain. You can even sell your developments off-the-plan partway through construction!

Retaining your developed properties as high-value assets lets you benefit from generous rental yields, refinancing and equity options, as well as depreciation and capital growth in the long term.

The ultimate value of your real estate is often realised in the long term, but in the end, the decision to sell now or hold for later will depend on your financial position and the goals you set heading into the process.

Property Development Can Change Your Life… Want to Find Out More?

After reading this article, you’re probably either keen to learn more about property development or ready to run a mile!

If you are still interested in property development in Melbourne, I would love to hear from you. My name is Andrew Stone from Property Analytics, and my team and I specialise in finding quality sites for small developers of all experience levels.

Property Analytics can find and secure your development site for a great price as your buyers agent in Kew East and throughout Melbourne. I can then guide you in all phases of property development, setting you up so you’re ready to build profit-generating properties.

Property Development changed my life, and it can change yours too. Call or email Property Analytics to find out more.