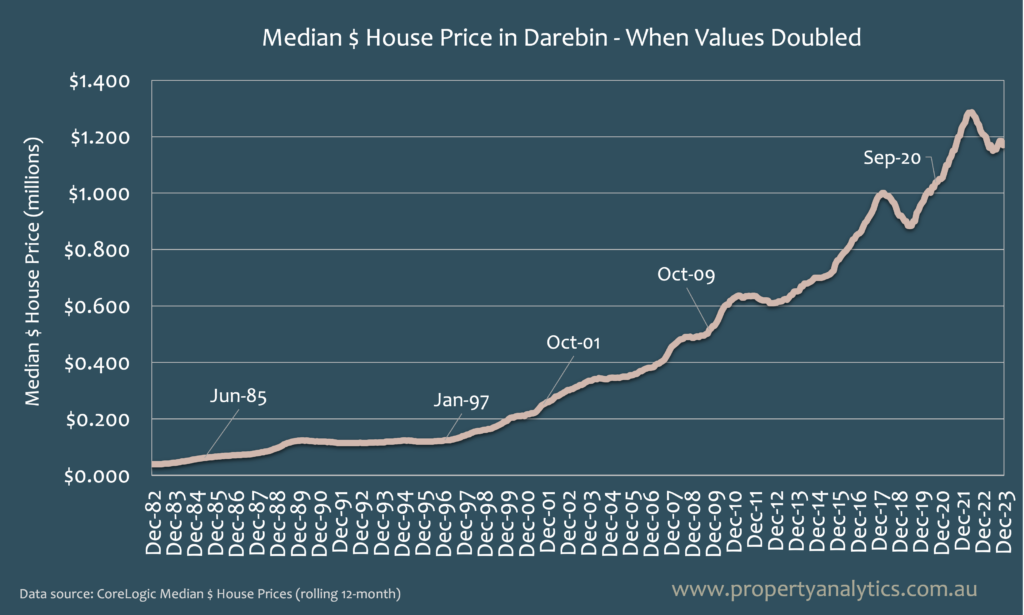

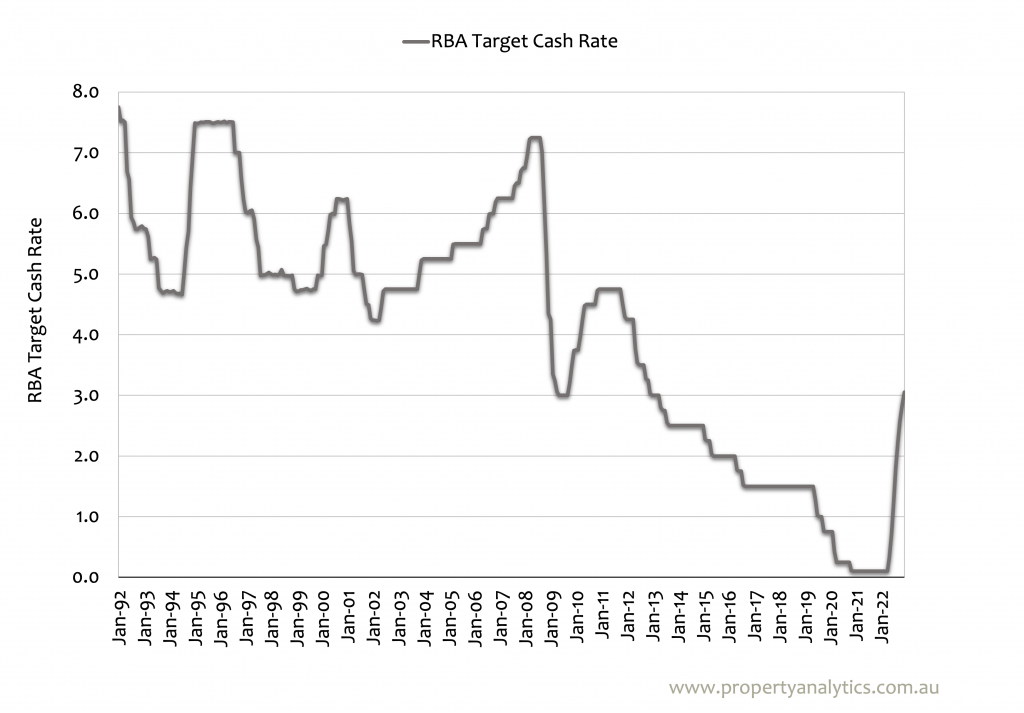

It’s been a tumultuous time for the Australian property market. With rising interest rates, soaring house prices, a lack of supply and an increase in demand, it can often feel like an unlevel playing field for those looking to buy. Despite these challenges, there are still plentiful opportunities for house hunters in Melbourne.

For starters, let’s take a quick look at the previous three years:

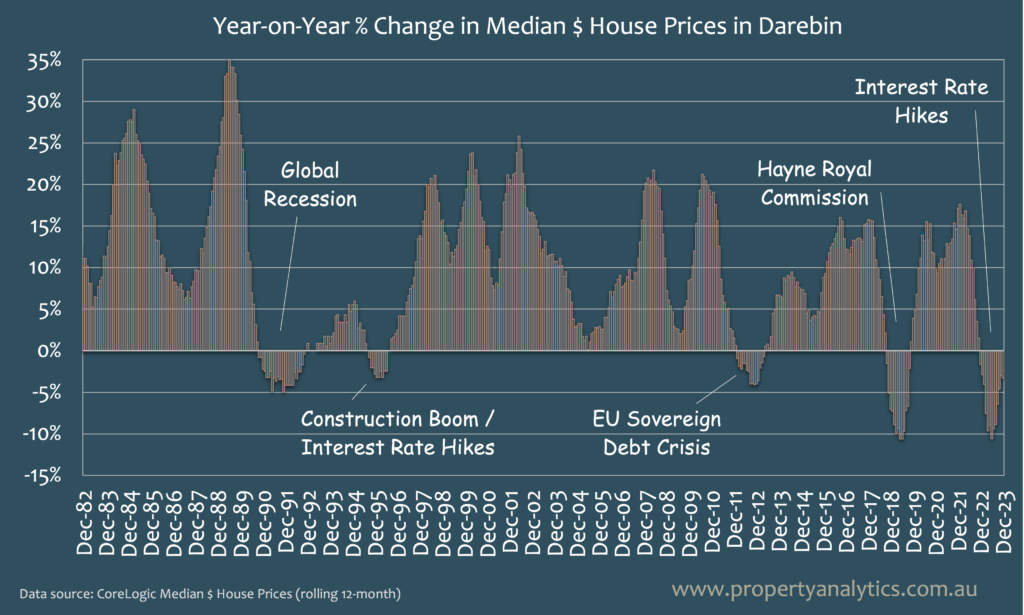

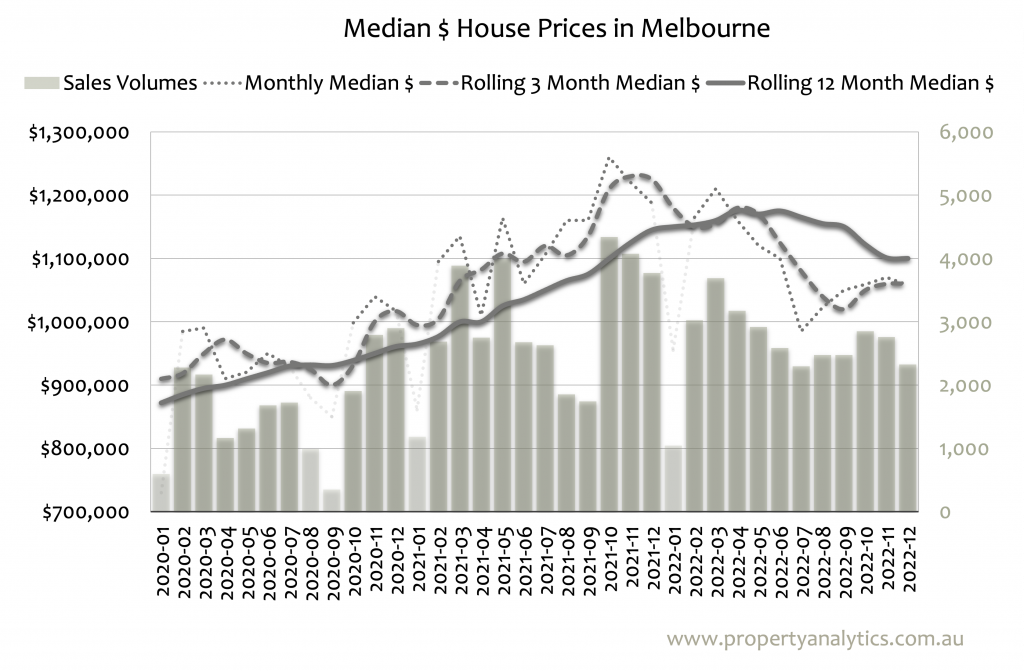

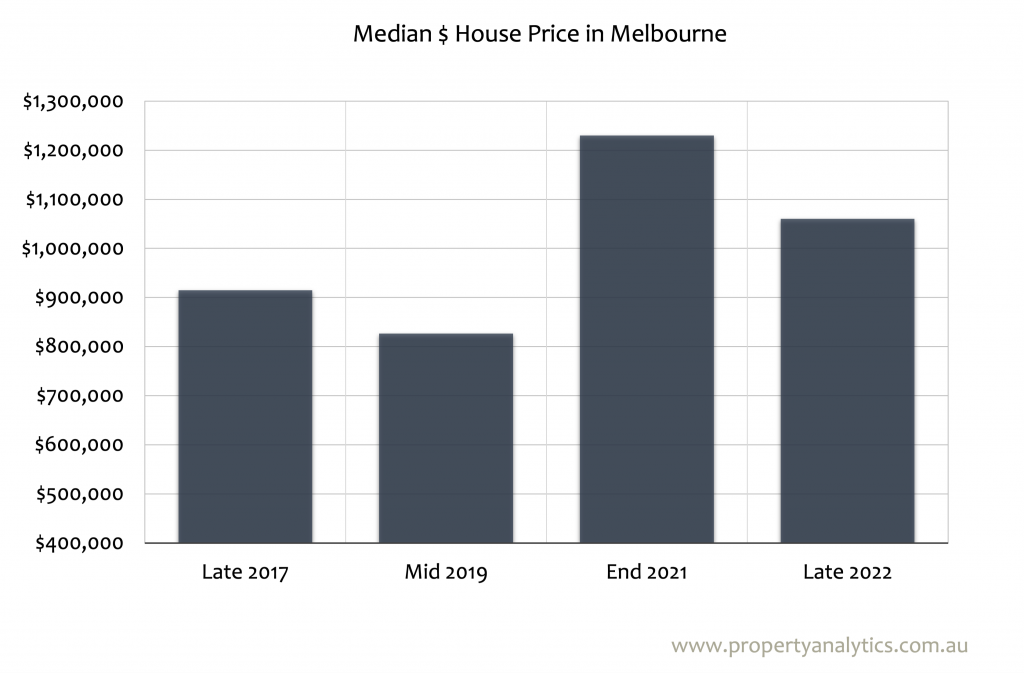

2021: Melbourne’s property market witnessed a meteoric rise in 2021, with median prices surging over +17%.

2022: A turbulent period as home values plummeted by -9.6% from their February peak, according to CoreLogic.

2023: Momentum shifted significantly compared to the previous year. In November, however, things took another turn as Melbourne property prices declined slightly.

That aside, what’s in store for 2024? Below you’ll find expert picks, predictions and answers to burning questions from a seasoned buyer’s agent in Melbourne.

A Snapshot of the Current Property Market

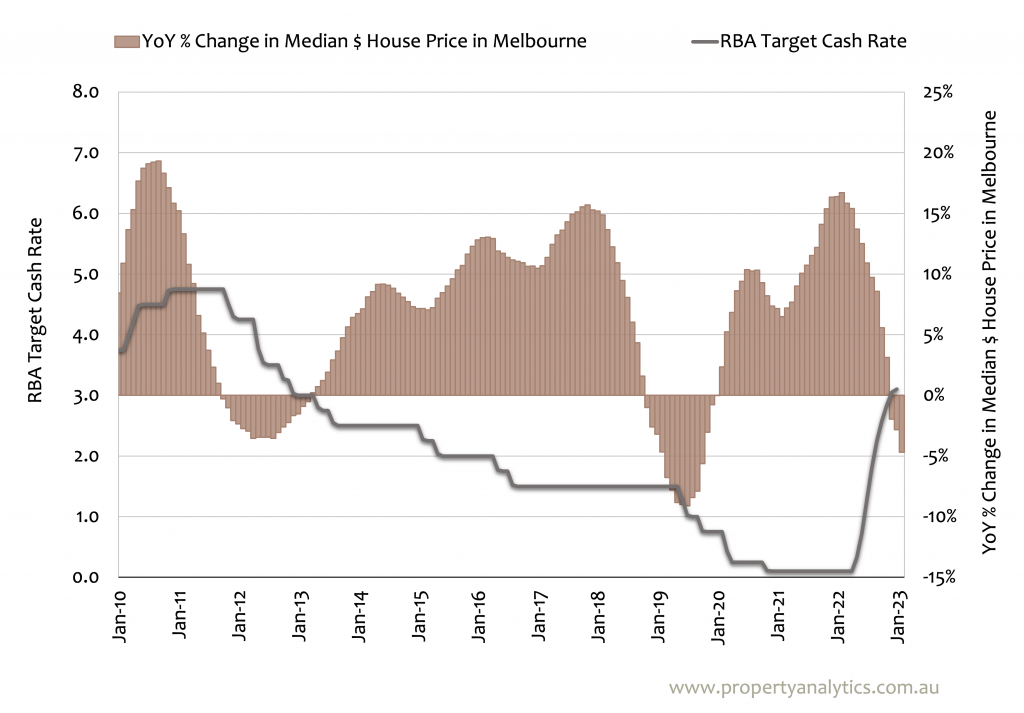

The Australian property market in 2023 surpassed expectations as property prices surged despite rising interest rates. This surge revealed a stark shortage of listings, driven by heightened buyer demand – resulting in price hikes that even seasoned economists found surprising.

Looking ahead, here are some major points that keep resurfacing:

- Melbourne’s median house price currently sits at around $1,050,000, according to Domain, while its median unit price is close to $570,000.

- Those figures are respectively 4.1% and 5.5% lower than their previous price peak, but are expected to grow in the new year.

- Melbourne house values are tipped to rise between 2% and 3% in 2024 and those of the city’s units are forecast to climb 3% to 4%.

It’s no secret that buying a property in Melbourne has become increasingly challenging. To navigate through these obstacles, having a top buyer’s agent on your side can make all the difference.

What Property Markets in Melbourne Are the Strongest?

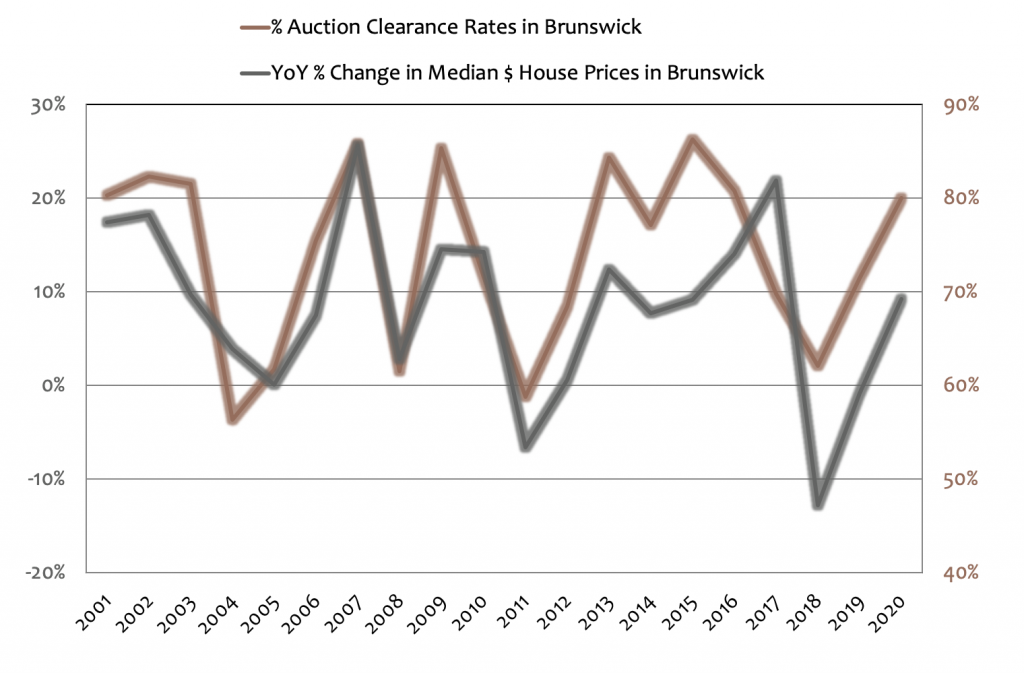

While the overall market may have experienced fluctuations due to various factors, there are specific regions within Melbourne that have remained resilient and continue to attract potential buyers.

CBD: The standout market was the City of Melbourne (the CBD and near-city suburbs like North Melbourne and Carlton), which is rising on the emerging national trend of buyers opting increasingly for apartments as a lifestyle choice or an affordability measure.

City of Yarra: The nearby City of Yarra also had four rising markets (Abbotsford, Clifton Hill, Collingwood and Fitzroy) and two recovering ones among the seven suburbs in the analysis.

The City of Casey: in the far south-east, which previously had many declining suburbs, had three rising and nine recovering suburbs (including suburbs like Doveton, Botanic Ridge, Cranbourne and Endeavour Hills) among 15 suburbs in the analysis of June Quarter activity.

Frankston: The neighbouring City of Frankston was another market showing emphatic signs of recovery.

The Mornington Peninsula, previously a national leader in price growth but past its peak in the past 12 to 18 months, is also showing increasing evidence of recovery, including in the prestige suburb of Sorrento.

The outer-ring municipalities perhaps best illustrated the recovery trend in the Greater Melbourne market. Outer-ring LGAs in the north and west, including Whittlesea, Hume, Wyndham and Melton, also demonstrated the recovering theme in the Melbourne market. The revival trend extended to middle market precincts like the City of Whitehorse, including the suburbs of Box Hill and Burwood East.

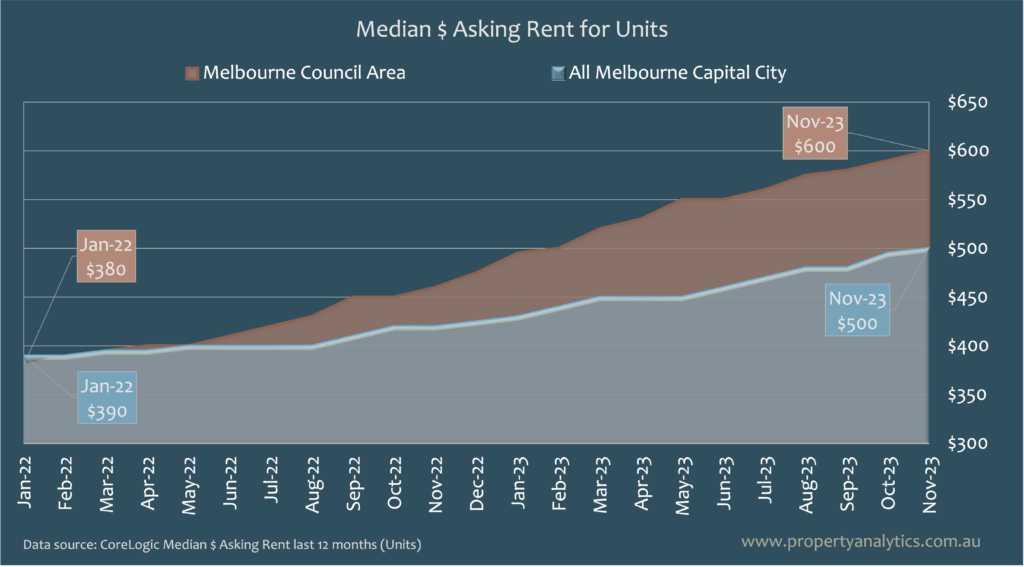

What About Vacancy Rates?

In line with nationwide trends, vacancy rates in Melbourne have remained at record lows, and this trend shows no signs of changing anytime soon. In the real estate sector, vacancy rates refer to the number of vacant properties that are put up for lease. A low vacancy rate, therefore, means that very few properties listed fail to secure tenants.

Over the past few years, Melbourne has experienced a significant increase in population, driven by factors such as job opportunities and a thriving economy. This influx of people has created a high demand for rental properties, resulting in an extremely competitive rental market.

As of the latest data, the vacancy rate in Melbourne’s Outer East is 0.6%. This is welcome news for investors as it means less time from purchasing a property to a new tenant signing a lease agreement.

A low vacancy rate indicates that a property has strong rental sales while a high vacancy rate suggests that a property is not renting well. Areas with a low vacancy rate will ensure a better yield for investors as their properties are less likely to remain vacant after a tenant moves out.

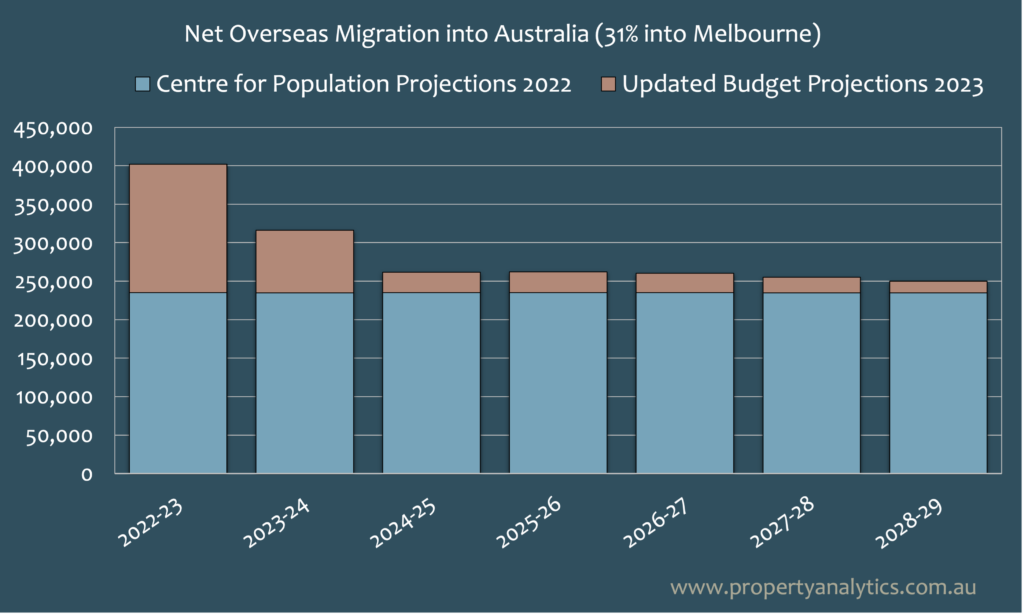

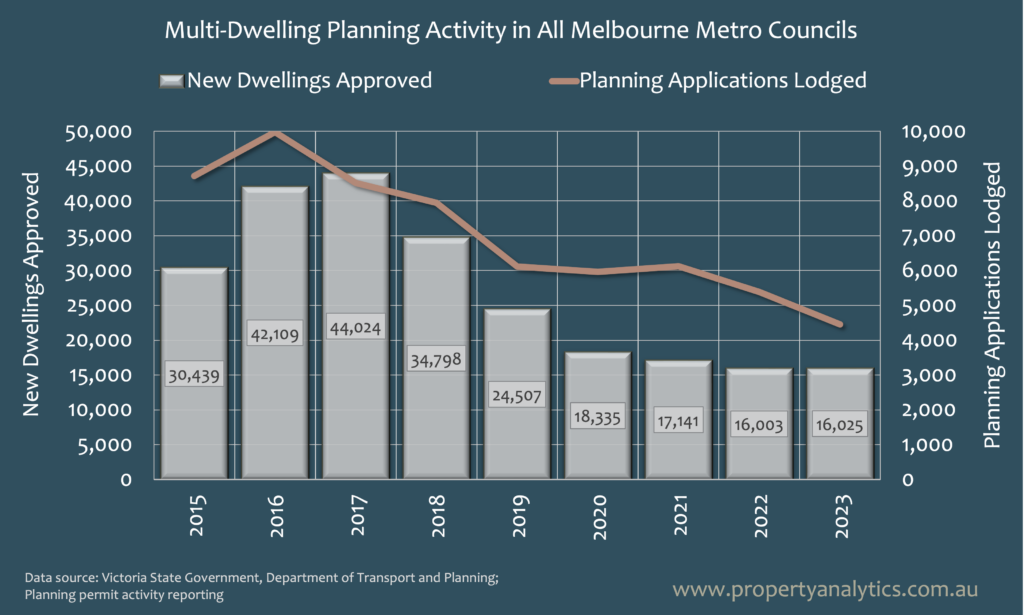

Population-Driven Housing Demand

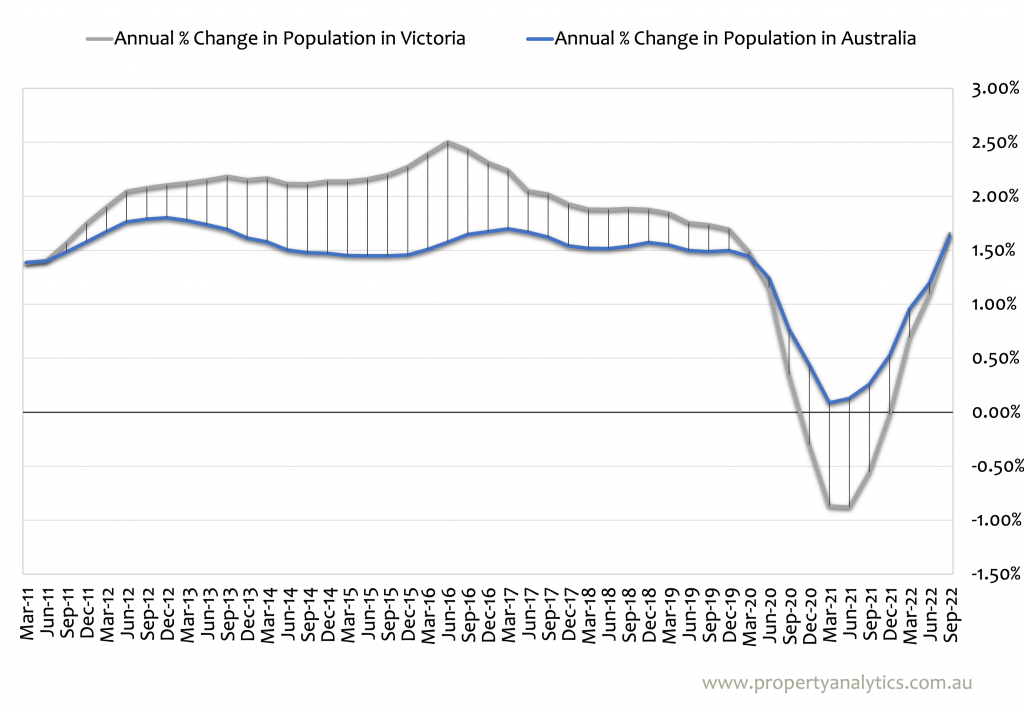

In 2024, population growth continues to be a significant factor influencing the housing market, with domain analysis indicating its lasting impact on property prices. Australia’s population increased by 2.2% year-on-year, mainly driven by net overseas migration. Despite the expectation that temporary residents like students wouldn’t directly impact housing demand, their influx has created a ripple effect, increasing demand across various segments of the market. This population-driven demand is anticipated to exceed the current housing supply.

Economists emphasise the necessity of building more houses to address this shortage, highlighting that even if immigration were to halt, there would still be a substantial housing deficit. The national cabinet’s target of constructing 1.2 million homes is seen as crucial in alleviating these pressures created by immigration.

Get More Insights from Expert Buyers Agent in Melbourne

Our buyer’s agents and advocates specialise in the Melbourne property market, analysing trends, measuring the potential for growth and much more. Therefore, your advocate is there to provide expert analysis and support throughout all phases of the investment process in areas like Surry Hills, Kew East, and Doncaster.

The groundwork begins at the pre-selection strategy phase. Here, you will work together to find a suitable location, price range and property type. This often involves the creation of suburb analysis reports. From here, your advocate will generate detailed feasibility reports, deal with external consultants and finally, assist with any aspects of the final handover.

Contact us today to arrange a consultation with a buyer’s agent in Melbourne.