Some people invest in property to generate rental yield and increase their monthly income. Others invest to build long-term wealth, and they do this by targeting properties that are likely to generate capital gains.

One person looks for “positive cash flow properties” while the other is willing to accept “negatively geared properties”.

At Property Analytics, we know that long-term wealth is best created through asset appreciation, not through positive cash flow. Our best advice for clients is to purchase the property that will grow most in value over time.

In other words, prioritise capital growth over rental yield.

What… that’s not enough info for you?

Read on for key reasons why our Melbourne property investment advisors put capital growth first.

It’s Land That Appreciates in Value Over Time, Not Dwellings

Even the best brick-and-mortar dwellings will depreciate in value over time if left untouched. That’s why we have depreciation schedules.

But the same thing isn’t true for the right block of land.

Your land can increase in value simply due to supply and demand dynamics. Everyone wants a block of land in certain Melbourne locations, and over time, it becomes harder and harder to get one, sending the value of your property through the roof.

To demonstrate the power of capital growth and this type of strategy, let’s look at the performance of an apartment purchase compared to a house purchase.

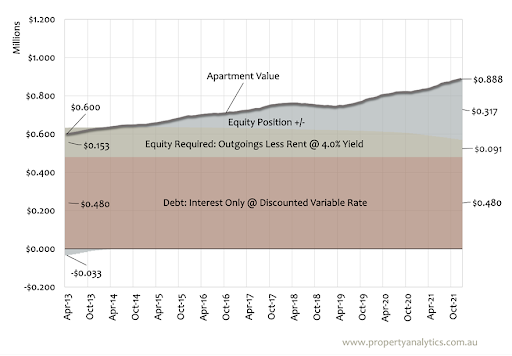

This graph shows the performance of an apartment purchased for $600k in April 2013.

An apartment like this could be a great buy if you’re solely focused on a rental yield strategy. With the right features and the right location, you could attract a steady supply of high-paying renters.

Let’s assume this apartment was purchased with $153k in cash. That’s a 20% deposit plus stamp duty and all the legal and financial costs.

Over nearly 9 years, the “Equity Required” section of the graph has reduced from $153k to $91k. This means the investor has generated $62k in rental income.

Over the same period of time, the apartment has experienced capital growth, increasing in value from $600k to $888k.

The rental yield and capital growth combine to put the investor up about $350k. That’s great, but now let’s compare that to a house purchased at the same time for the same price.

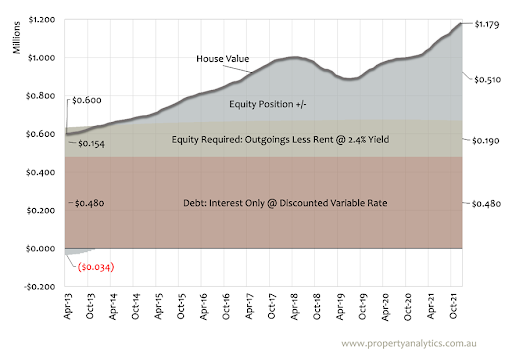

In this case, the “Equity Required” has increased, meaning the investor has contributed about $36k to cover the difference between rental yield and the property’s holding costs.

But the house also increased to $1.179m in value thanks to the land it sits on. So, even with the negative cash flow, the investor is up about $540k.

The apartment investor would be pretty happy with their investment. But think about making about $200k more just by investing in a house.

That’s capital growth – significant passive income that you didn’t need to do anything extra to achieve.

The Snowball Effect of Capital Growth Strategies

Now that we’ve demonstrated the power of capital growth, let’s take a look at what happens next.

- Your high capital growth property generates plenty of equity

- You can use that equity to build your property portfolio by targeting another high-capital-growth investment

- Or you can choose to use that equity to fund value-adding renovation work on your investment property

- Meanwhile, you can enjoy tax benefits like negative gearing (to soften the impact of rental losses) and delayed capital gains tax

- If you need to sell or choose to sell, a property with proven capital growth potential will be more liquid than a property that only has a strong historic rental yield.

Questions to Ask Yourself Before Pursuing a Capital Growth Strategy

While it is the preferred strategy, capital growth – and property investment in general – is not for everyone. Depending on your financial position and your overall investment goals, capital growth may or may not be for you.

Ask yourself:

- Can I afford higher entry costs?

- Can I afford to cover holding costs if the property is not cash flow positive?

- Am I willing and able to retain the investment property in the long term in order to make significant profits?

The Types of Property to Buy for Capital Growth

Properties that are metropolitan, residential, and titled tend to achieve strong price growth over time.

Why?

They are sitting on residential land, and there is a scarcity of residential land available in Melbourne’s suburbs.

Meanwhile, regional, commercial, and multi-unit properties tend to grow at weaker rates.

Why?

Because new apartment developments are dime a dozen and these properties aren’t sitting on a block of suburban residential land.

They might be great for generating some rental income, but with so many other apartments flooding the market, they have nothing that will significantly increase their value to offer in the long term.

The Bottom Line on Rental Yield vs Capital Growth for Property Investors

If you focus only on rental performance and your investment fails to deliver, you will have nothing to fall back on.

But if you carefully select your investment for capital growth and it doesn’t deliver strong rental returns, you still have the promise of future capital gains and a stronger equity position.

So, if you can afford a higher purchase price and you can budget for ongoing payments to supplement rental losses, we strongly recommend prioritising capital growth.

You will be much better off financially in the long term.

Property Analytics are independent investment advisors and licenced buyers advocates serving Kew East, Kew, Doncaster, Ivanhoe, and all of Metro Melbourne.

From strategy to purchasing, we offer a proven process for securing quality investment properties that offer strong long-term capital growth rates.

Reach out today to discuss your investment goals and start generating real wealth from the Melbourne property market.