Take a look at the below and tell me if it sounds like genuine property investment advice or a Ponzi Scheme:

- Buy a property

- Wait for it to increase in value

- Drawdown equity from that property to use as a deposit on another investment property

- Wait for them both to increase in value, then repeat.

I know some people make this work, and congratulations to them, but it’s always felt like a Ponzi scheme to me.

The critical flaw in this approach is obvious – what happens if the property market doesn’t go up?

Is the investor expected to fund the rental shortfall each week indefinitely? And, when interest rates eventually rise, as we’ve seen this year, what happens then?

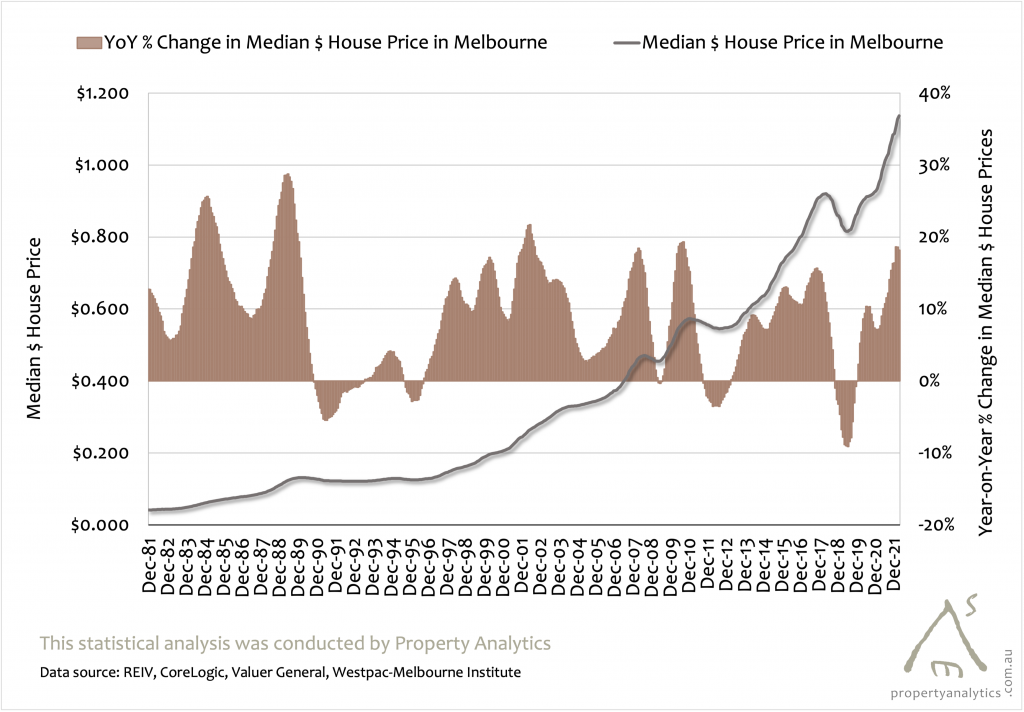

We know that high and/or rising interest rates adversely affect median $ price growth, so things can get very tough very quickly for people subscribing to this approach.

I know an awful lot about real estate, but there are still so many forces that impact the broader property market: interest rates, exchange rates, unemployment rates, consumer and business confidence, immigration and new housing supply, GDP growth in Australia/China/US/Europe, fluctuations in natural resource prices, government budgets, taxation policy, etc, etc.

All these factors and more can affect how much your property appreciates and how much equity you get access to.

So, how do you build equity independent of current market forces?

Our property investment consultants in Melbourne are here to explain, including a case study of how it can be done.

The Basics of Equity

For the uninitiated, let’s quickly run through what you need to know about equity.

What Is Equity?

Equity is the difference between what your property is valued at and what’s remaining on your loan.

So, if you’ve bought a property for $1 million with a 20% deposit of $200k, then that $200k is your equity (assuming you haven’t paid overs for the house).

If you’ve paid off more of your loan and have $600k owing, then your equity jumps to $400k.

This accumulated equity can be a valuable asset. Some homeowners choose to leverage it by using equity to buy a house or for other investments.

How Much Equity Can You Actually Use?

The above numbers look great at first but keep in mind that banks will often lend you equity based on about 80% of the total value of your property.

Or in other words, your property drops from $1 million to $800k in value for equity purposes, but the amount owing is not recalculated.

So, if you’ve only paid the 20% deposit and owe $800k, you can’t access any equity. And if you have $600k owing, your $400k equity drops to $200k.

This is what’s known as useable equity.

If you want to buy another million-dollar investment, you’re going to need $200k in useable equity for a 20% deposit plus all the funds you need for stamp duty and other fees.

So, What Do Smart Investors Do to Build Equity and Hedge Against the Market?

Making a few extra repayments or having an offset account isn’t going to net you the equity you need to properly invest.

And just waiting for your property to passively appreciate is problematic, as we said off the top.

So, what do you do?

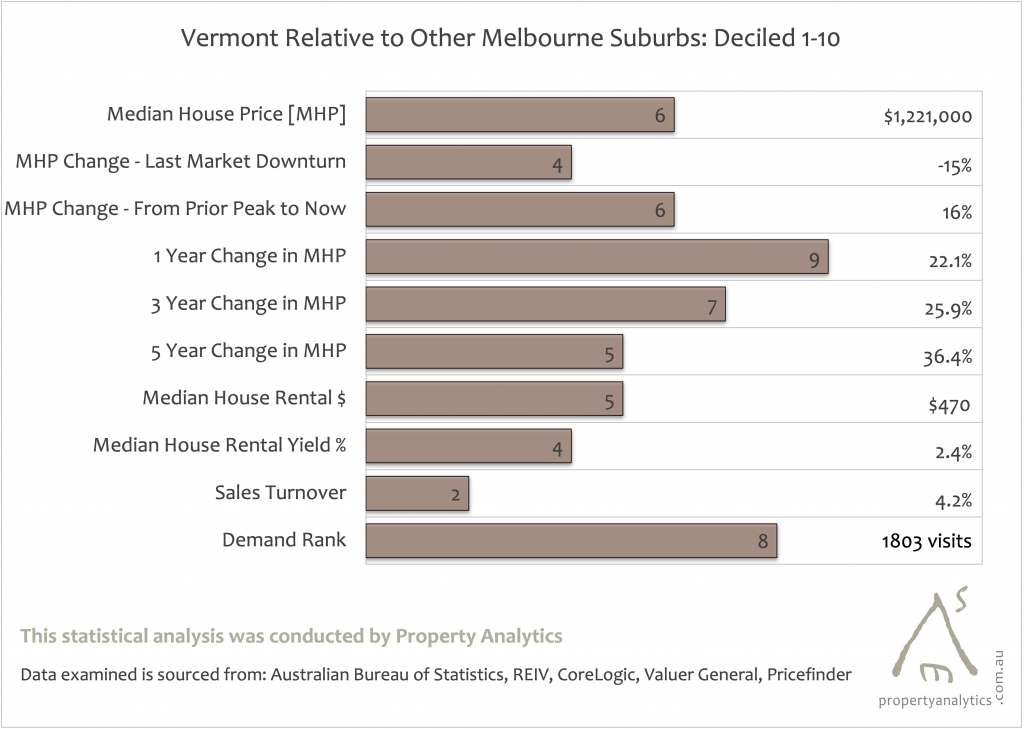

- First and foremost, it’s about buying that first investment in the right area. Our buyers agents serve Templestowe Lower and Melbourne’s hottest suburbs. We know how to purchase in areas that are statistically likely to outperform the market in the future – not necessarily those areas that have performed strongly in the current market or in the past.

- Next, it’s about buying the right type of property in that growth area. For example, why buy a small apartment in a suburb with a great school zone that attracts families looking for family homes? You can read about what to look for in an investment property here.

- With the first two criteria ticked off, I strongly advocate for property development as a means to manufacture equity growth and build a portfolio more sustainably.

Why Property Development for Equity Growth?

I’m not just spruiking property development because I’m a property development consultant in Melbourne.

I’m doing it because I’ve seen with my own eyes – and my own hard-earned money – what property development can do.

Even in poor market conditions, you can dramatically improve your equity position and Loan to Value Ratio through modest townhouse developments.

Once you’ve found the right property with development potential, you can build equity and make good money.

Just take a look at the below development opportunity that I set up with Aden.

CASE STUDY: Aden’s Dual Occupancy Development for Equity Building

I helped Aden purchase a ripper little development site that really set him up for long-term investing success. Let’s walk through that process.

Getting to Know Aden

Aden lives in Singapore but visits Melbourne every month or so. We started out by trading emails back and forth for about six months.

Aden is a smart guy – pretty conservative by nature but full of insightful questions and legitimate concerns. He’s exactly the kind of person I like dealing with, and I was very happy to build a dialogue and mutual trust over time.

He met with a few other buyers advocates, and in the end chose to appoint us – mainly, from what he said, due to the analytical approach we take with everything.

Aden’s Brief

- $1.2m – $1.5m purchase price

- Reasonable-sized block not too far from the CBD

- In an area statistically likely to outperform the market

- Rentable as-is with the option to develop in the short- to medium term.

The Moves We Made

Ahead of Aden’s regular visit to Melbourne, I inspected about 20 properties that fit the brief, eventually narrowing things down to 3.

Each was in a different suburb, with each suburb offering something slightly different:

- One had great growth drivers and was slightly undervalued in my opinion

- Another had experienced strong growth in recent years, primarily due to East Asian demand, but what it lacked in near-term growth prospects it more than made up for in potential development gains

- And, the third was very popular with families, tightly held, and being further from the city, offered more value for money.

In the days before he visited, a couple of other properties came up for sale (one off-market) and we inspected all 5 together.

The Dual Occupancy Decision

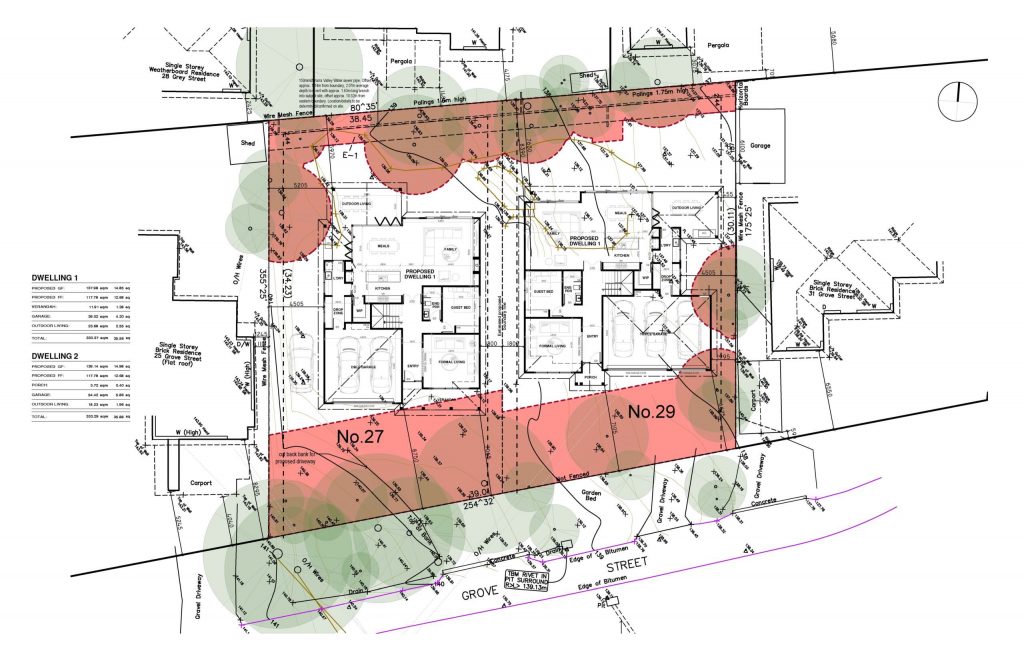

Of the five properties we inspected, we both decided on the one that allowed for immediate dual occupancy.

A dual occupancy development is one where you keep the existing dwelling and build a second in the backyard. This is an ideal scenario for a buyer whose main motive is long-term investment.

Dual occupancy provides rental income that kicks in immediately and continues throughout the construction phase. Meanwhile, the new dwelling provides tax benefits through depreciation.

The existing dwelling could ultimately be demolished at a much later date, meaning that you continually maximise the potential of the site.

When considering a site for dual occupancy, you can generally afford a higher purchase price than a typical home buyer or property investor.

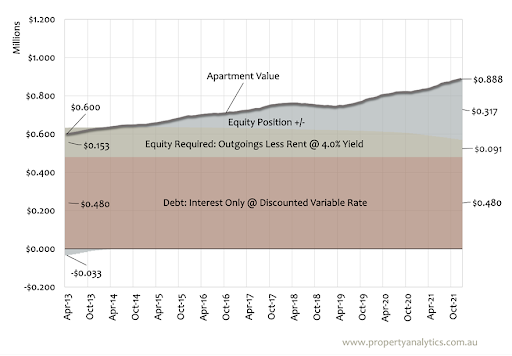

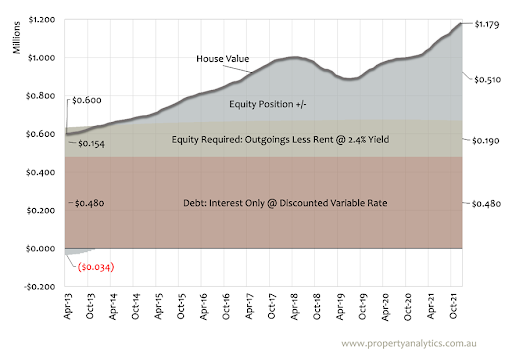

How the Numbers Stacked Up

- Market value @ time of purchase = $1,400,000, with Minimum Equity @ time of purchase = $280,000 (20% of Value).

- Estimated Market Value with Permit for 2nd dwelling = $1,600,000.

- Equity with Plans & Permits = $480,000 (30% of Value)

- Estimated Fixed Price Build Cost = $485,000

- Estimated Bank Valuation of completed development = $2,300,000, with Total Debt for Purchase + Build = $1,605,000

- Equity Position = $695,000 (30%)

The Future Is Bright for Aden Thanks to Proactive Equity Building

- Within 12 months, Aden will increase his equity by $200,000 by spending about $25,000 on design and permits. His 20% equity turned into 30%.

- That 30% equity allows him to engage the bank regarding construction. In this scenario, the bank will look at his income, credit history, and strong equity position, and should lend him 100% of construction costs, based on our conservative property valuation for a completed development.

- In 24 months, Aden will have two properties (1 brand new) and will have increased his equity position by over $400,000. The rental return on the brand-new property, combined with the depreciation benefits, will make it an ideal long-term investment.

All of the above assumes 0% growth in Median $ House Prices over 24 months. With sustained demand from investors, homebuyers and foreign purchasers, that is extremely unlikely in Melbourne.

We purchased the property for $1.385m at a competitive auction. It has nearly all the growth drivers we look for in an area: very desirable primary and secondary state schools, strong and improving demographics and socio-economics, close proximity to transport and hospitals, widespread gentrification, etc.

Yes, Aden bought his property in a great area and at a good price. But importantly, he’s taking control of his investment by proactively growing his wealth, all with the help of experienced industry professionals.

Equity FAQs and Final Thoughts

So, How Do You Build Equity Fast?

By improving your loan-to-value ratio/debt-equity position. Most people can’t do that by quickly reducing their debt. But they can do it by choosing their investment wisely and significantly increasing their property value.

Renovating a bathroom or kitchen is one thing – but property development is where the real money is (just ask Aden!)

How Exactly Do You Get Access to Your Equity?

You can access your equity via an investment loan/construction loan from your existing lender, or you can refinance with another bank for a better deal.

Instead of a separate loan, you can also get access to equity funds by applying for a home loan top-up or home loan increase. This essentially uses the equity to extend your current home loan limit. You can then use that extra cash to fund your investment or development.

Cross collateralisation is another strategy that allows you to leverage the value of your property by using it as collateral for your next investment property loan, rather than withdrawing the equity directly.

Can You Buy an Investment Property Using Only Equity?

If you have enough equity in your current property to cover a deposit, stamp duty, and all your other expenses, then equity is all you need to buy an additional investment. Just keep in mind that useable equity offered by lenders may be based on up to 80% of the value of your home. You may need additional cash or Lenders Mortgage Insurance (LMI) to supplement your equity.

Using equity as a deposit can be a strategic move when acquiring another property, potentially allowing you to expand your investment portfolio without needing substantial upfront funds.

Is It Better To Use Equity or Cash?

Using equity to grow your property portfolio effectively allows you to borrow 100% of the funds required. You will not need any cash deposit if you have access to sufficient equity. This is the big advantage of equity over cash. Seek financial advice on the best decision in your circumstances.

Does Using Equity Increase Repayments?

Withdrawing equity from your home means adding to your current home loan balance. This can result in higher repayments.

Final Thoughts

Here’s the bottom line. You should not leave yourself at the mercy of market forces when it comes to building equity. This article has demonstrated how you can build equity through smart property investment and development.

I firmly believe that property development is less risky than property investment. As your property investment advisor and buyers advocate serving Kew East and all of Melbourne, I can help you find high-value investment properties and development sites that supercharge equity growth and stimulate your investment portfolio.