As data geeks, we regularly build predictive models to determine which suburbs will grow most in value in the coming months and years. We analyse demographics, socioeconomics, infrastructure projects, development activity, transport options, proximity to hospitals and shops, and many other factors…

But in recent years, perhaps the most important predictive variable has been school zones.

Government Secondary Schools are hugely important in determining where house prices will rise most. And Primary Schools play a significant role, too.

So, why are homeowners and investors paying a hefty premium for properties in key school catchments, and how much are buyers willing to pay?

Let’s find out exactly how school zones affect property prices in Melbourne.

What Are School Zones and Why Do They Impact Property Prices?

For investors or homebuyers without school-aged children, it’s easy to overlook the importance of school zones.

But it’s also easy to understand why these school catchments play a role in price growth.

Said simply, school zones are geographical boundaries around State Government Schools that are determined by the Education Department.

The easiest way to get into a particular state school is to live within that school’s designated zone.

In fact, entry into the local public school is considered a right and is pretty much guaranteed.

If you live outside a school’s designated zone, you can still seek enrolment, and you might even get in. However, there is no guarantee, and there will often need to be special circumstances for a child to secure a spot.

As a parent, you can navigate lengthy waitlists and fork out tens of thousands of dollars a year to send your child to a quality private school. Or you can put that money towards a house that guarantees entry to one of the state’s leading public schools.

Now, your child gets a quality education, and you get a family home in an in-demand area.

And that’s what it’s all about… demand. Many parents want to live in popular school zones, but the neighbourhoods within those zones are invariably well-established. Demand for properties is high, but there’s not a whole lot of spare land available.

The only way to get into the area is to buy an established property, and this demand contributes to higher median price growth compared to properties in other suburbs.

School zones only apply to state schools, but other schools may work in similar ways. For example, Catholic Secondary Schools often prioritise students from nearby Catholic Primary Schools.

School Zones and House Prices: Digging into the Data

Now that we understand the why of school zones, let’s see what the stats say.

We’ve built a database of all secondary schools across Victoria, including data points such as Median VCE Scores, % of VCE Scores 40%+, Education Rankings, and other factors.

Merging this data with House $ Price performance data leads to some interesting analyses.

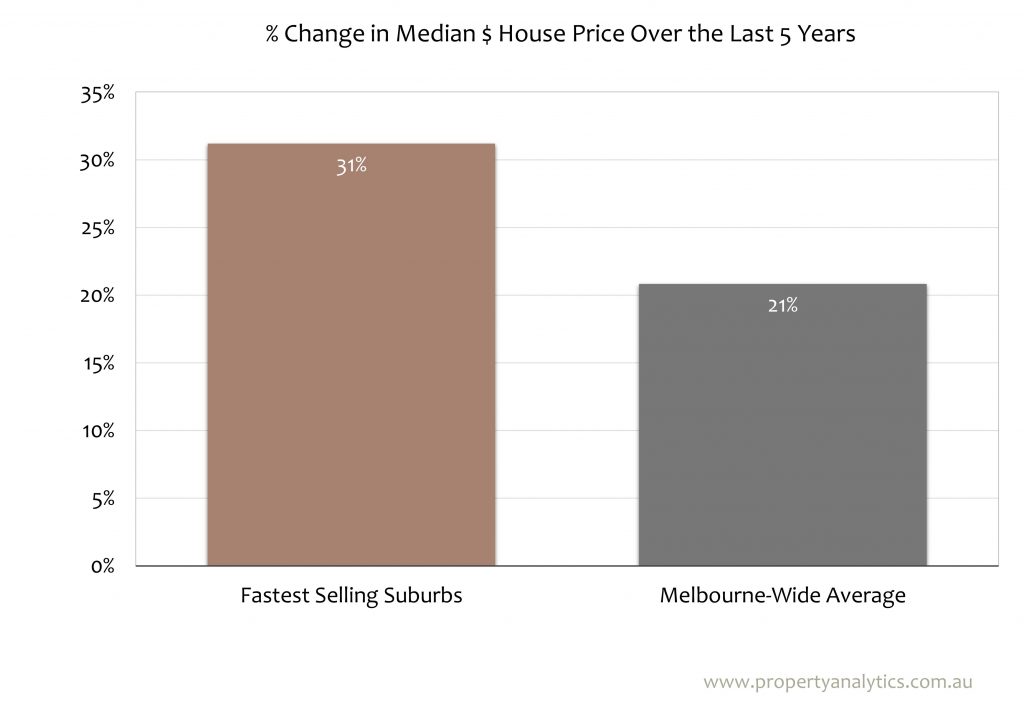

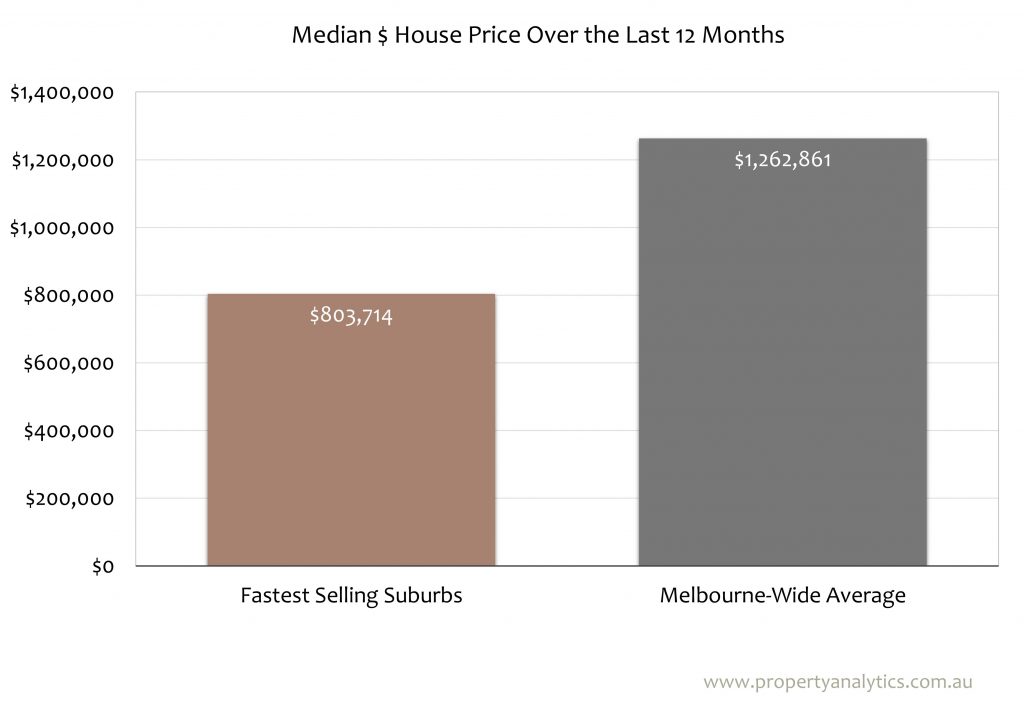

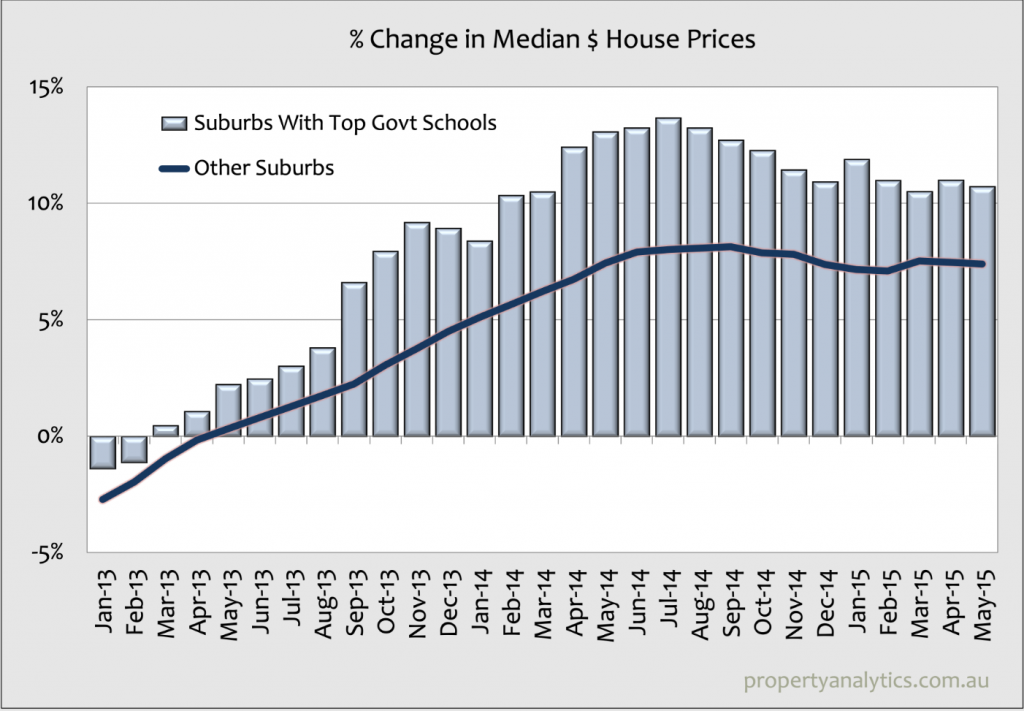

This graph shows how suburbs with top-performing Government Secondary Schools have performed over the last few years compared to Other Suburbs.

On average, Median $ House Prices grew significantly more in those suburbs with top government secondary schools between January 2013 and May 2015.

However, at several points, the difference in growth rates shrunk, proving that there are many other factors at play.

The data might be a few years old, but the story is the same in today’s market.

Primary Schools Are Playing an Increasingly Important Role

We’ve talked a lot about Secondary School Catchments, but over the last few years, our Melbourne property investment advisors have also been keeping a close eye on public primary schools.

Now, Domain’s 2023 School Zones Report has named Melbourne the only national capital city where secondary and primary schools have a roughly equal influence on price growth.

As a property investor in Melbourne, in-demand Primary School Catchment Zones should also be on your radar.

Advice for Investors: Should I Buy in a Premium School Zone?

For investors and developers looking to buy in areas that will outperform the property market in the coming years, targeting preferred school zones may be a good idea.

However, we don’t automatically recommend purchasing in suburbs with top public schools.

Here are the reasons why school zones are important to consider when investing:

- There is a direct correlation between coveted school catchments and faster median house price growth

- There can be strong tenant demand from families who want to live in certain school zones but cannot afford to buy

- Most desirable school zones are in areas where supply is unlikely to increase, which could contribute to strong long-term capital growth and steady performance for rental properties.

However, looking too closely at school zones could be an investor’s downfall:

- Many suburbs in top school zones have already experienced their highest growth rates and are unlikely to be top performers in the future

- Investors will need to pay a premium for properties in school zones that have been highly regarded for years

- School zones change over time, and certain investment properties are at risk of being zoned out of the area in the future – resulting in lower prices for those properties

- Many families are realising that the hundreds of thousands spent on buying or renting in the ‘right school zone’ can go towards paying private school fees instead

- Investing in real estate based solely on school zones and nearby school performance is highly risky. Performance is not guaranteed, and without multiple ways to drive demand and property price growth, your investment is vulnerable.

Final Thoughts

School zones are important to consider, but when thinking of schools, it’s best to think ahead. You want to invest in suburbs with schools that will become Top Performers, not necessarily the ones that are already at the top of their game.

To find these schools, you need to study the trends behind school performance, as opposed to current rankings.

At Property Analytics, we’ve kept a close eye on school performances over several years, and we’ve identified certain schools that are steadily improving but are yet to be widely recognised by savvy homebuyers and investors.

Of course, these suburbs offer more than just an up-and-coming school zone, and the properties that we’re targeting in these areas meet all our investing fundamentals.

If you want to learn how to invest in these suburbs for future capital growth, reach out to Property Analytics for a one-on-one consultation. We’re buyer’s advocates for investors and developers in Melbourne, securing high-value properties in areas like Kew, Thornbury, and throughout the city.

Our proven process for buying investment properties and development sites will set you up for success.