This is a really common question. The answer depends in part on what you prioritise more – capital growth or rental yield.

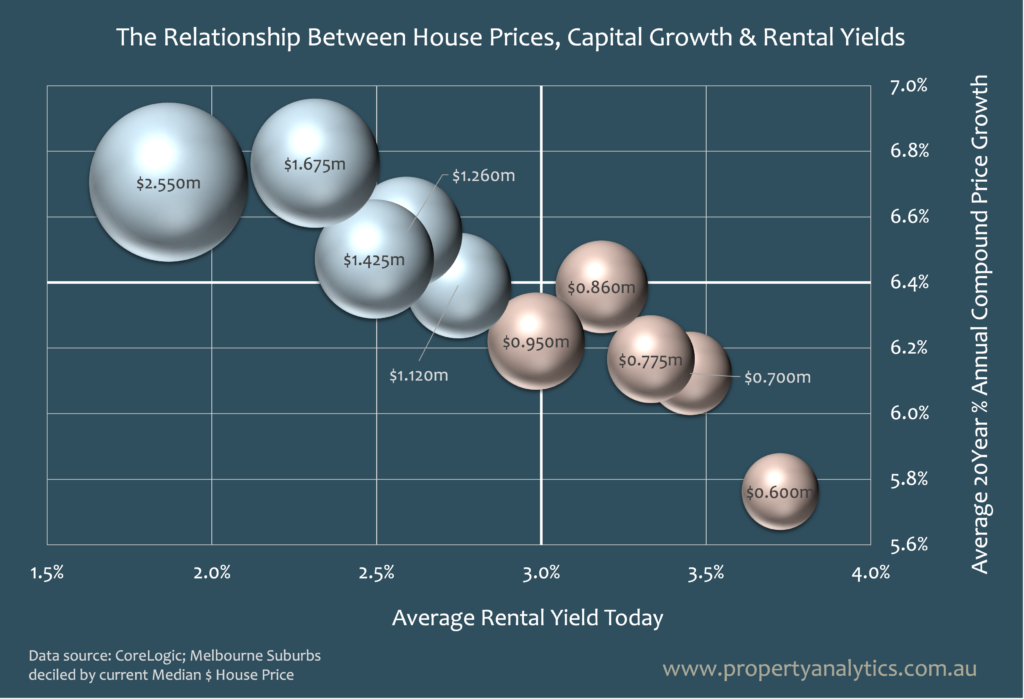

We know instinctively that higher priced suburbs tend to achieve greater capital growth over time, but they also tend to deliver lower rental yields.

Until now, we’ve struggled to convey this truth in a single visual..

Look how Melbourne’s more expensive suburbs (the bigger grey bubbles) cluster to the top left – they generally promise lower rental yields but stronger capital growth.

The inverse is true for Melbourne’s more affordable suburbs (the smaller red bubbles) which promise higher rental yields but weaker capital growth.

Your property investing objective should be long-term wealth creation. And, that means prioritising asset appreciation over rental income.

Not everyone can afford the Toorak’s of the world of course 🙄 And, the 6.1% annual compound price growth in Cranbourne and other more affordable locations is nothing to sniff at.

But, those who understand the impact of an extra 0.5% per annum over a decade or two, and who can budget for a negatively geared position are among the smartest investors around.