We've all heard of the pot of gold at the end of the rainbow.

Optimists will tell you that it's real and that you can realise all your biggest hopes and dreams.

Pessimists will tell you that the pot of gold is the ideal that you will probably never achieve, and that chasing it will only bring you misery.

And property investors will tell you that the pot of gold comes in the form of long-term capital growth.

The average appreciation of houses in Melbourne sits at around 8% annually, and a well-chosen property will appreciate over time.

The problem isn't whether or not the pot of gold exists. It's retaining your asset long enough to get to the end of the rainbow.

Sometimes your investment property might be generating profits through rental returns, and at other times, you might be losing money simply by holding an asset. The returns from capital growth may be worth it in the long term, but what do you do while you wait for your property to appreciate?

This is where negative gearing comes in.

If the costs of owning your investment property are higher than the money it is generating, you can use these losses to lower your personal income tax and save money at tax time.

This is called negative gearing, and it's a strategy that many investors pursue - even deliberately - to achieve tax deductions and soften the financial burden of retaining a property that's losing money.

Holding onto an investment property that costs more money than it makes sounds precarious and doing it deliberately just for some tax benefits seems downright reckless.

But like we said, many property investors deliberately pursue this strategy, and it's often recommended by property investment advisors in Melbourne - including Property Analytics.

I've already given you the number one reason - capital growth! Investors aim to retain their investments for longer and eventually sell when house prices rise. The theory is that the capital gains will generate enough wealth to offset the purchase price and any losses that were made along the way, resulting in a tidy profit.

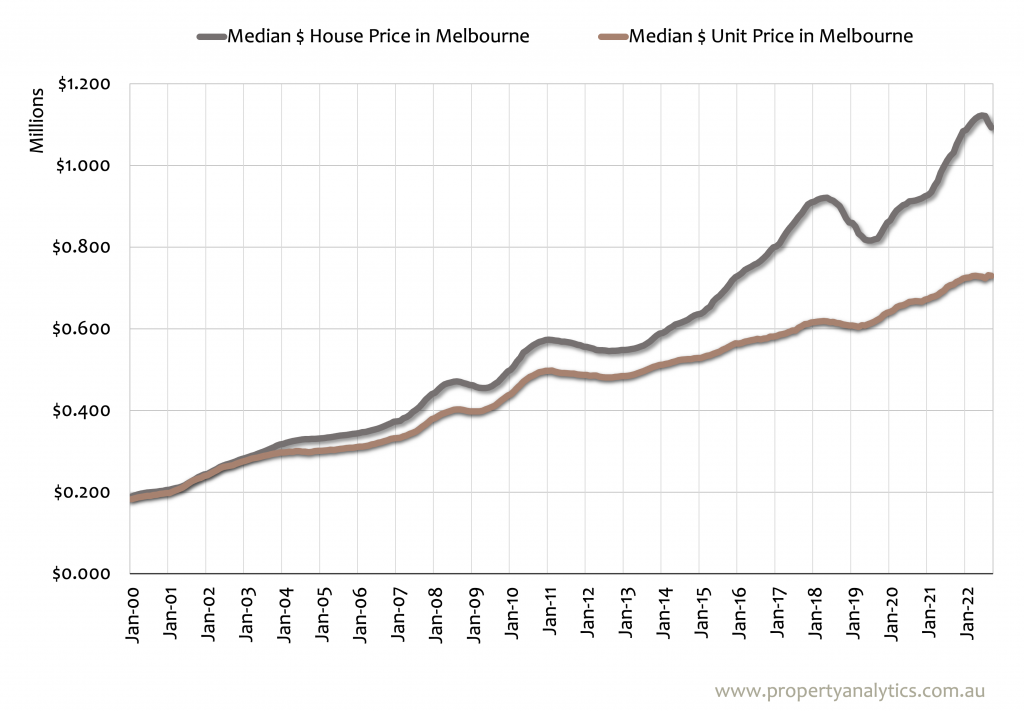

A general principle of property investment in Melbourne is this: negatively geared properties (e.g. properties with lower rental yields) tend to appreciate more in value over time than cashflow neutral/positive properties (e.g. properties with high rental yields). Houses tend to return less rental yield than apartments - the below graph compares house price growth to apartment price growth over the last 20 years.

Negative gearing also takes some of the stress out of rental returns. Investors can offer lower rental prices to attract more stable long-term tenants and attract a higher pool of potential renters to replace an outgoing tenant.

Of course, not everyone deliberately pursues negative gearing. You might unexpectedly end up in a loss position due to lower returns or higher expenses than forecasted, allowing you to take advantage of negative gearing.

Negative gearing comes into play when your eligible investment property expenses outstrip your rental income. The difference in these two numbers can then be taken off your income tax for the financial year. Eligible expenses include management fees, maintenance expenses, and mortgage interest payments.

For example, if your property generates $15,000 in rental income but your costs total $20,000, you can reduce your taxable income by $5,000 - that turns $100k in taxable income into $95k.

However, this doesn't mean you get $5,000 more in tax savings. Rather, you're saving 32.5% of $5,000, as the marginal tax rate for a $95,000 income is 32.5 cents in the dollar for every dollar over $45,000.

So really, you reduce your tax by $1625 and you still need to cover the other $3375 in property losses yourself.

The savings associated with negative gearing can be compounded if your reduced income pushes you into a lower tax bracket. For example, property losses of $5,000 will reduce a taxable income of $122k down to $117k. This puts you in a lower tax bracket, meaning your entire taxable income is subject to a marginal tax rate of 32.5% rather than the higher bracket of 37%.

As you can see, negative gearing is not a silver bullet that eliminates property losses. It's important to consider all your taxable income and chat with tax and investment professionals before jumping into a negative gearing strategy.

Our buyers advocates serving Kew East, Brunswick, and the surrounds can help you understand how negative gearing will apply to you.

Positive gearing is the opposite of negative gearing. In this case, your rental returns outstrip your combined property expenses. Neutral gearing occurs when your rental income and property expenses more or less cancel each other out, resulting in no significant positive gearing or negative gearing benefits.

The clear benefit of positive gearing is that you are making profits that you can use to continually strengthen your financial position, whether that's through saving for your next investment property or chipping away at the principal on your investment property loan.

However, positive gearing also increases your taxable income in the same way that negative gearing reduces it. Increases in taxable income could even push you into a higher tax bracket.

For negative gearing to be successful, you will need:

It is essential to consider the worst-case scenario and ask yourself if you are financially equipped to handle the situation if disaster does strike.

What if you go from relying on reduced rental income to not being able to fill your rental property at all?

What happens if you lose your job or you have to sell your investment property before it has the chance to appreciate further?

Are you really in a position where you can afford to retain a money-losing asset for 10, 20, or even 30+ years?

The most important negative gearing risk management strategy is buying the right investment property. Select a rental property with wide-ranging appeal, such as property close to major amenities and high-income producing activities centres (e.g. hospitals, universities). It's wise to buy in capital cities and inner suburbs, and you should consider active value-adding opportunities when selecting your asset.

This is the sort of due diligence and consideration that I will apply as your buyers advocate in Northcote and nearby target areas. Property Analytics will test these criteria not just when considering negative gearing possibilities, but your overarching investment goals and the overall viability of each short-listed property.

Other ways to reduce negative gearing risks include careful management of your income, taking out appropriate investment property insurance, and maintaining a balanced portfolio that contains both positively geared and negatively geared assets.

As well as negative gearing, the other major tax consideration comes when you sell your property investment.

Capital Gains Tax (CGT) applies to any profits you earn from selling your asset. A 50% CGT tax discount applies for investment properties that are retained for 12 months or more.

Also remember that the tax benefits associated with your property investment apply regardless of whether your property is positively geared or negatively geared. A positively geared property will always result in higher taxable income but claiming eligible expenses will reduce the amount of money that’s added.

Expenses you can claim to reduce your tax liability include:

As an owner-occupier, your home is not classed as an income-generating asset. This means it cannot be negatively geared, household expenses are not tax-deductible, and you are exempt from capital gains tax when selling.

However, if you no longer intend to live in your home, it can be turned into an investment property. It may also be possible to rent out part of your home and claim tax deductions proportional to the amount of space you are renting out. However, some Capital Gains Tax will also apply when selling.

You will need to talk to your lender to discuss your options, and you should also chat with a property investment consultant and your accountant before making the switch.

There are some topics that will always be discussed in the Australian housing market, from housing supply problems to soaring property prices.

And when either of these topics comes up, negative gearing is sure to follow.

While investors can lower their rental prices for negative gearing purposes, a property may also remain vacant. An investment cannot be left vacant by choice if you want to claim negative gearing benefits, but if you genuinely can’t find a tenant, all your expenses will go towards a tax deduction.

In the eyes of some, negative gearing is a property investment strategy that contributes to a much larger problem. Investors are protected if they can’t find a tenant, but vacant properties still result in less supply, which may result in higher house prices for buyers and greater rental expenses for tenants.

Detractors believe negative gearing is bad for the property market and want the associated tax write-offs scrapped completely or heavily restricted.

However, another truth of the Australian property market is that Aussies love property investing. And any policy that removes tax concessions will also lose votes.

Regardless of what you think of negative gearing, it's most likely here to stay, and if you are pursuing long-term capital gains, it's a strategy worth considering.

At the very least, this strategy can reduce your tax liability and alleviate some of the stresses associated with collecting weekly rent, advertising for tenants, and covering initial losses while your property increases in value.

My name is Andrew Stone and I'm a Real Estate Analyst, Licensed Buyers Advocate in Melbourne, and Director of Property Analytics. To discuss Property Analytics' comprehensive, data-driven approach to acquiring high-growth investments in Melbourne, get in touch today.