Wealth is created through asset appreciation not through cashflow. If you want to truly make a better future for yourself and your family through property investment, then you should absolutely prioritise capital growth over rental yield.

The most successful property investors recognise this truth, and invest in the type of properties that increase the most in value over time: Houses. Land appreciates in value, whereas the dwellings that sit on land tend to depreciate in value.

Think about why you get a property depreciation tax break when you rent out newly built properties? The value of the dwelling decreases over time.

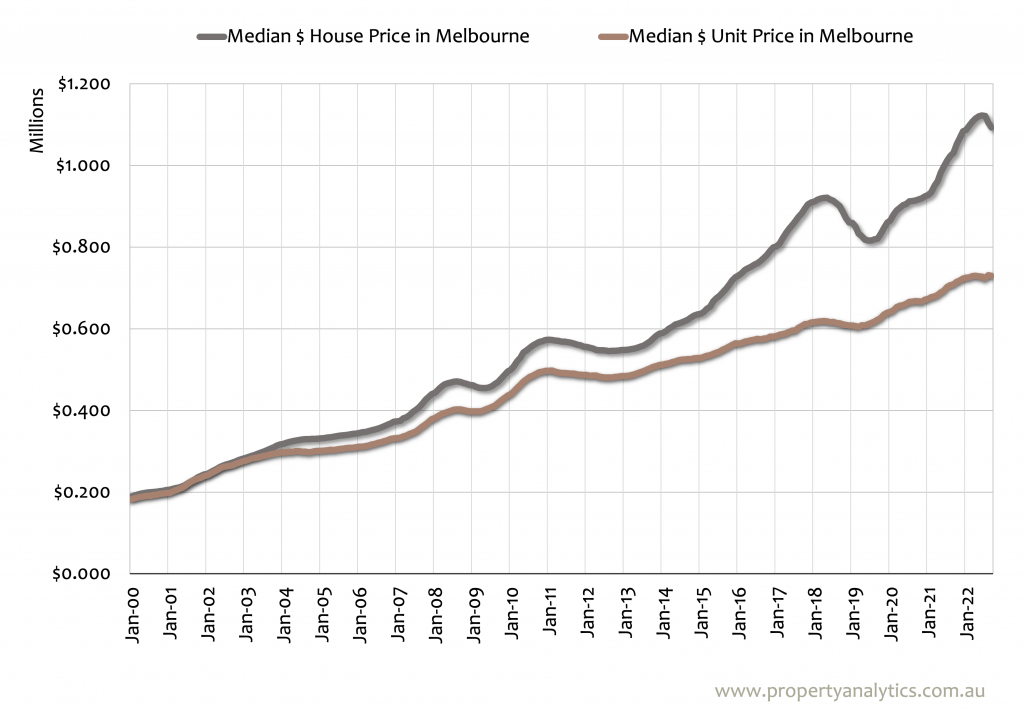

Properties with reasonable land content (e.g. Houses or Townhouses) experience significantly higher capital growth than properties that lack land content (e.g. Apartments/Units). Most of us know this intuitively, but what does the data say?

The Melbourne Median $ House Price has increased about 5.5 times, whereas the Melbourne Median $ Unit Price has increased about 4 times. Over the long-term, houses have proven much better investments for building individual wealth.

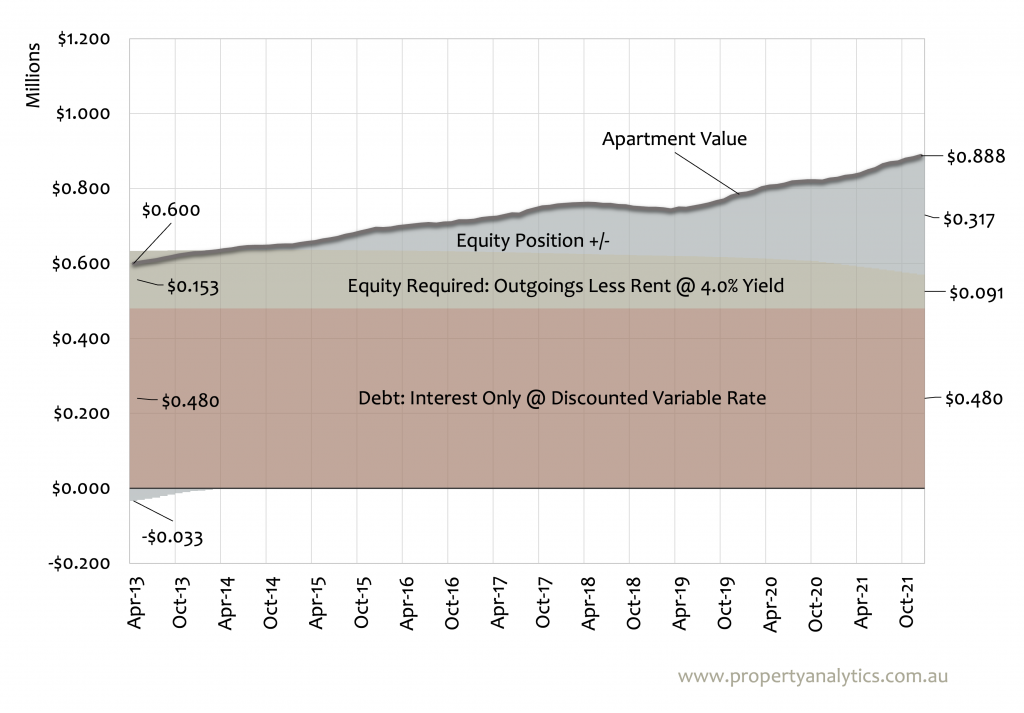

The following 2 graphs compare the performance of an Apartment purchase to that of a House purchase. They illustrate why smart property investors prioritise capital growth over rental yield.

In the common example graphed above, an Apartment purchased for $600,000 in early 2013 would have required about $153,000 in Equity (Cash) to pay for stamp duty, legal fees, deposit, etc. You would have required a $480,000 loan, and your Equity Position at the time of purchase would have been - $33,000 due to purchase fees. Assuming you maintained an Interest Only loan at a discounted variable rate, your Apartment investment would deliver you a modest positive cashflow totalling about $60,000 after accounting for mortgage payments, rates, body corporate, land tax, etc.

Your Apartment investment increased in value over 9 years to $888,000. You would be close to $320,000 better off today.

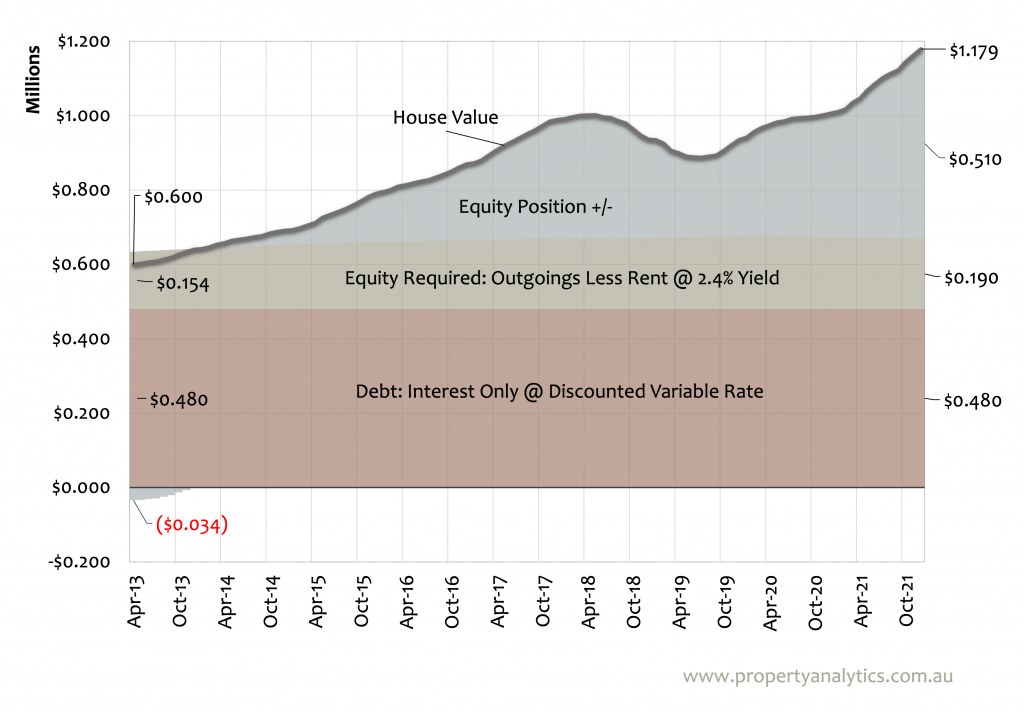

The below graph shows the same metrics for a House purchased for $600,000 at the same time.

The Equity (Cash) required to pay for stamp duty, legal fees, deposit, etc was nearly identical at just over $150,000. You would have required a $480,000 loan, and your Equity Position at the time of purchase would have been - $33,000 due to purchase fees. Assuming you maintained an Interest Only loan at a discounted variable rate, your House investment would cost you money each month after accounting for mortgage payments, rates, body corporate, land tax, etc. You'd have to tip in about $40,000 to maintain it.

Your House Investment increased in value over 9 years to $1,179,000. You would be better off today by more than $500,000.

Investing in an Apartment in 2013 would have been a smart move. Investing in a House would have delivered you an extra $200,000 in wealth. Houses are more expensive to purchase today, and they will require you to tip in extra funds each month to maintain your loan, but an historical analysis suggests that they make a better investment.

Apartment developments will continue at pace, and will likely make up an increasing proportion of new dwelling supply. The scarcity of residential land within Melbourne suburbs has been - and will continue to be - a fundamental driver of capital growth for Houses.

If you can afford a bigger purchase price and you can budget for ongoing supplementary payments to your investment property mortgage, we strongly recommend that you consider prioritising capital growth. You will be much better of financially over the long-term.