March 3, 2025

March 3, 2025

Property development remains one of the best ways to achieve capital growth. However, much like anything in life, it requires careful planning and thought. The development process comes with an endless array of decisions that are far from black and white. Often, these decisions don’t have a clear “right” or “wrong” outcome. This is why […]

READ MORE February 13, 2025

February 13, 2025

A lot is made of the current state of the Australian property market. From interest rate fluctuations to auction clearance rates and the investments made by our politicians, we’re constantly hit with information that tends to make the outlook a little difficult to decipher. So, as we enter 2025, you might be wondering–is now the […]

READ MORE January 10, 2025

January 10, 2025

Property investment can open the door to a world of opportunities you may have never thought were possible. However, it’s not all about leaping at the first option that catches your eye. In an Australian property market that’s constantly changing, evolving, and bringing new challenges, the pathway to tangible long-term success lies in the details. […]

READ MORE November 25, 2024

November 25, 2024

Spanning approximately 1,000 square kilometres and incorporating over 2,000,000 properties, the Greater Melbourne area continues to grow larger with every passing year. From developments in Melton to the newly incorporated Mornington Peninsula, our city is now home to 31 local councils and over 500 suburbs. Naturally, each one of these councils has its own unique […]

READ MORE November 22, 2024

November 22, 2024

I bought a property for a client the other weekend with a simple but effective auction strategy: Quietly study the competition until bidding hits the reserve, wait for things to slow down a bit, and then bid hard. Every property, campaign, and auction is different, so this isn’t a one-size fits all approach (i.e., I […]

READ MORE November 15, 2024

November 15, 2024

Planning permits enable owners to use or alter properties in different ways. In the State of Victoria, a variety of situations will require you to go through the local council to obtain approval and receive a planning permit. From heritage properties to subdivisions, duplexes or developments, there are countless situations where you can really benefit […]

READ MORE October 21, 2024

October 21, 2024

When it comes to making an investment count, there are many factors at play. One of the most undervalued yet underrated aspects of the entire process is, without a doubt, market analysis. If the ever-changing Melbourne housing market, you should never underestimate the power of thorough market analysis and research. Whether you’re a first-time buyer […]

READ MORE October 2, 2024

October 2, 2024

If you’re pursuing an investment or simply following the news, you’ll be well aware of how topsy-turvy Melbourne’s real estate market can be. However, there are experts available to help. As an investor, one of the most valuable partnerships you can make is with a dedicated property development consultant. Whether it’s a high-rise in the […]

READ MORE September 16, 2024

September 16, 2024

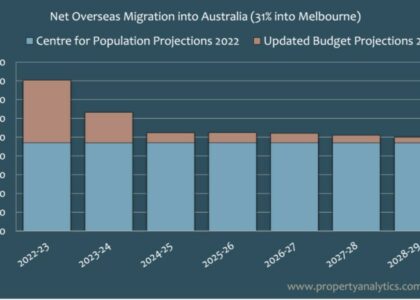

Rental prices have boomed across Melbourne over the last 2+ years. The graph below shows overall asking rents are up 40%% for units, while Melbourne’s Inner City has seen an increase of 60%. When combined with remarkably low vacancy rates, the current supply-demand balance in Melbourne is scary. If we cast our minds back even […]

READ MORE July 30, 2024

July 30, 2024

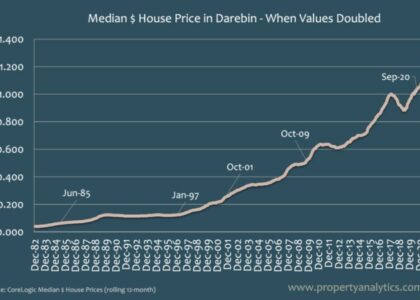

Darebin is a Council Area in Melbourne’s North that trends pretty closely to the city’s property market as a whole. The graph below illustrates how house prices have doubled in value over the past four decades. It’s taken anywhere between 3 to 10 years for prices to double. Three further insights jump out from this […]

READ MORE June 18, 2024

June 18, 2024

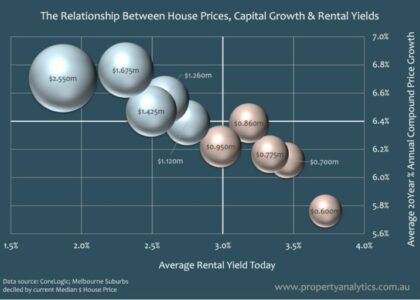

This is a really common question. The answer? In part, it all depends on what you prioritise more – capital growth or rental yield. We know instinctively that higher priced suburbs tend to achieve greater capital growth over time, but they also tend to deliver lower rental yields. Until now, we’ve struggled to convey this […]

READ MORE May 10, 2024

May 10, 2024

Entering the property market or expanding your portfolio can be complicated. There’s a lot to understand, and for new investors, there’s certainly a lot to consider. From keeping track of property markets to the average value of suburbs, the future outlook is difficult enough for real estate professionals, let alone individual property investors. Thankfully, there […]

READ MORENotifications