A lot is made of the current state of the Australian property market. From interest rate fluctuations to auction clearance rates and the investments made by our politicians, we’re constantly hit with information that tends to make the outlook a little difficult to decipher.

So, as we enter 2025, you might be wondering–is now the right time to invest in property? The answer? It all depends on how and where. Throughout this article, we’re going to explore and analyse a variety of Australian property development trends, then offer some expert insights into what it all means.

Last year was one of contrasts and uncertainties for the Australian property market. While many regions saw recovery following the pandemic downturn, others faced slow growth or even declines. Several key factors shaped the property landscape:

If you're wondering whether it's a good time to invest and want to speak with an expert, feel free to contact us now! We’re a client-driven team of buyer’s advocates in Melbourne. Every day, we help investors to secure first-class properties backed by industry data and analytics.

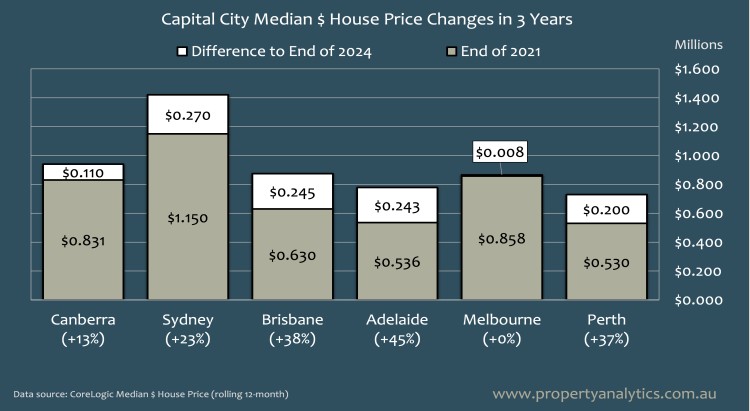

Australia’s property market is not a monolith. Each region’s performance depends on a mix of local demand, housing supply, economic conditions, and government policies. As the summer of 2024/25 unfolds, the data reveals many interesting insights into the current state of play.

According to CoreLogic figures from October 2024, “Sydney, Brisbane, Adelaide and Perth dwelling values” had all hit a “record high” entering the fourth quarter of 2024. These figures also revealed that “Perth had the highest monthly, quarterly and annual dwelling value increase, while Adelaide has overtaken Brisbane as the second strongest capital city market nationally.” (Source: CoreLogic).

On the flip side, this data also points to the fact that both “Melbourne and Hobart recorded quarterly and annual dwelling declines” were at “-5.1% and -12.5% respectively” when compared to their record highs in 2022.

We’ll cover the Melbourne property market in more depth later.

Although prices have been shown to fluctuate from city to city, other metrics indicate that there is certainly no lack of demand. In fact, the sheer level of demand has resulted in a supply-demand imbalance in Melbourne and major other cities. Be sure to read our recent article on this topic for further insight!

One of the key figures we can look to that illustrates this demand is the current vacancy rates–many of which have hit record highs in recent years. Put simply, the vacancy rate is a percentage outlining how many rental properties are currently empty/without tenants.

Assessing this number is quite simple–the lower the number, the more demand there is for rentals. For the investor, these lower figures mean that once a property is advertised, there is a strong likelihood of attracting interest and finding tenants.

Here’s a look at the current vacancy rate in various Australian cities:

Melbourne: 2.2%

Sydney: 2.1%

Brisbane: 1.2%

Adelaide: 0.8%

Perth: 0.7%

While Melbourne’s property market has long been one of Australia’s most active, recent years have seen a slight slowdown in growth. Here are three trends to keep an eye on:

In 2024, house price growth in Melbourne was lower than in Sydney, Brisbane, and Perth. This is reflective of broader economic factors, including inflation, wage stagnation and rising interest rates, which all play a role in reducing a buyer’s purchasing power.

However, the outlook is far from doom and gloom–there are still endless opportunities for savvy investment, both in the form of existing properties and developments. Of course, one way to find and take advantage of these opportunities is to partner with our seasoned buyers' advocates.

Despite these challenges, history shows that Melbourne’s market is cyclical. Consider Darebin, a council area in Melbourne’s north that closely mirrors the city’s overall market. Since 1982, house prices in Darebin have doubled five times—even amid downturns and corrections. This is just one of many areas in Melbourne that have become more highly sought after than ever before.

This cyclical nature highlights the potential for long-term gains.

Melbourne recently reclaimed its title as Australia’s largest city. According to the ABS, Melbourne’s population grew to over 5.3 million by 2024, up nearly 2 million since 2000. This surge is driven by a mix of overseas migration and regional-to-urban movement.

Population growth fuels demand for housing, but with supply lagging, the imbalance continues to place upward pressure on prices. Melbourne’s ability to accommodate future growth will hinge on strategic urban planning and increased housing availability.

The supply of new dwellings has not kept pace with demand. While high-density developments (like those constructed in Carnegie, Elsternwick or Springvale) have added some stock, it’s not nearly enough to address the housing shortfall. The result? Fierce competition for available properties and upward pressure on prices, even during periods of overall market slowdown.

Many experts believe Melbourne is at or near the bottom of its current market cycle. While growth has been slow, history suggests that these downturns present a great opportunity for well-planned investment-particularly when those backed by the data. Property prices are unlikely to remain stagnant forever, and those who buy when confidence is low often benefit the most when markets rebound.

Melbourne’s recent downturn, coupled with rising interest rates, mirrors previous market corrections such as the sharp decline in 2018/19. If history is any guide, a recovery phase may soon follow—as long as economic conditions stabilise.

If you’re currently looking to invest and want to make sense of the current market, reach out to us to connect with highly knowledgeable property development consultants in Melbourne

If you’re considering property investment in 2025, Melbourne’s current market presents a mix of risk and potential reward. With prices lower than their peak, opportunities exist for those who are willing to plan strategically and hold long-term.

However, success depends on:

When navigating the complexities of property investment, having the right data and expertise at your disposal can make all the difference. Here’s how Property Analytics supports property developers and investors across the city of Melbourne.

Market research is the backbone of our service. Our team uses data insights to stay ahead of the curve, analysing everything from feasibility to property prices, population growth, supply and demand, and other key metrics that help you identify high-growth areas.

Whether you’re looking to invest in inner-city developments or emerging suburban markets, we’ll equip you with the tools to make informed decisions.

From feasibility studies to planning approvals, Property Analytics offers complete support for your development projects. Our team of licensed buyer’s advocates and real estate analysts has extensive experience in managing the intricacies of property development.

We work with a network of industry professionals to conduct a detailed feasibility analysis, secure profitable sites, assess planning regulations, obtain planning permit approval, and manage the entire acquisition process.

Every investor has unique goals, and our personalised strategies reflect that. We work with everyone from first-time developers to seasoned investors and small business owners to create investment plans that align with their personal aspirations.

Whether you’re aiming to build a property portfolio or develop high-value residential projects, our customised advice delivers actionable results.

Still wondering how we can assist? Here’s just one of our many recent success stories:

Walter, an Australian citizen living overseas, wanted to secure a development project in Melbourne before his return. With a budget of around $1.2 million, he engaged us to find a profitable site.

I tracked a property for months but initially dismissed it as too expensive. However, after negotiating with the agent, I secured it for Walter, ensuring full project feasibility, council feedback, and expert valuation. We purchased in April and immediately assembled a team to fast-track planning permits.

A permit was approved just before settlement, and with the market appreciating, profits looked strong. Walter decided to cash in, so I connected him with a trusted local agent and managed the resale process. Within 14 months, he made significant profits.

Walter continues to work with us, praising our market knowledge, development expertise, and hands-on approach: “Andrew is honest, hardworking, and always available—highly recommend his services.”

With over 15 years of experience, we’ve built a strong reputation for integrity, expertise, and a commitment to client success. As our name suggests, the Property Analytics team leverages data to uncover properties and developments that represent real long-term potential.

If you’re ready to take advantage of the current market and explore profitable property development opportunities, get in touch with our expert team today.