Rising interest rates will affect Melbourne house prices – price growth will go down because borrowing costs increase and buyers can’t spend as much. Before April 2022, the last time the Reserve Bank raised the Target Cash Rate was November 2010. It’s been a long time since the property market has dealt with a rate rise, so what should we expect?

Firstly, it’s worth noting that Melbourne house prices have increased in the past when interest rates were high.

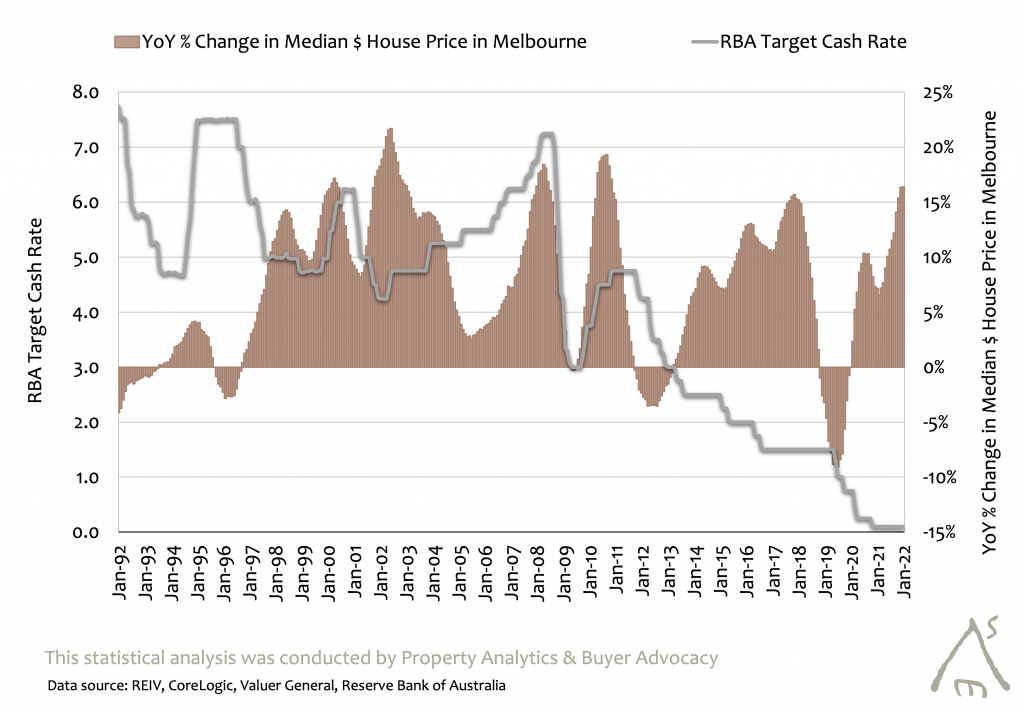

Look at the period from 1998 to 2004 in the below graph – the RBA Target Cash Rate was +/- 5% and house prices boomed. As interest rates steadily increased from 2004, price growth dropped significantly, but the market remained in positive territory.

History suggests that the direction of interest rates is more important to house prices than the actual level of interest rates. The Melbourne property market tends to respond quickly to changes upwards or downwards – look what happened to house prices during interest rate rises in 2000, 2005, and 2011, and look what happened to prices when interest rates fell in 2001, 2010, 2013, and 2020.

Interest rates will continue to rise given inflation levels and overseas experience. Melbourne house price growth will likely cease in response.

Melbourne house price growth had flattened in recent months prior to the rate rise in April. Talk to most selling agents, and they’ll tell you the market is very different in 2022 than it was in 2021. Hot competition between 5-6 bidders quickly turned into private sales with 1-2 genuine buyers who refuse to overpay.

The market is patchy though. Quality houses in good locations on conventional blocks are still achieving great results under the hammer. But most other vendors are being brought down to earth. The market was already coming off the boil – now with interest rates set to rise, what should we expect?

Widespread drops in Melbourne house prices are likely but not necessary inevitable in coming months as interest rates rise.

Household savings are higher than ever, population growth is returning, unemployment is at record lows (and predicted to fall further), and massive construction cost escalations will lead to less new housing stock. All that said, the market was already slowing and if interest rates rise dramatically in a short space of time, we could be in for a correction.

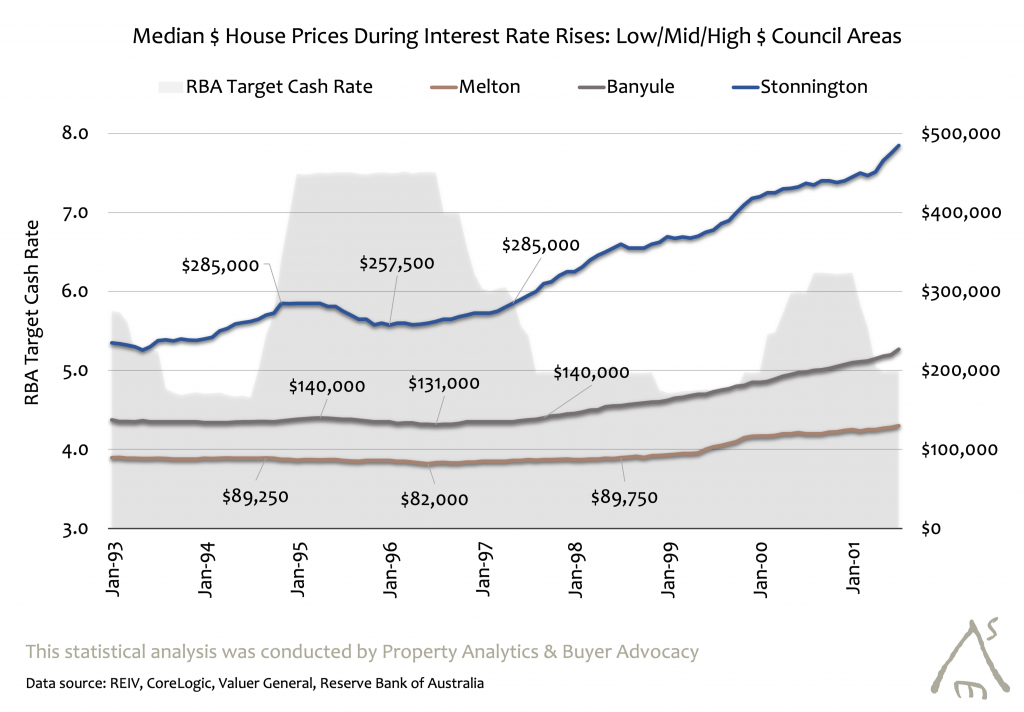

The below graph shows how Melbourne house prices responded to a near 3% increase in the RBA Target Cash Rate over just 6 months from July 1994. In affordable areas, average areas, and expensive areas alike, the affect was similar – price drops of 6 to 10% over a year or two.

Supply and Demand will likely buffer us against serious shocks in the short-term though. New listings were already slowing due to the federal election; winter is always quieter; and a lot of vendors will likely sit on their hands to see how the wind blows. Less Supply should act to prop up prices before the busy Spring season from September onwards.

The main risk that we see in the Melbourne property market relates to property investors.

Rising interest rates will affect Melbourne house prices. As borrowing costs increase, the number of property investors will shrink. And those looking to invest will be more cost conscious than they have been in recent years.

I’m already seeing this in the market anecdotally. From late 2020 to late 2021 speculation in the market was rampant. So many people were overpaying for investment properties and development sites. The mindset was clear – why not pay a bit extra, I’ll make it back in the next few months as the market continues to rise. I went to countless auctions for small-to-medium townhouse development sites where I walked away knowing beyond a doubt that the purchaser would lose money on any project they tackled.

Every dickhead was a property developer in 2021!

Said anyone who buys or sells for a living

Now, most properties that have a few warts (older kitchens/bathrooms, warn carpets, outdated lighting, minor cracks, etc) are struggling. Trees, slope, easements, challenging overlays – too hard.

We’re in a more balanced property market than we’ve been in for years. The rollercoaster of unsustainable price growth, rare price drops, and pandemic hysteria has seen sentiment shift sharply. A sellers market turned into to a buyers market into a sellers market into a buyers market into a sellers market. Crazy.

In coming months, we’re going to focus on off-market opportunities. We’re already dealing with more vendors who have realist price expectations and are open to long settlement periods. Prospects for price growth over the next year or two are pretty slim, so smart operators will manufacture wealth through property development instead of hoping for more favourable market conditions.