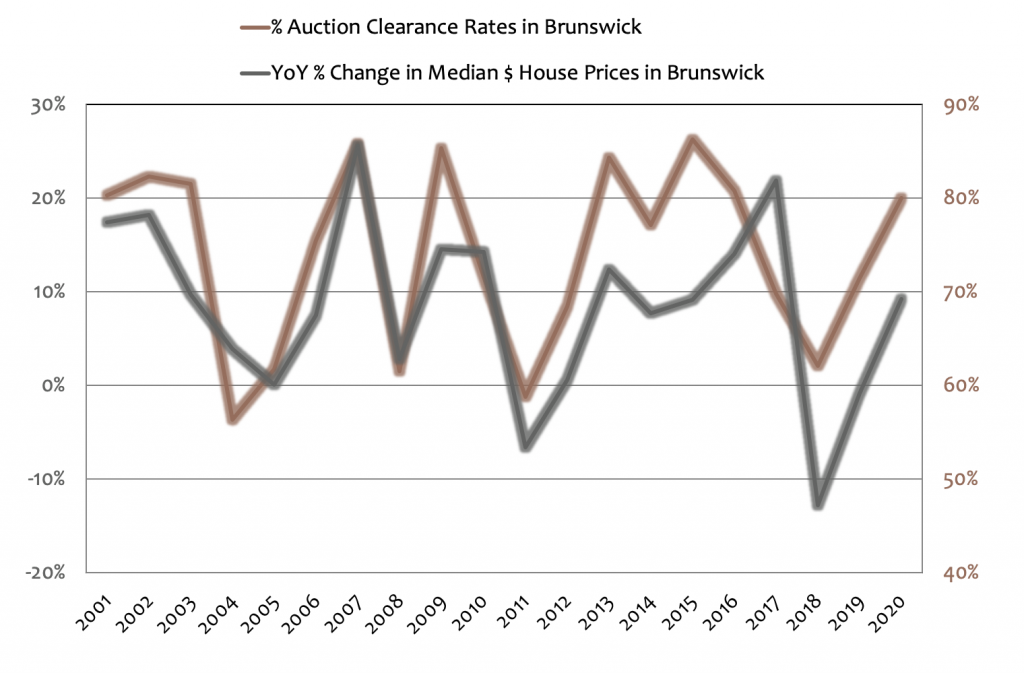

This is a really common question. The answer? In part, it all depends on what you prioritise more – capital growth or rental yield.

We know instinctively that higher priced suburbs tend to achieve greater capital growth over time, but they also tend to deliver lower rental yields.

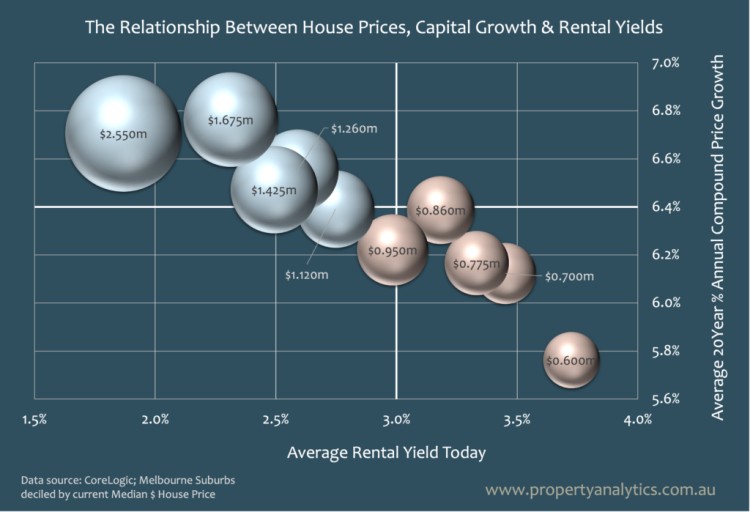

Until now, we’ve struggled to convey this truth in a single visual.

In the table above, you’ll notice how Melbourne’s more expensive suburbs (the bigger grey bubbles) cluster to the top left – this is because they generally promise lower rental yields but stronger capital growth.

The inverse is true for Melbourne’s more affordable suburbs (the smaller red bubbles), which promise higher rental yields but weaker capital growth.

Your property investing objective should be long-term wealth creation, and that means prioritising asset appreciation over rental income.

Of course, not everyone can afford the Tooraks or Brightons of the world. The 6.1% annual compound price growth in Cranbourne and other more affordable locations is also nothing to sniff at.

However, those who understand the impact of an extra 0.5% per annum over a decade or two, and buyers that can budget for a negatively geared position are among the smartest investors around.

Let’s dive into what all of this means in more detail.

Capital Growth vs Rental Yield

Whether you’re a seasoned investor or looking to enter the market for the first time, these are two terms that you’ll definitely want to know.

In a general sense, capital growth refers to an increase in the value of an investment or asset over time. This figure (usually listed as a percentage) is determined by its present value in comparison to the original purchase price.

For example, if a property was originally purchased for $600,000 and has been valued at $700,000 this year, this represents an overall capital growth of 16.67%.

A rental yield, on the other hand, is the amount that you are receiving by leasing out the property to tenants each year.

The Fundamentals of Capital Growth

Capital growth, or capital appreciation, is a crucial concept for investors in the real estate market, particularly those engaging in negative gearing. For property investors, capital growth is often the primary objective, as it can lead to significant financial gains when the property is eventually sold.

Investors rely on capital growth to offset the short-term losses incurred through negative gearing. While they may be operating at a loss on a yearly basis due to rental income being less than expenses, the ultimate goal is for the property’s value to increase substantially over the investment period. This increase can lead to a profitable sale, where the gains realised from selling the property exceed the cumulative losses sustained over the years.

Several factors can influence the capital growth of properties:

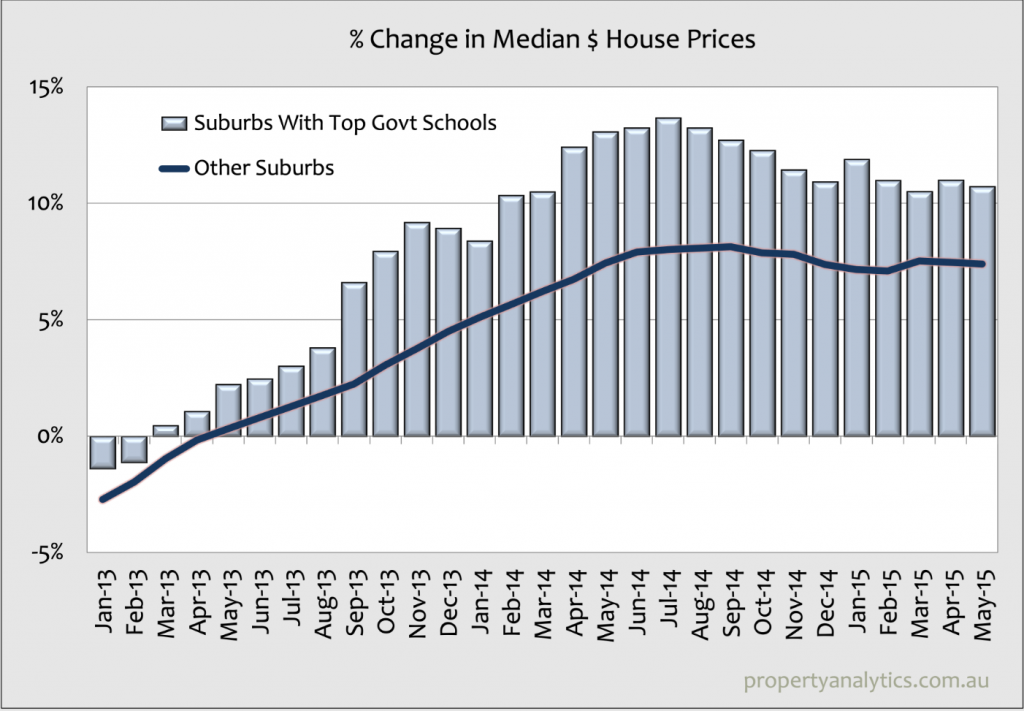

- Location: Properties in desirable locations, such as those close to amenities, good schools, and public transport, tend to appreciate faster.

- Economic Conditions: Economic stability and growth can boost property values. Low interest rates and strong economic performance generally lead to increased property demand.

- Infrastructure Developments: Areas undergoing significant infrastructure developments, like new roads, public transport, or commercial hubs, often experience higher capital growth.

- Supply and Demand: The balance between the supply of new housing and demand from buyers and renters directly affects property prices. High demand with limited supply often drives prices up.

Rental Yields and the Local Property Market

As vacancy rates continue to drop in Melbourne, this has led to an increase in rental yields across the city. Importantly, this rise has been at a higher rate than the increase in house prices. As noted by realestate.com.au “houses in Brooklyn in Melbourne’s west and Aberfeldie in inner Melbourne both encountered a 38% rise in their median gross rental yields over the past year. This was the highest among all suburbs in the country.”

As an investor, this illustrates that it’s possible to cover mortgage payments with rental income and still come out on top in the long run. When this relates to multiple investment properties, the accrued income becomes even higher.

Currently, the vacancy rate in Melbourne is currently a staggering 1.1%. In real terms, this means that there is no shortage of prospective tenants.

Capital Growth and Flipping Properties to Sell

Capital growth is highly beneficial for property flippers—investors who buy, renovate, and quickly sell properties for a profit. By focusing on properties with potential for significant short-term value increases, flippers can maximise their returns. Effective market timing is crucial, as investors need to buy in areas or periods where capital growth is strong, allowing them to buy low and sell high.

Capital growth can also be achieved through value-add strategies like renovations, upgrades, and improvements to general curb appeal. These actions directly increase the property’s market value, contributing to higher selling prices. However, flipping carries risks, including market downturns and renovation delays. To manage these risks, flippers conduct thorough market research, set realistic budgets and timelines, and prepare for contingencies.

The profitability of flipping relies on achieving strong capital growth. The difference between the purchase price (plus renovation costs) and the selling price determines the profit. For instance, buying a property for $500,000, spending $50,000 on renovations, and selling it for $650,000 results in a $100,000 profit before transaction costs and taxes.

What Does it Mean to Negatively Gear Your Investment Property?

Negative gearing continues to be a popular investment strategy in Australia, especially in the real estate market. Even if you aren’t familiar with its nuances per se, chances are that you’ve heard it mentioned on radio, TV, and countless other news outlets.

In practice, it refers to the process of borrowing money to invest in a property, where the income generated from the investment (usually through rent) is less than the expenses incurred (such as loan interest, property management fees, maintenance costs, and depreciation). This shortfall can then be deducted from the investor’s taxable income to reduce the overall tax liability.

When an investor negatively gears a property, they are essentially running the property at a loss. Here’s a simplified example to illustrate:

- Rental Income: Suppose an investor receives $20,000 annually in rental income.

- Expenses: The costs associated with the property, including mortgage interest, maintenance, and other expenses, total $30,000 per year.

- Net Loss: The difference between the income and expenses is a $10,000 loss.

In essence, a $10,000 loss can be offset against the investor’s other income, such as their salary. From here, their taxable income and, therefore, the amount of tax they need to pay.

In Australia, our current taxation rules allow property investors to claim the net rental loss as a deduction against their other forms of income. For example, if an investor is in the highest tax bracket (47%, including Medicare Levy as of 2024), a $10,000 loss could potentially save them $4,700 in taxes.

Are There Challenges of Managing Multiple Properties?

While purchasing multiple affordable properties certainly has its benefits, it’s also worth considering the logistical elements that come along with it.

In this sense, we’re talking about property management, which includes everything from securing tenants to dealing with lease renewals and contracts, setting a rental price, and more. Of course, there are ways to make everything easier, such as partnering with a property management firm.

Overall, this boils down to personal preference, as well as the amount of time and resources you have to handle everything.

If you have a busy lifestyle and generally a lot on your plate, you may prefer the simplicity of owning a single property that provides consistent capital growth. On the other hand, if you’re a little more involved and have the time, the latter option could be perfect for you.

Need to speak with an expert? Contact us today to connect with a leading property investment agent in Melbourne.

Assessing Your Options

Obviously, the path you take depends on your individual circumstances and whether or not you have the means to purchase a single property for a high asking price. However, for investors with the necessary resources, there is actually value in both options.

To help you out, we’ve compiled the major benefits of each approach below:

Option A: Investing in a Single Expensive Property

- Greater Capital Growth: Higher-priced suburbs tend to achieve stronger capital growth over time. Investing in a single, more expensive property in a desirable location can lead to substantial long-term value appreciation.

- Simplified Management: Managing one property is less complex and time-consuming compared to multiple properties. It involves fewer logistical issues such as tenant management, lease renewals, and maintenance.

- Strategic Advantage for High-Income Investors: Wealthier investors can leverage negative gearing more effectively, using the tax benefits from property losses to offset other income, making it a smart long-term investment strategy.

Option B: Investing in Multiple Cheaper Properties

- Higher Rental Yields: More affordable suburbs generally offer higher rental yields, providing a steady income stream that can cover mortgage payments and potentially generate a profit.

- Diversification: Owning multiple properties spreads risk across different locations and property types, reducing the impact of market fluctuations on the overall investment portfolio.

- Increased Income Potential: With multiple properties, the total rental income is higher, and the cumulative rental yield can offer a significant return, especially in markets with low vacancy rates like Melbourne, where demand for rental properties remains strong.

Partner with Property Analytics

As you can see, property investment isn’t a one-size-fits-all practice. Luckily, Property Analytics seasoned professionals who know the intricacies of the market and remain up-to-date with the latest trends.

If you’re currently deciding between a single expensive property or thinking of diversifying with multiple affordable options, our buyer’s advocates in Melbourne are here to help. You can also connect with us and receive a detailed property feasibility analysis in Melbourne.

We are data-driven and care about your goals, interests, and outcomes. Discover your new investment property and invest today.