Leafy Dual Occ Subdivision

Bassel is a long-time client who appointed us to secure and project manage this modest project with a mind to recouping capital by selling one portion and retaining the other for long-term capital appreciation.

We know that he loves his big blocks, and we quickly zeroed in on one particular suburb with reasonable cost per square meter and strong demand from owner occupiers. After watching the property pass in at auction with big price expectations, we maintained dialogue with the selling agent so that we were first to know about a significant price adjustment. The vendors were increasingly motivated.

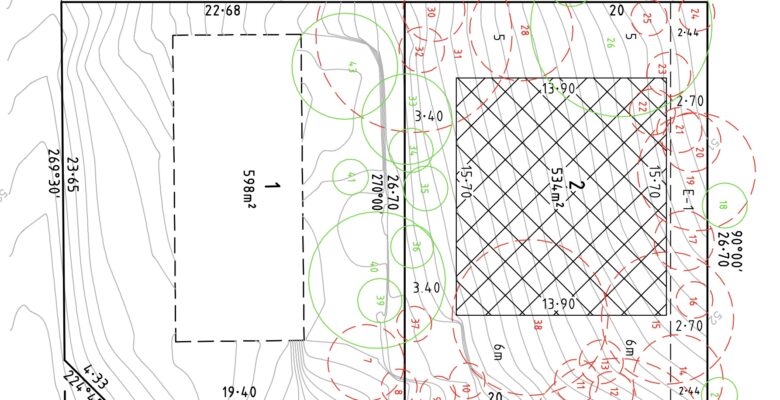

The location is very popular for knock-down rebuilds from owner-occupiers who aren’t adverse to overcapitalising. We knew that a vacant 500m+ block with a big street frontage would sell really well. Council doesn’t like approving vacant subdivisions (they prefer you to build then subdivide) but we know what we’re doing. We defined a new build footprint, ran all services (drainage, electrical, internet, gas, vehicle cross-over), attained a new title, and advised Bassel on a good local agent to sell through.

The vacant block sold for $0.750m and the existing dwelling was revalued afterwards at just over $1m. Funnily, it ended up renting for more per week after losing its massive rear yard.

Bassel had some nice things to say about us afterwards: “My family and I were looking to get into property development in Melbourne in 2015.Andrew his team have helped us complete two successful projects. Andrew is honest, transparent and smart. We have put a lot of faith in him and his team – we haven’t been disappointed”

- Property

- Investment

- Development

Idyllic township, rural feel with metro amenities and big future infrastructure

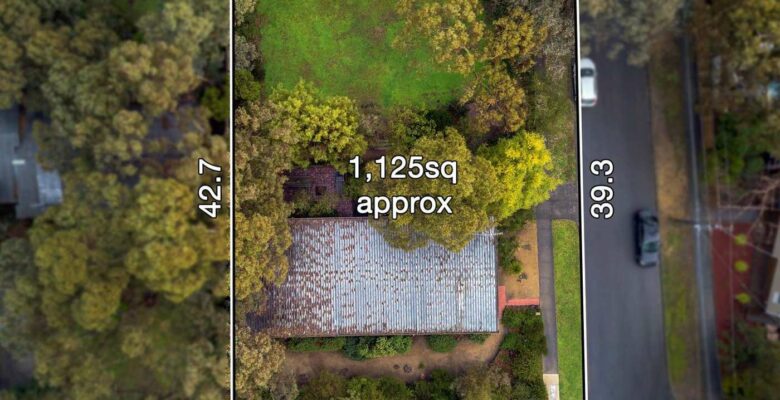

1125m2 sloping corner w/ vegetation

Tidy but dated 3bed/3bath

$1.125m

up to $1.290m

Private Sale, 3 weeks Post-Auction

3 months

$650 /week

3.0% gross

House $0.895m | Unit $0.690m

7.5% p.a. over last 10 years

Diverse, increasingly affluent demographic; regular media hype; big gentrification

Good value post-auction buying; straightforward, profitable subdivision with continual rental income

Retain and rent existing dwelling; subdivide and sell large rear street-facing yard

18 months from purchase to completion

$1.520m inc full subdivision

$1.790m

$0.270m

53%

18%

3.6%

- Off Market Bargain w/ Big Value Add

Harvey is a big earner, building a portfolio of negatively geared properties with value-add

Price : $1.850m

Location : Blue chip, affluent, close to hospitals, transport, shops and parks

Scope : 3 large, quality, detached houses

Profit : $0.900m

Return on Cash : 48%

- Build 4 and Keep Them All

Jim semi-retired from finance young and is building an impressive portfolio

Price : $0.950m

Location : Urban, gentrifying, with good transport and access to CBD

Scope : 4 attached street-facing townhouses

Profit : $0.475m

Return on Cash : 45%

- Big Block Needing Unique Design

Jack asked us to JV with him on a bigger site, and this made sense for us both.

Price : $2.125m

Location : Quiet, leafy, family-oriented with top schools and shops

Scope : 8 townhouse with dual access

Profit : $0.675m

Return on Cash : 58%