Everyone who is interested in building a real estate portfolio has the same over-arching goal.

We all want to make money, and preferably, plenty of it!

Some people are starting from the ground floor and looking to purchase their first investment property, while others are looking to diversify and strengthen their position.

Many investors are more interested in a passive income and generating cash flow, while others are in it for the long-term gains and big wins that can come with capital growth.

But it still all comes back to money.

In this article, I'm going to explore 5 real estate investment strategies that can bolster your real estate portfolio and help you make more money through property.

What's the right strategy for you? This will depend on your goals, circumstances, and a range of other factors. Not all strategies are made equally for every investor, but each of these strategies can help you to buy more properties and make more money from real estate.

As well as these 5 property investment strategies, we'll also discuss:

Every property investor is asking "what's the best investment strategy?"

But what they really should be asking is "what's the best investment strategy for me?"

To answer that question, there are a number of questions that I would ask you (and that any worthwhile buyers advocate or property investment advisor in Melbourne should also ask you).

These are just a few of the questions I will ask if you come to Property Analytics to generate wealth through real estate. Once I understand your situation, I can pair this with proprietary data and analyses to determine what your goals should be and the investment strategies you will need to get there.

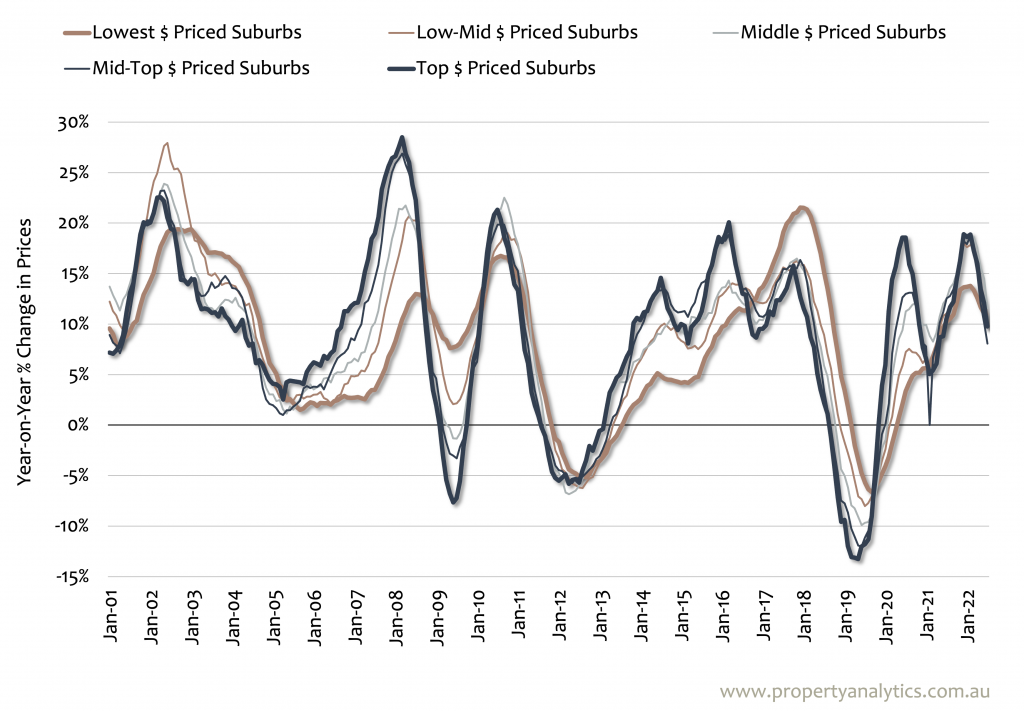

"Finding the right location to buy" isn't an investment strategy on its own, but it is one constant that will make or break any property investment strategy.

It doesn't matter what your financial position is or whether you're looking for rental yield or capital gains, it is essential to select the location of your investment property strategically and carefully.

Here's what a great investment property location will typically look like:

These days, just about everyone seems to be a property investor, but the vast majority of the property-buying market is still dominated by owner-occupiers.

When you're targeting properties to purchase for investment purposes, the last thing you want to do is buy a property that has been specifically designed by a developer to sell to real estate investors.

This "investor stock" is often good for nothing other than making a profit off you!

An important part of your investment strategy should be looking at properties that owner-occupiers want to buy.

Location, land, livability, the status of the area, and the character of the property are all features to consider. Remember that while you are buying with your head, many would-be property owners are buying with their hearts.

If we're talking endgame, then capital growth - and not just high rental yield - is what most investors are looking for. Many investors are even willing to run their investment property at a loss and cover the gap while they wait to eventually cash in.

However, if you're a starting investor on the lower end of the income scale, it can be beneficial to target a property with a higher rental yield in order to generate positive cash flow

By positively gearing your first investment property, you can put yourself in a better financial position to purchase your next investment property. The excess income you generate can form the basis of the deposit for your next investment loan.

Targeting a rental property with higher yield often means sacrificing capital growth, which can also make the process to build equity slower. You also can't leverage the tax benefits associated with negative gearing if your property is in the black.

However, as a way to generate passive income that can be used to fund your next investment, a cashflow investment strategy can be useful. Investors may also target cashflow positive properties at different stages of their investing journey to balance their portfolio or "retire" debt that has accumulated while investing.

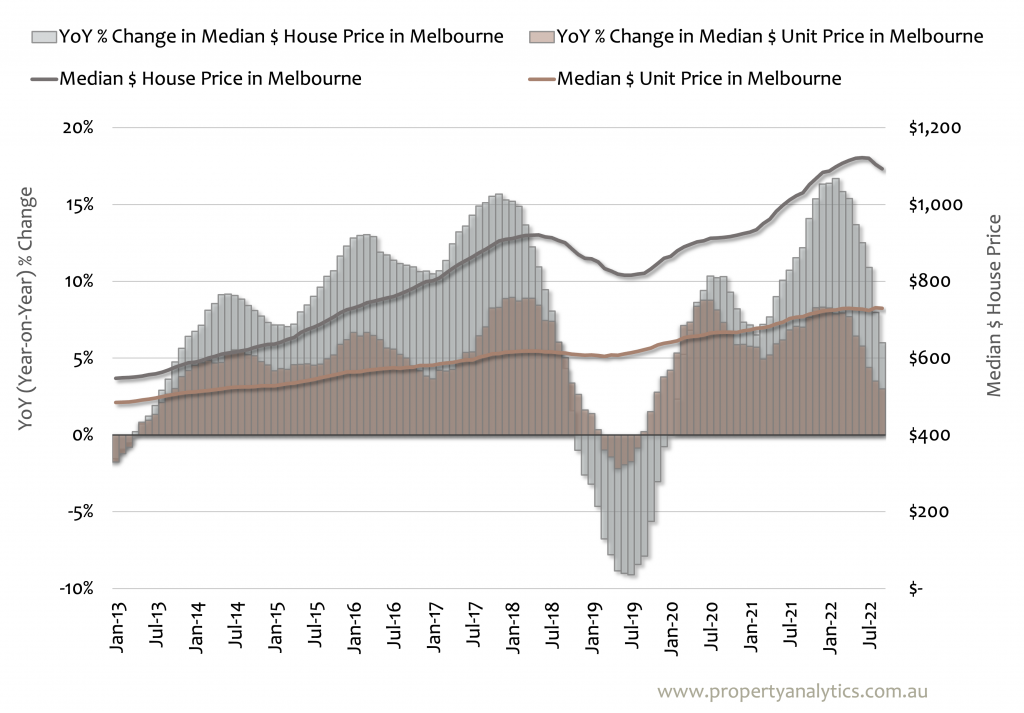

Cashflow and rental yield are excellent tools for Australian property investors, but capital growth is the Holy Grail and your key to wealth creation.

When you choose Property Analytics as your property investment consultant in Melbourne, we will always prioritise and emphasise the importance of purchasing properties with high capital growth potential.

One way you can take advantage of these properties is through the "Buy and Hold" method, which looks a little something like this:

The key to this strategy is finding the right area - and the right property in that area - to maximise your chances of significant capital growth. "Buy and Hold" strategies can be short-term if you time your entry and exit well, or they can be longer-term when you invest in a property with ongoing appeal and increasingly high demand.

Properties with good capital growth potential often come with high purchase prices compared to rental yield, which puts you into a negative cash flow position in the short term. However, this also gives you access to potential negative gearing tax write-offs and the promise of financial freedom via future capital gains.

If you're in a financial position to cover these short-term losses, you can even establish your investment portfolio by making your first purchase a property with high capital growth potential.

"Buy and Hold" capital growth strategies are easy in investor-friendly markets where desirable properties are going up in price across the board. But when the market goes flat or prices begin to drop, fewer and fewer investment properties will be able to net you the capital growth you're looking for in your planned timeframe.

There are always methods to beat the market, and our data-driven buyers agents in Templestowe Lower, Preston, and across Melbourne know how to find properties that can better weather market changes. The location data mentioned at the top of this article is just one tool at our disposal, while a focus on land content and thorough due diligence checks are a few other steps we take.

But if you want a capital growth strategy that more effectively weathers market changes, then a passive "Buy and Hold" method might not be the best approach.

With that in mind, let us tell you about a strategy that will be the future of property investing in Melbourne.

Most of the property investment strategies I have discussed so far are pretty passive.

You buy the right property in the right area, you rent it out for some cash flow, and you watch it appreciate in value over time. Once you're in a stronger financial position, you take the next steps and keep building your real estate investment portfolio. Assuming you hire someone else to act as the property manager, you’re not doing much to the property at all.

But smart property investors understand that you can't always rely on the market to help you out. Sometimes, you need to actively take steps to add value to your investment property.

Renovations are one course of action you can take to value-add and improve your return on investment. Upgrading wet areas, ripping up carpets, overhauling outdoor spaces, and even changing your curtains and blinds can have a big impact on property prices.

Houses that need a bit of work can often be picked up for a bargain, and smart renovations can be a great way to increase your capital growth. It will work wonders in a hot property market and can even help you turn the tide in a flat or slightly downturned market.

When you're selecting a property for this type of investment, it's important not to get caught up in the cosmetic details. If you can find the biggest eyesore in the best neighbourhood at the right price - all without nasty underlying structural issues - you could be on a winner.

Renovation is really just the tip of the iceberg. If you've got the right block of land in a good suburb, you can proactively add value through property development.

You will need to navigate the world of property design, planning permits, council approvals, zoning constraints, construction documents, and tenders (to name just a few). But if the property you're targeting ticks all the boxes, you could turn a rundown property into multiple townhouses, 2 fully detached homes with their own street frontage, or other appealing, brand new properties.

Getting to that point takes time and planning, but once you get there, the world is your oyster. You can rent or sell multiple properties, leverage them for equity, and keep growing your property portfolio.

A series of investment properties that are owned by one individual, a group of individuals, or a larger entity like a company or trust. The vast majority of individual property investors never get past their first or second investment property due to bad decisions, a lack of expert advice, and a combination of other factors.

The investment properties in your portfolio could be development projects or they could be rental properties. Some properties will be positively geared - where the rental income outweighs your outgoings, and others will be negatively geared - where the monthly income is less than the mortgage payments and other money you're spending. Both positive and negative gearing have their perks, from increased cash flow to tax write-offs.

A property portfolio that pays for itself, grows in value and is diversified.

It can be tempting to buy the same sort of properties in the same area for the same purpose to make your property portfolio more predictable. After all, you've already got a few properties that are generating a handy rental yield. You can just keep targeting similar properties in the same area for a snowball effect and a never-ending stream of income!

But when the rental market turns and all your properties have the same problem, you've multiplied the risk by 2x, 3x, 4x, or more!

Instead, it can be useful to have some properties that generate decent rental income (depending on your financial position), while you add high-growth properties to your portfolio. Some of the properties that you target for capital gains may also be rentals, while others will turn into development projects that can accelerate your capital growth and access to equity.

Properties with high capital growth are the golden goose that all serious investors are chasing, and they're the properties that will eventually get you out of the property game altogether (and onto the beach!)

Investor stock.

If you're buying a high-rise unit or an apartment that you couldn't pick out of a line-up, then you have to ask yourself why?

Is anyone going to want to buy or rent your unit in a market flooded with this type of property? Do you have any land to play with, and is there anything you can do to actively increase the value of your asset?

Or are you just buying an "investment" that's been sold to you by a developer with vested interests?

It's properties like this that you absolutely don't want or need in your portfolio!

Talking about an investment strategy is easy, but pulling it off takes time, data, and expertise. You're probably a busy professional. You're already short on time and your expertise is better used elsewhere. But you do have the potential to succeed in the property investment market.

Property Analytics offers a proven, data-driven process for buying investment properties and development sites in today's market.

Property Analytics was founded by me, Andrew Stone. Since 2010, my team and I have been supplying market research to some of the industry's biggest names. We can take that same data and leverage it to deliver results for you. Not just your first investment property - but permits and tenders to get developments off the ground and feasibility reports to help you make your next move.

As buyers advocates serving Rosanna, Thornbury, and Greater Melbourne, we specialise in the whole process, from strategies and budgets to purchase negotiations and development planning.

Reach out to Property Analytics to determine the best investment strategies to establish or grow your real estate portfolio.