Spanning approximately 1,000 square kilometres and incorporating over 2,000,000 properties, the Greater Melbourne area continues to grow larger with every passing year. From developments in Melton to the newly incorporated Mornington Peninsula, our city is now home to 31 local councils and over 500 suburbs.

Naturally, each one of these councils has its own unique property trends and set of statistics. While we won’t be able to cover every single one, this article is going to focus on five that paint a bit of a picture of the overall market dynamics.

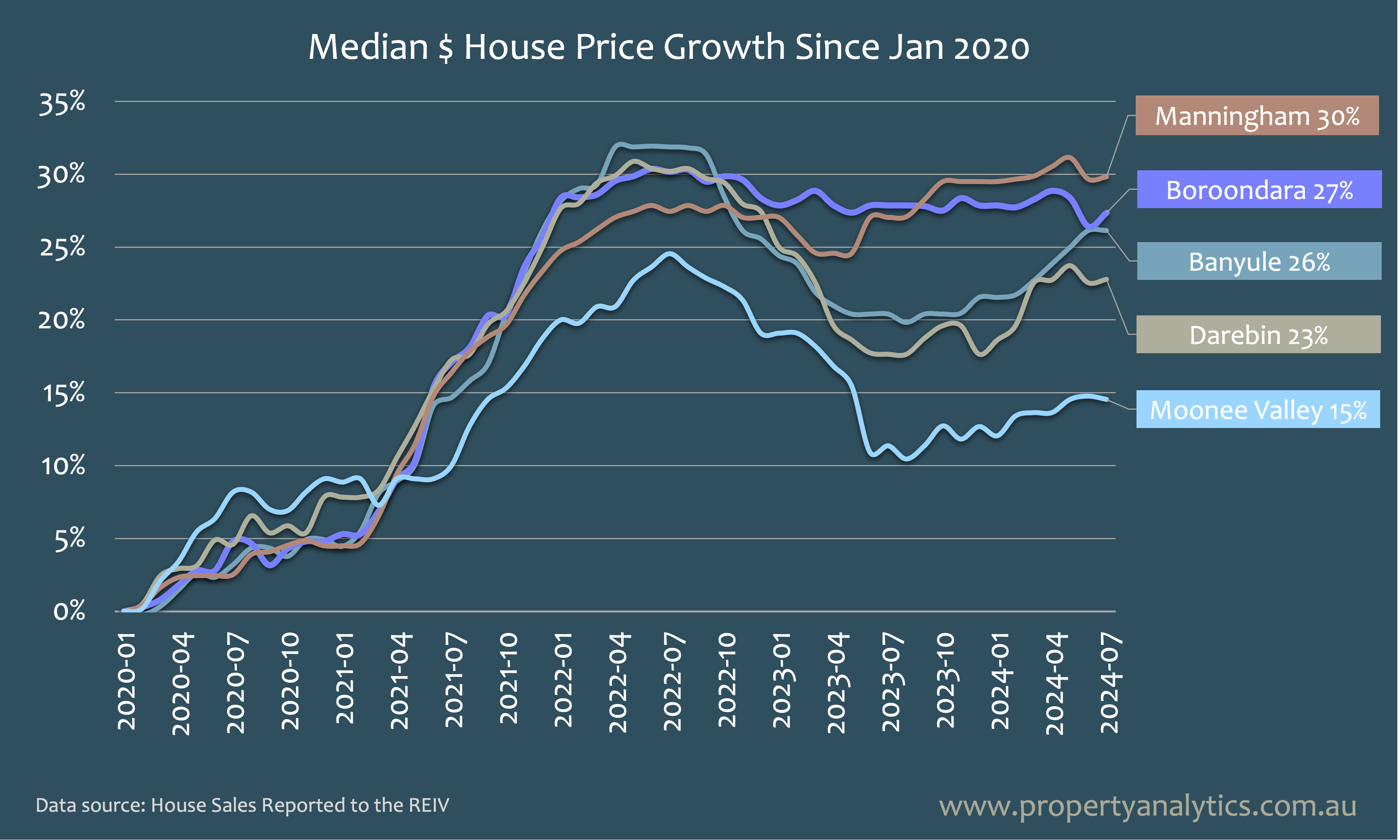

Manningham barely faltered in early 2023 and has been gradually climbing since.

Boroondara dropped a bit late in 2022 and has been steady since.

Banyule peaked big in 2022, dropped big in 2023 and has been rising since.

Darebin was trending similar to Banyule, albeit a bit choppier.

Moonee Valley grew less, fell hardest, and has been rebuilding for a while.

As you can see, each council area has its own unique set of circumstances. Let’s dive into the nitty gritty for all of these right now!

Location: North-eastern suburbs of Melbourne

Suburbs: Bellfield, Briar Hill, Bundoora (shared with Darebin and Whittlesea), Eaglemont, Eltham North (shared with Nillumbik), Greensborough (shared with Nillumbik), Heidelberg, Heidelberg Heights, Heidelberg West, Ivanhoe, Ivanhoe East, Lower Plenty, Macleod, Montmorency, Rosanna, St Helena, Viewbank, Watsonia, Watsonia North, Yallambie.

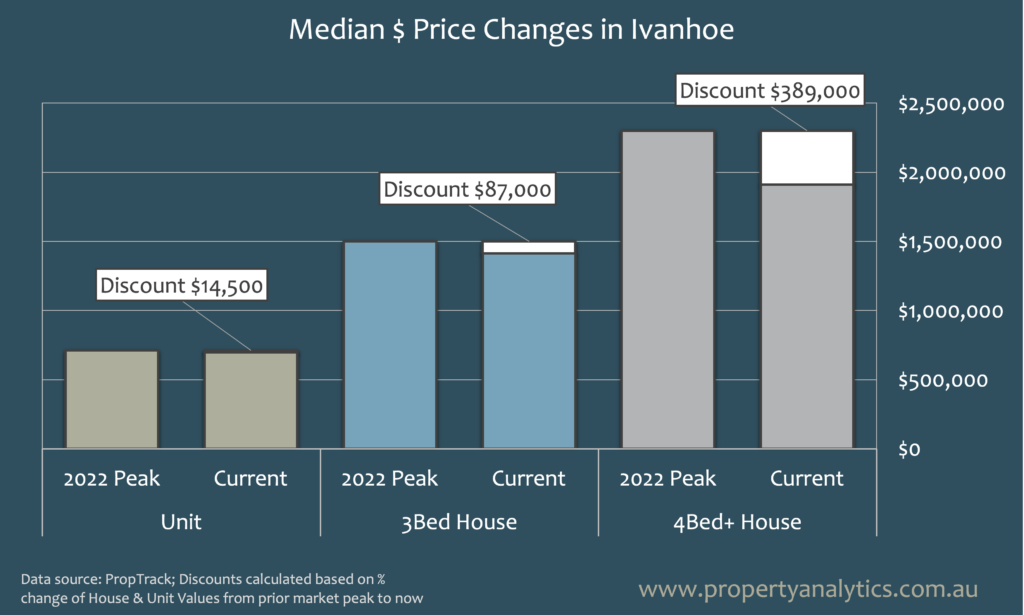

Banyule has definitely had an interesting ride in the property market. It hit a peak in 2022, saw a drop in 2023, and has been gradually recovering ever since. Known for its leafy, family-friendly suburbs like Heidelberg, Ivanhoe, and Greensborough, it features a great mix of classic suburban homes, charming period properties, and even some newer townhouses.

Location: Inner-eastern suburbs of Melbourne

Suburbs: Ashburton, Balwyn, Balwyn North, Camberwell, Canterbury, Deepdene, Glen Iris (shared with Stonnington), Hawthorn, Hawthorn East, Kew, Kew East, Mont Albert (shared with Whitehorse), Surrey Hills (shared with Whitehorse).

Boroondara has always been a ‘blue chip’ part of Melbourne, especially in the real estate world. What we can see from the data is that even despite market changes, its growth continues to be steady–especially when we compare the numbers from today to those of early 2020.

Location: Northern suburbs of Melbourne

Suburbs: Alphington (shared with Yarra), Bundoora (shared with Banyule and Whittlesea), Fairfield, Kingsbury, Macleod (shared with Banyule), Northcote, Preston, Reservoir, Thornbury.

Manningham

Location: Eastern suburbs of Melbourne

Suburbs: Bulleen, Doncaster, Doncaster East, Donvale, Lower Templestowe, Park Orchards, Templestowe, Templestowe Lower, Warrandyte, Warrandyte South, Wonga Park.

Known for its spacious family homes, townhouses, and a few sleek apartment developments, the area attracts everyone from families looking for room to grow to downsizers wanting a quieter pace of life. Suburbs like Doncaster and Templestowe continue to be popular, thanks to their green spaces, schools, and easy access to shopping and dining.

Location: Eastern suburbs of Melbourne

Suburbs: Bulleen, Doncaster, Doncaster East, Donvale, Lower Templestowe, Park Orchards, Templestowe, Templestowe Lower, Warrandyte, Warrandyte South, Wonga Park.

The property market here has shown steady growth, maintaining resilience even through recent shifts. Known for its spacious family homes, modern townhouses, and luxury apartments—particularly in Doncaster—the area attracts a mix of families, professionals, and retirees. With excellent schools, lush green spaces, and convenient city access, these suburbs offer an appealing balance of suburban comfort and natural beauty.

Location: North-western suburbs of Melbourne

Suburbs: Aberfeldie, Airport West, Ascot Vale, Avondale Heights, Essendon, Essendon Fields, Essendon North, Essendon West, Flemington (shared with Melbourne), Keilor East, Kensington (shared with Melbourne), Moonee Ponds, Niddrie, Strathmore, Strathmore Heights, Travancore.

Moonee Valley was one of the hardest-hit council areas during recent property market downturns, but it has since been steadily rebuilding. With a mix of heritage and modern homes, along with strong infrastructure, the area continues to attract a range of buyers, all the way from families to young professionals. Suburbs like Essendon and Moonee Ponds remain highly sought after (perhaps more sought after than ever).

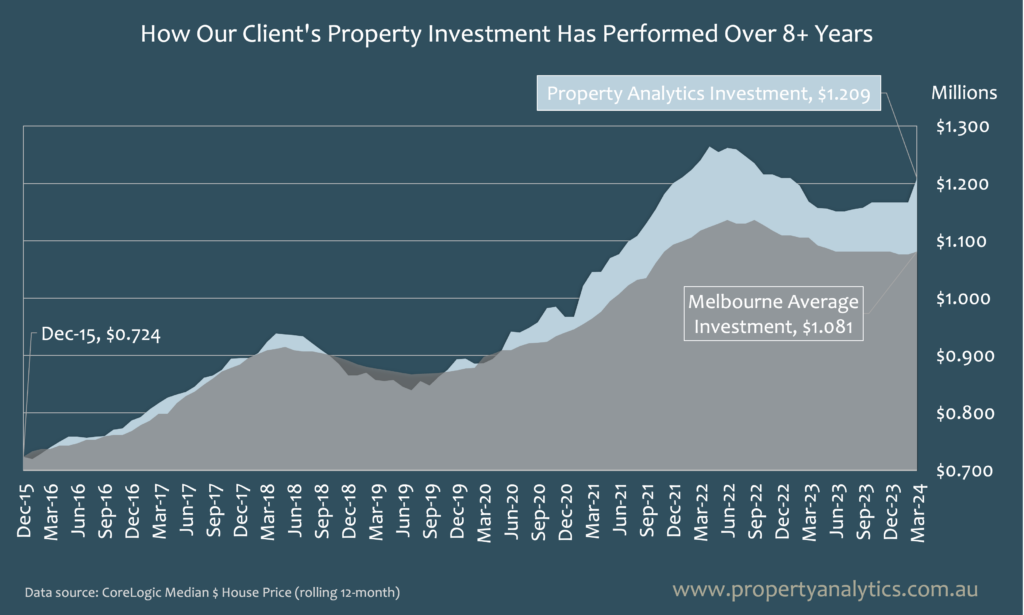

Real estate can be a murky business. As a result, deciding who to trust is part of the challenge. We’re proud of the reputation we’ve built as a data-driven company, and one that can be relied upon. We say what we think and do what we say.

We leverage our proprietary statistical analyses when acting as buyers advocates and property development consultants in Melbourne. Here are just a few ways we can help you achieve meaningful results and long-term growth.

At Property Analytics, we combine real-time data with pragmatic and practical industry insights to help you invest smarter. Instead of chasing underquoted properties that may not have the long-term growth potential, our goal is to provide you with accurate assessments of each and every opportunity, as well as looking beyond the obvious to uncover hidden gems.

We don’t just tell you where to invest; we analyse market trends, property performance, and future growth potential, all while creating an open and honest line of communication. It’s all about giving you confidence in your investment choices, knowing you're set for long-term success.

Some of the areas we can assist you with include:

If you’re a Melbournian, chances are that, like us, you’ve seen just how topsy-turvy the property market can be. But that doesn’t mean there aren’t excellent opportunities for growth and investment–in fact, there are prospects popping up every day (even right now as we speak).

At Property Analytics, we undertake detailed market analysis that not only keeps up with trends, but also allows us to stay ahead of the curve. Whether it's an opportunity in Manningham, Moonee Valley or a suburb you didn’t even know was part of Melbourne, we’ll provide data-driven insights that are more than a whim.

From shifting prices to emerging hot spots, or chances in buyer demand, we break down the data and present it to you in a way that's easy to understand. This means you can make informed decisions, whether you’re buying, selling, or investing.

We’ll provide you with:

Investing in Melbourne? Here’s Why Housing Market Analysis & Research is so Important

Taking the leap and deciding to invest is one thing, but everything that follows isn’t always easy–especially without professional assistance.

At Property Analytics, you can partner with a seasoned buyers’ advocate who can handle the hard work for you. We take time to understand what you’re looking for and use our market knowledge to find the right match.

You can count on us to get you the best deal, so you can feel confident and excited about your new property without the stress.

Wondering if you need a Buyers Advocate to purchase a house?’ Read our recent article for expert advice.

Interested in property development? Don’t overlook the importance of due diligence. Just because you can develop a property, it doesn’t necessarily mean that you should. In our experience, only about 10 in 100 Melbourne properties with development potential are worth exploring. Of these, only about 1 in 10 of those promise strong enough profits at an acceptable level of risk.

This is why it’s so critical to know if it’s viable or simply smoke and mirrors.

One of the best ways to know if a development is really viable long-term is to enlist our help and we’ll carry out a detailed feasibility study. At Property Analytics, we do the heavy lifting by analysing every angle of your project, from costs and zoning laws to market demand and potential returns.

We’ll help you understand whether your development is worth the investment or if adjustments need to be made. It’s all about giving you a clear picture of the risks and rewards, so you can move forward confidently with your plans.

Financial Projections: We provide detailed financial forecasts to help you understand potential returns on investment.