We know from experience that you can buy a good investment property when prices fall and markets soften. Be smart – know your values, negotiate well, and add value proactively.

The price boom we’ve experienced over the last couple years started running out of steam a few months ago. The Reserve Bank of Australia have lifted rates, and they’re indicating that rates will likely rise further.

House prices are down from their peak and tipped to fall.. Would you purchase an investment property in this market?

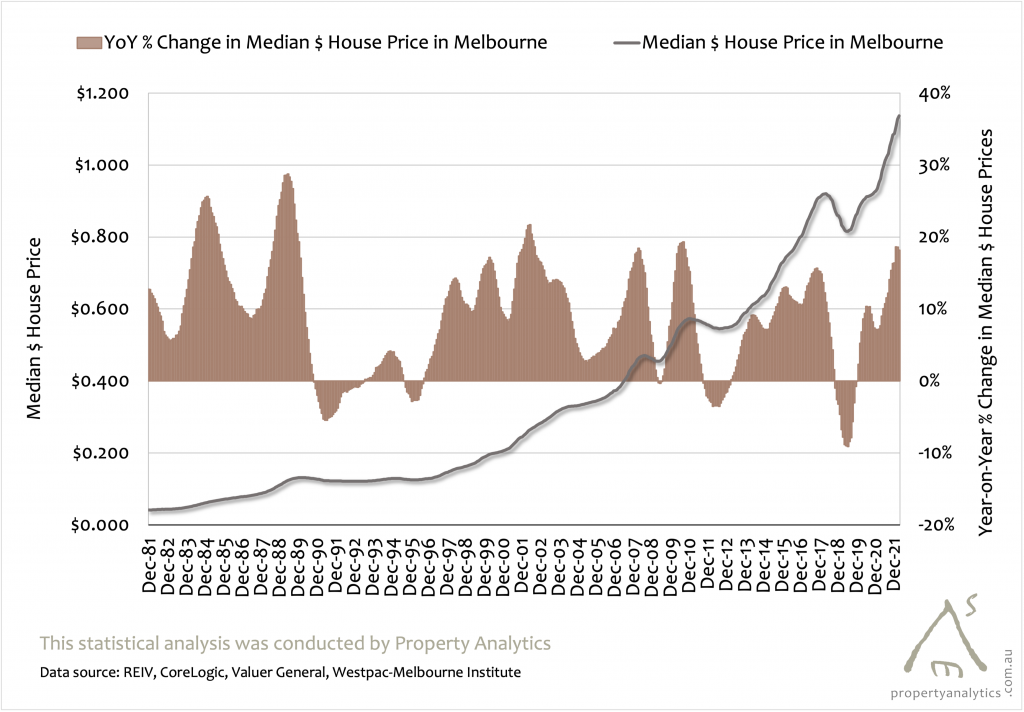

Remember when house prices fell significantly in 2018-2019? That was the sharpest market correction in living memory – the below graph shows that really clearly.

The market started to soften in late 2017, and prices began falling early the following year. Around that time, a builder that we had come to know asked us to keep an eye out for a development site.

Russ is a really sharp guy. He recognised that the market had shifted and that prices would potentially fall (though few people predicted them to fall by 10%!).

But, if we could buy him a good investment property, under market value, and with value-add opportunity, then he could succeed even if prices fell.

Russ said “If you’re standing still then you’re going backwards”. We totally agree, but put it a slightly different way…

- If you’re able to accurately assess market values, then you’re able to recognise bargain prices.

- If you understand leverage and motivations, then you can negotiate purchases on exceptionally favourable terms.

- If you know how to add value to properties proactively through planning and design, then you can make serious money.

There are a lot more off-market properties in a softening market.

In late June, an agent we know came to us with a large block in Ringwood East. Without going into personal issues, the vendors were very motivated to sell. They needed a settlement of exactly 6 months, and were aiming for a price between $1.0 to $1.05m.

Recent nearby sales pointed to good value at under $1.1m. The existing dwelling was in pretty good condition and would rent well. We ran a feasibility and a development of 3 good sized 4bed houses would deliver strong profits. Was Russ interested? Absolutely.

The market was clearly softening, and who’s to say that the property would be worth the same in 6 months?

The vendors didn’t want to advertise, they needed to get a signed contract quickly. After some serious haggling, we secured the property for just under $0.98m.

Russ cracked on immediately with the planning and design process. After settlement, he got a good renter in. Eventually, after a typically hard slog with Maroondah Council, he attained a planning permit for 3 houses. Once working drawings and engineering were in place, he costed the job up.

The problem was that Russ was bloody busy building for clients. He struggled to fit the build into his program of work. The market started to pick up considerably through 2020-2021…

Why not sell the property as-is with the plans and permits?

I recommended a good local selling agent for Russ to talk to. They decided to take the property to auction in October 2021, and it sold under intense competition for over $1.4m.

Russ trusted our advice and made really good money through a smart property investing strategy when prices were falling.

- We demonstrated that the property was worth more than what the vendors were asking – both by looking at comparable nearby sales and by conducting a comprehensive feasibility study.

- We understood the vendor’s motivations and applied leverage through negotiations to secure it for well below market value.

- Russ secured really good plans and permits, designed to appeal to the increasingly affluent demographic of young families in the area.

The market ran extremely hot from 2020-2021. A lot of buyers overpaid for properties (not our clients!).

We’re entering into a challenging market. Even though strong employment and savings levels mean that widespread forced sales due to interest rate rises are unlikely, most analysts are predicting price falls.

There will be really good property purchase opportunities in coming months.

Particularly off-market with favourable settlement terms. Be smart about values, negotiation tactics, and planning permits, and you could make a couple hundred thousand dollars profit like Russ did.