Melbourne’s property market has long been recognised as a vital player in Australia’s real estate scene. From charming inner-city terrace houses to sprawling suburban homes, its breadth and diversity champions endless investment opportunities.

Of course, ‘endless’ is a bold claim, however, there’s plenty of evidence to back it up.

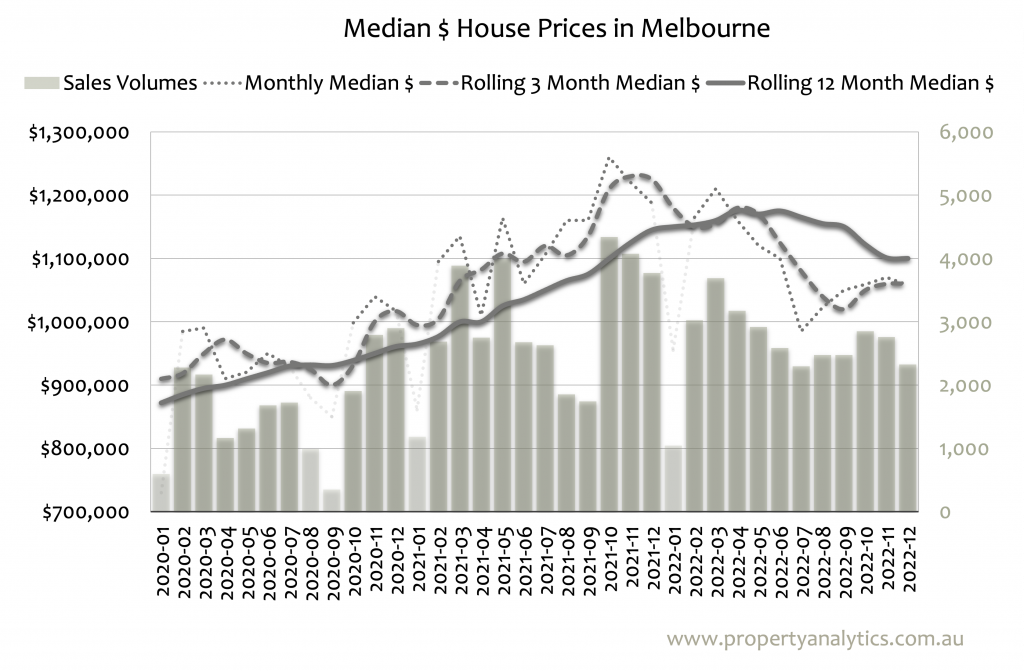

Recent data from CoreLogic tells us that Melbourne’s property market has experienced an upturn in median house prices, with a 5.3% rise in dwelling values over the past year. And considering that Melbourne has recently become Australia’s most populous city, it has the right formula for future long-term growth.

This surge in property values is driven by a few factors, including population growth and infrastructure development, both of which have positioned Melbourne as a prime choice for property investment. Despite economic and environmental impacts over the past few years, the resilience of the property market reflects its strong fundamentals and underscores its investment appeal.

In Melbourne, the choice between investing in houses and apartments can greatly influence your financial outcome. Let’s further explore the investment potential of Melbourne’s property market as well as the financial implications tied to each property type.

The Role of Land Value in Property Investments

While it may change from suburb to suburb, the initial prices of houses and apartments usually differ significantly. Houses, with their larger space and potential for land appreciation, tend to have a higher initial cost. On the other hand, apartments, although smaller, offer a more affordable entry point into the property market.

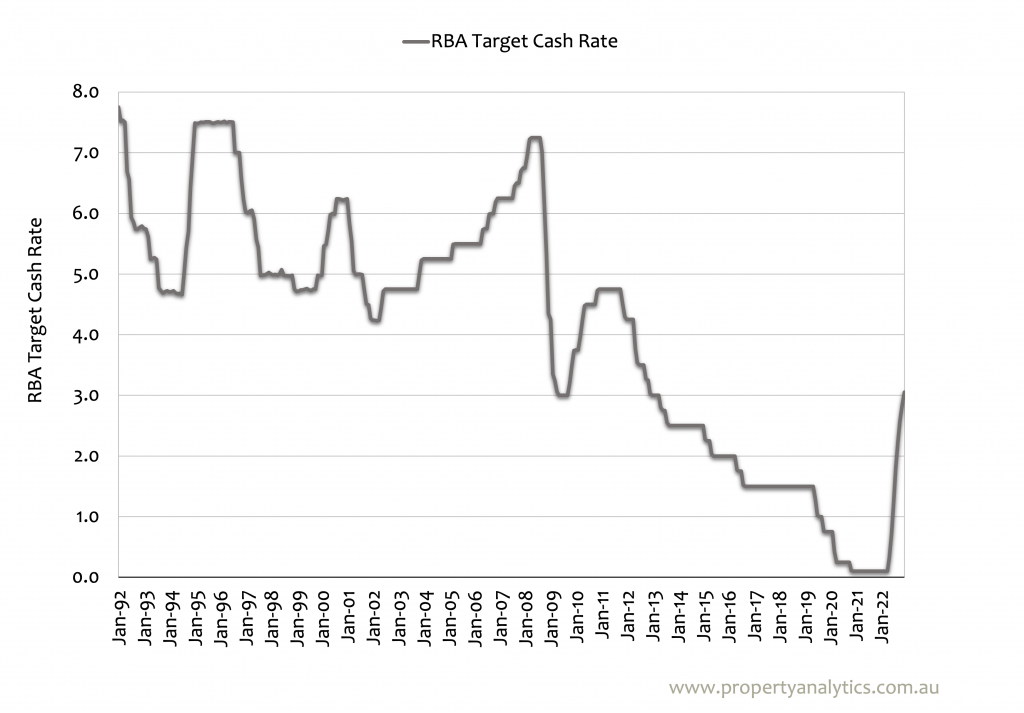

However, a Melbourne property’s value is intrinsically linked to the land on which it’s situated. Consider this: When you buy a property, you’re essentially investing in two components — the land and the building. While the building depreciates over time, the land typically appreciates.

Current market trends show that established houses, especially those on large land parcels, offer substantial long-term capital growth. This growth is primarily driven by the underlying value of the land, which tends to appreciate more than the property itself.

Apartment or House: Which is the Smarter Investment?

When it comes to property investing in Melbourne, the house always wins. At Property Analytics, we purchase established houses on decent-sized blocks on behalf of clients who are seeking to increase their wealth.

But why the focus on established houses?

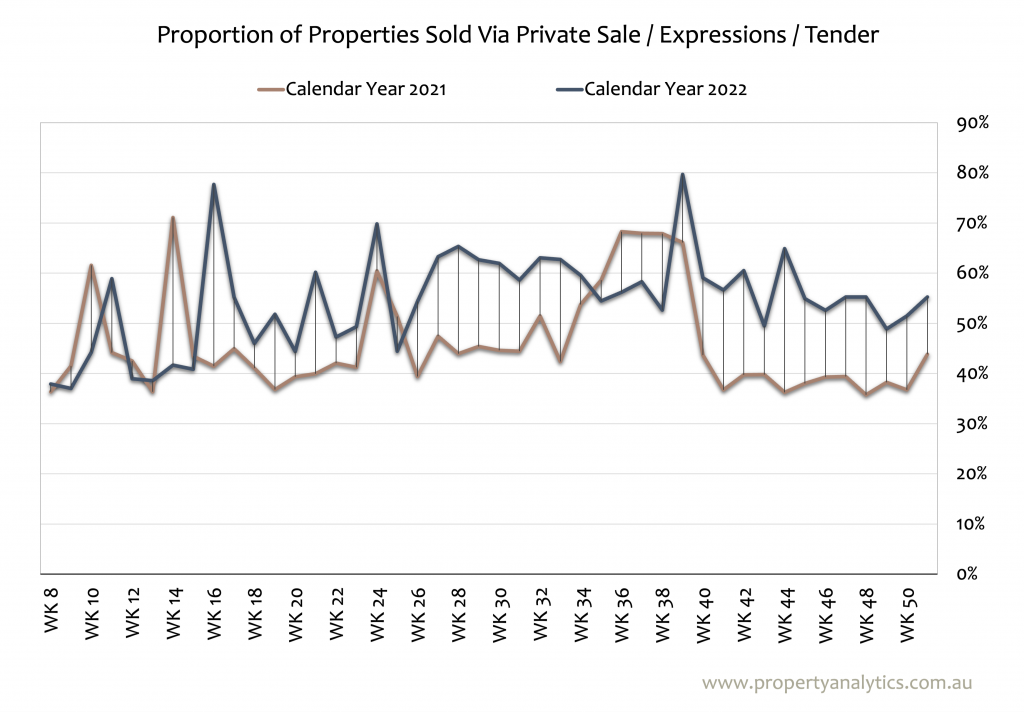

The answer lies primarily in their rarity and the high demand for such properties. In turn, these factors then work to drive up their market value. Unlike apartments, which can be rapidly developed in large numbers, the supply of established houses is limited. This makes them a more stable and potentially sound investment.

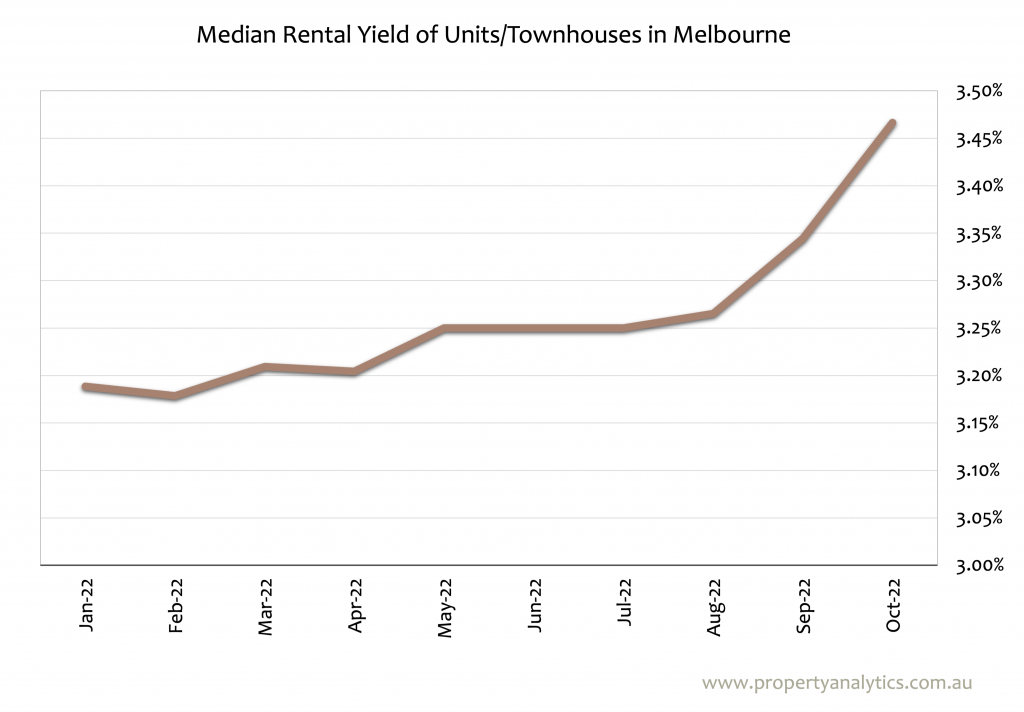

Houses are generally more expensive than apartments, and the rental yield you get from them is relatively lower. But, our analysis proves that houses make for far better investments over apartments because capital growth is more important to building wealth than rental yield.

The takeaway? Higher purchase prices and holding costs are the main reasons why property investors would consider apartments over houses.

With decades of buying experience, Property Analytics are your trusted buyer’s advocate in Melbourne. You can learn more about why we favour houses over apartments when it comes to property investments here.

Crunching the Numbers: Asset Appreciation vs. Cashflow

Wealth is created through asset appreciation, not through cash flow. In other words, you should prioritise capital growth over rental yield.

The most successful property investors recognise this truth, and invest in the type of properties that increase the most in value over time: houses. Land appreciates in value, whereas the dwellings that sit on land tend to depreciate in value. Think about why you get a property depreciation tax break when you rent out newly built properties? Properties with reasonable land content (e.g. houses or townhouses) experience significantly higher capital growth than properties that lack land content (e.g. apartments/units).

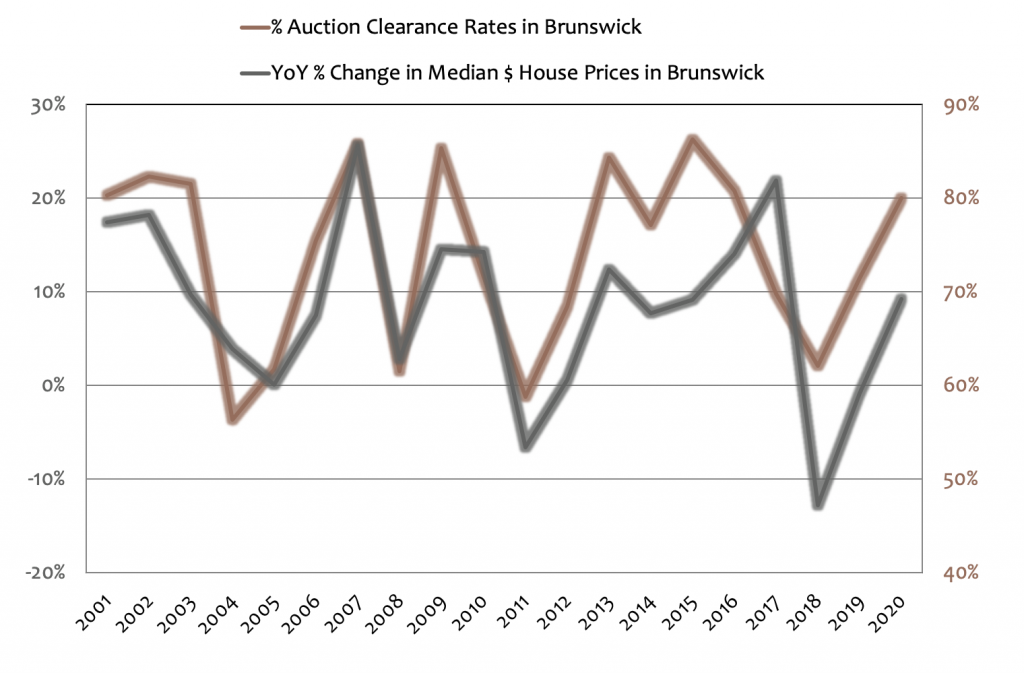

Most of us know this intuitively, but what does the data say?

- Year-on-Year % Growth in House Prices of 10-15% has been common, whereas Unit Price Growth typically hovers around 5%

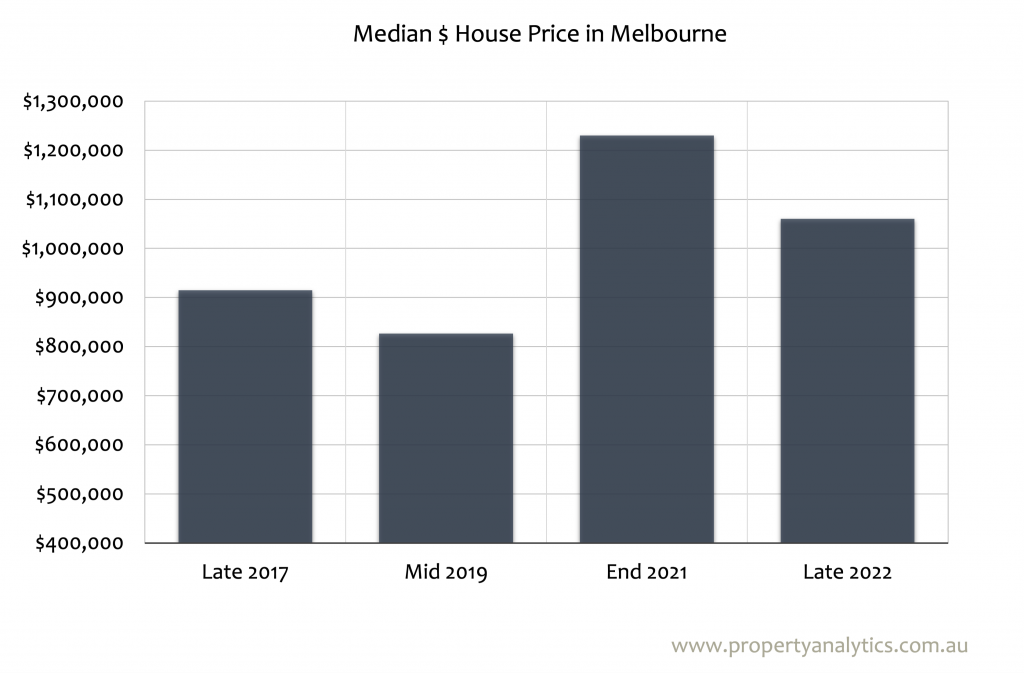

- During Melbourne’s last growth cycle, from 2013-2018, House Prices increased far more than Unit Prices: from $548,000 to $921,000 (+68%) versus $484,000 to $619,000 (+28%).

- Even allowing for the worst deflationary period in living memory, from late 2018 to mid 2019, house prices today are +60% higher than they were in early 2013; Unit Prices are +40% higher.

The 3 key metrics that every property investor should know:

- The Equity ($ Cash) Needed to purchase and retain a property investment – based on the Loan:Value Ratio and mortgage repayments made after rental income

- The Equity Gained through Capital Growth

- The Net Position – difference between Equity Needed and Equity Gained

In a common example, a house would have cost you about $120,000 more in 2012, and assuming an 80% LVR, that would mean you’d have had to stump up an extra $24,000 of your own cash at the time of purchase. And, because the rental yield of the house is lower than a unit, you’d have to tip in an average of $4500 per year to support the mortgage, compared to about $2400 for an Apartment.

But, because house price growth has been so much greater than Unit Price Growth, you would be far better off today – like $124,000 better off.

Invest smarter, not harder. Seek expert property investment advice from the best buyer’s agent Melbourne has to offer.

What Type of Property Should You Buy As An Investment in Melbourne?

This brings us to the next point — strategic property selection. Investing to grow your wealth isn’t as simple as buying a house over an apartment. With the assistance of a buyer’s agent in Melbourne, in-depth research, strategy, and planning is the pathway to a smarter investment.

Regarding established houses, location is a key determinant of value. Look for properties in desirable neighbourhoods with solid infrastructure and promising future development plans. Consider local amenities such as schools, shops, and public transportation. These factors not only contribute to the property’s desirability but also its potential reliability.

Below is a list of the top ten most livable suburbs in the Greater Melbourne Area, according to RMIT’s 2022 Social Infrastructure Index – which rates popular suburbs according to factors like access to services like health, train stations, education and community centres.

- Collingwood

- Fitzroy

- North Melbourne

- Carlton

- South Melbourne

- Carlton North

- Richmond

- Flemington

- Windsor

- Fitzroy North

As you can see, the list above is dominated by the inner North and its surrounding suburbs. If this isn’t your cup of tea, we’ve compiled a list of The Speediest Melbourne Suburbs for Real Estate Sales.

Are you thinking about dipping your toes into Melbourne’s property market but don’t know where to start? Turn to Property Analytics, a seasoned buyer’s agent for Melbourne investment properties.

Melbourne’s Long-Term Real Estate Investment Potential

How does the long-term value of houses compare to apartments? The evidence from Melbourne’s real estate market over the past seven years suggests a compelling case for houses. With a consistent growth trajectory that appears poised to persist according to current data and market forecasts, houses demonstrate their potential as a lucrative investment option.

If you’re seriously considering dipping your toes into the Melbourne property market, take the time to understand the basics, examine the metrics, weigh up the financial implications, and, most importantly, make an informed, strategically sound decision. Property investment, after all, is not just about short-term gains. It’s ultimately about building long-term wealth, and Melbourne’s market is one that could help you do just that.

Get in Touch with the Top Buyer’s Agent in Melbourne

It’s clear there are investment opportunities popping up in all corners of the city. If you want to team up with experienced investors and buyer’s agents in Melbourne, just give Property Analytics a shout. They’re here to provide real help and guidance as you navigate the ever-changing property market.