As you set your sights on your dream property, it’s only natural to feel a sense of anticipation and enthusiasm. These emotions, however, should be tempered with a dose of practicality. Have you got all the right information to make a smart decision?

If you’re serious about buying a property, you need to ask the right questions – and lots of them. Why? By the time settlement day arrives, it’s too late to address any issues with the property, and they become your responsibility.

As the eyes and ears of the real estate market, an experienced buyer’s advocate knows Melbourne and can address all your questions and concerns. A buyer’s advocate is a licensed real estate professional who works exclusively for you, the buyer. They are legally obligated to protect your interests and deliver expert guidance to facilitate the best possible deal on your behalf.

So, before you sign the dotted line, start by asking your buyer’s advocate these 10 essential questions:

1. Who owns the property and why are they selling?

As a buyer, you need to understand the identity of the property owner and the reasons behind their decision to sell. This knowledge can also impact the negotiation process in a significant way.

Here’s a quick example: If the seller has already secured another property and is in a hurry to sell, there may be more opportunity to negotiate a lower price. Whatever the motivation, whether it’s downsizing or a divorce settlement, assessing the seller’s intentions can give you a strategic advantage.

2. What are your thoughts on the location?

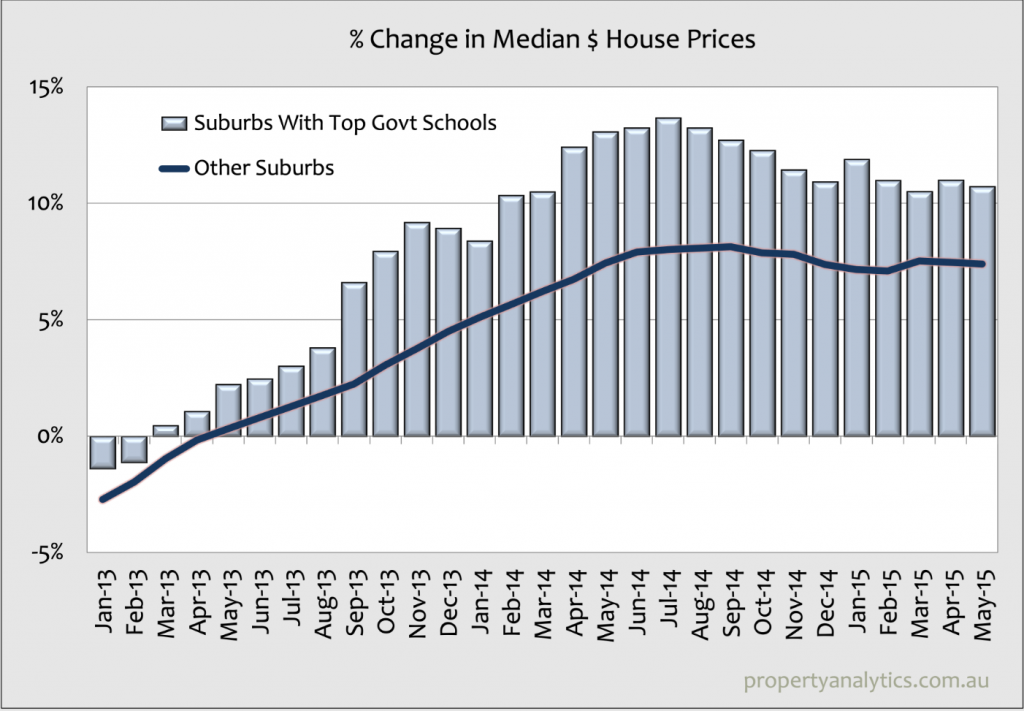

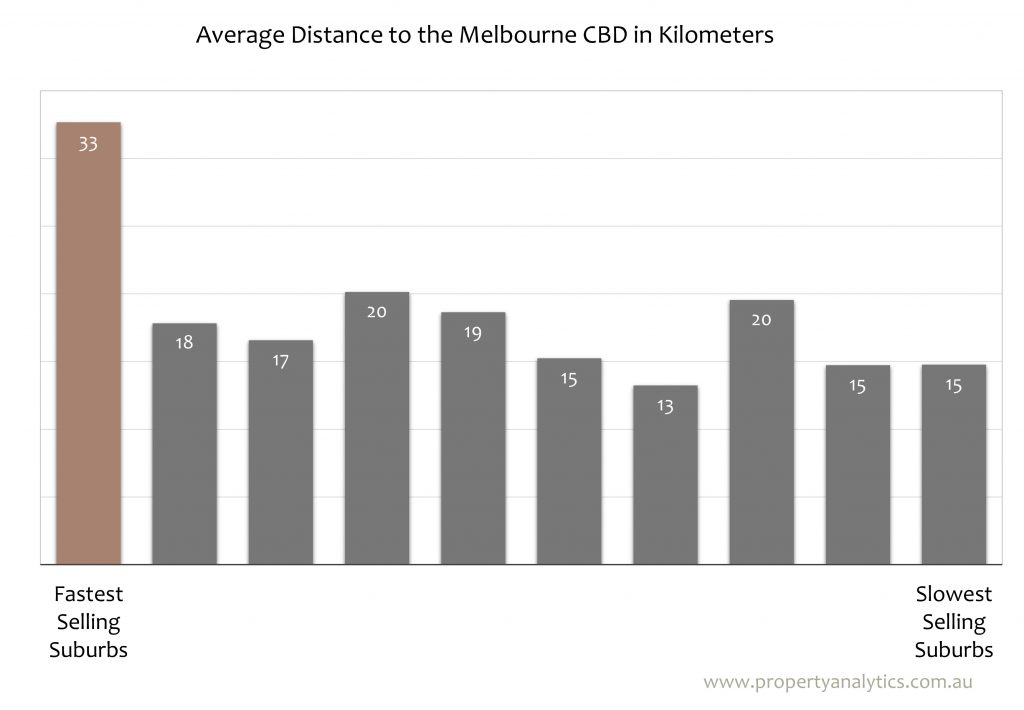

The surrounding area of a property is as important as the property itself. Looking at the area’s demographics, as well as the suburb profiles (amenities, access to transport, parks, schools and so on), is very important. How come? You’re not just buying a house – you’re also buying into an area.

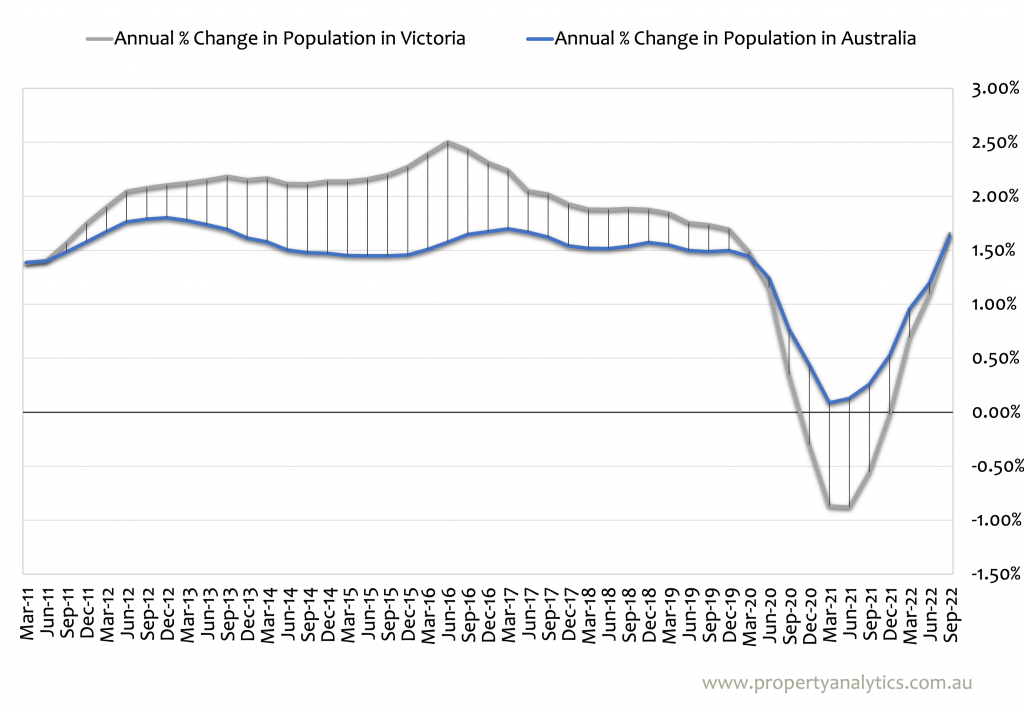

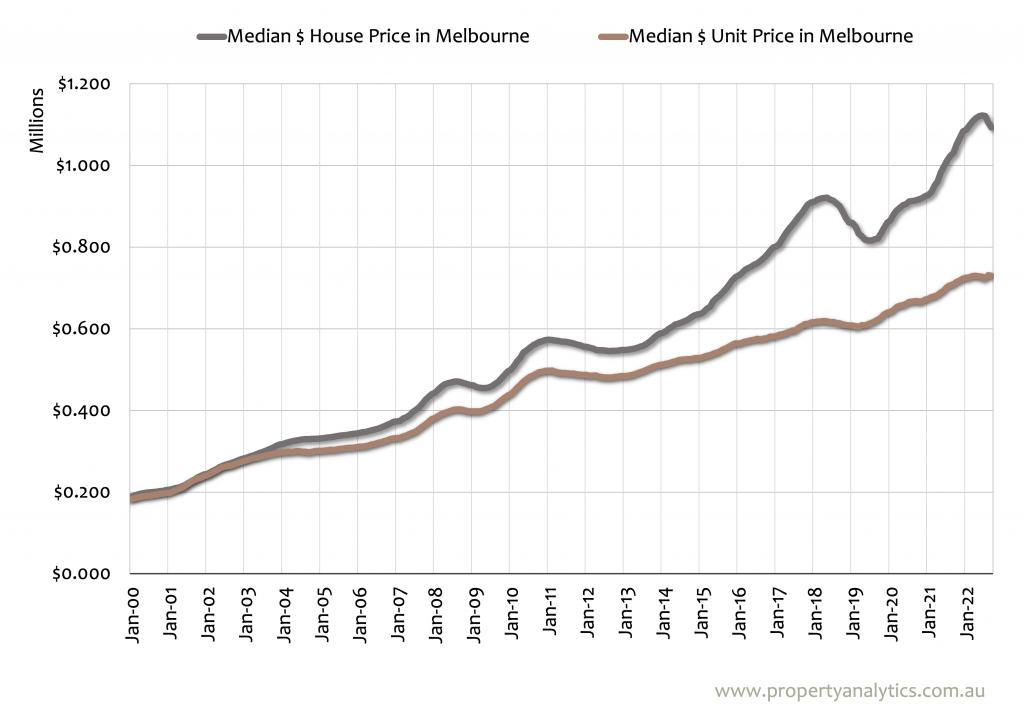

A good buyer’s advocate in Melbourne can provide a treasure trove of information and insights about the locality, the neighbourhood, and more. They can equip you with data on demographics, property pricing, local population statistics, growth rates, and prevailing market trends. This additional knowledge and insight allow you to make a more informed assessment of whether a particular price for a specific street or location within a suburb is reasonable.

Want to know if the area is full of young professionals, families, students, or seniors? Or if the area has grown recently in popularity with one of these groups? As seasoned buyer’s advocates in Melbourne, you can chat with Property Analytics about these details.

3. What are the neighbours like?

Applicable to both residents and businesses, friendly and respectful neighbours can significantly contribute to the overall ambience and experience of your chosen locality. This is both relevant to those buying for themselves, as well as anyone buying for the purposes of investment.

While visiting the area at different times of the day can provide some insights, a buyer’s advocate in Melbourne can offer valuable information about the neighbours and the community you otherwise wouldn’t easily uncover on your own.

4. Have there been any recent renovations?

Understanding the property’s renovation history is crucial for assessing its true value. If significant renovations have been carried out recently, you need to take this into account when comparing the property’s current market price with its last sale price. Verifying that these renovations received council approval and met the necessary quality standards is equally as important.

You should also get to know any existing warranties or any local development applications that might have implications for the property’s future. Once you have a grasp of the property’s renovation history, you’ll be better equipped to evaluate its potential risks and advantages, as well as an accurate assessment of its true market value.

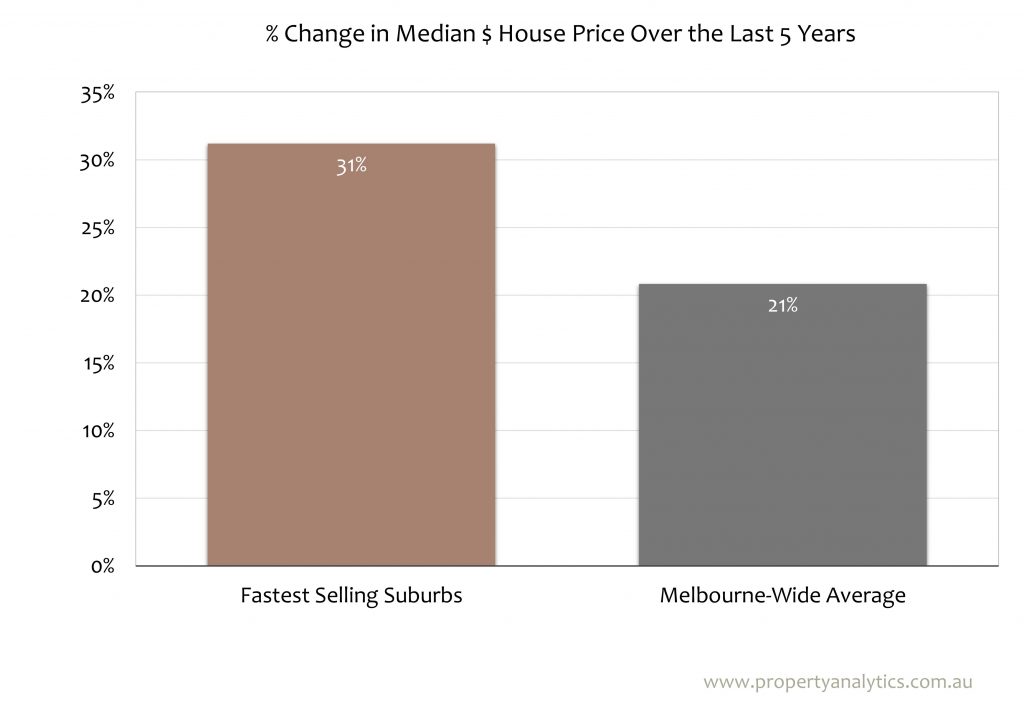

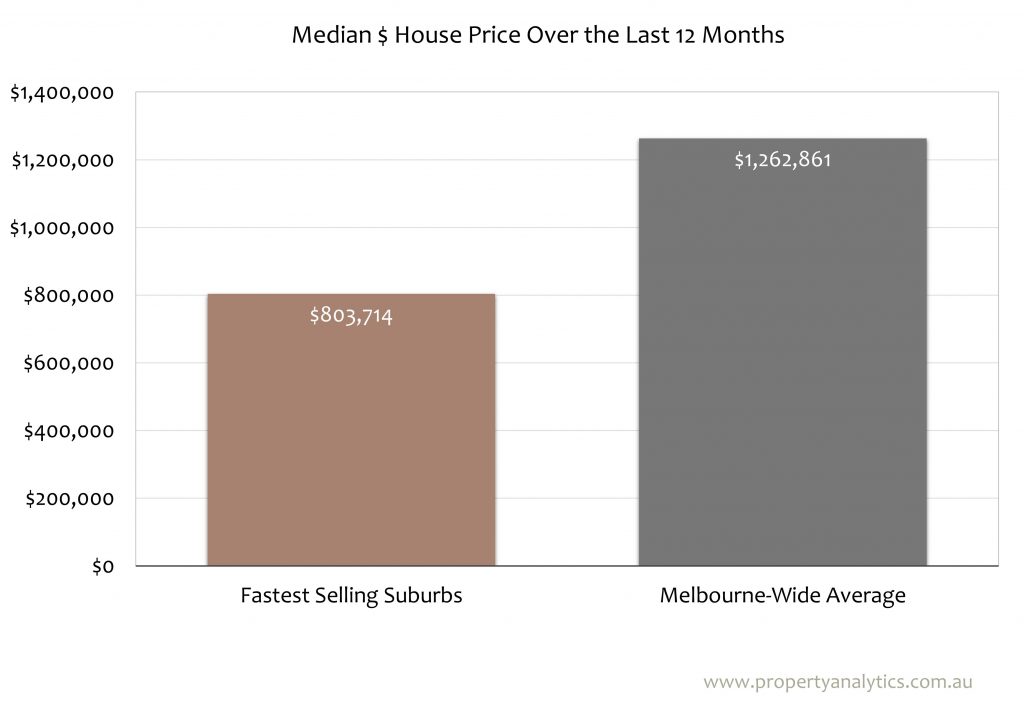

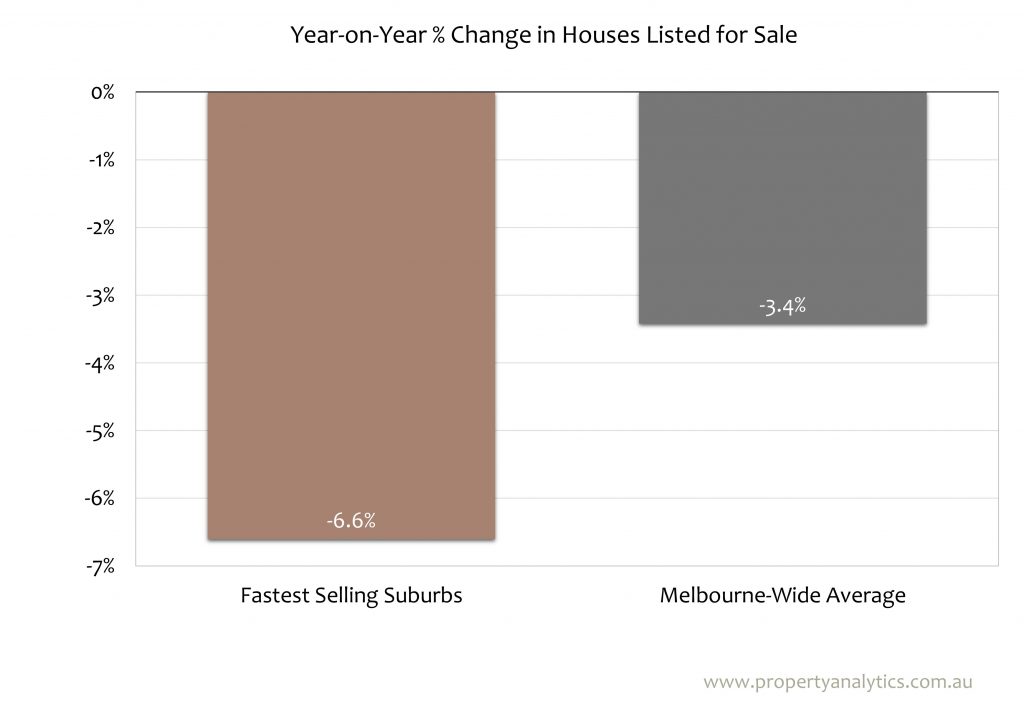

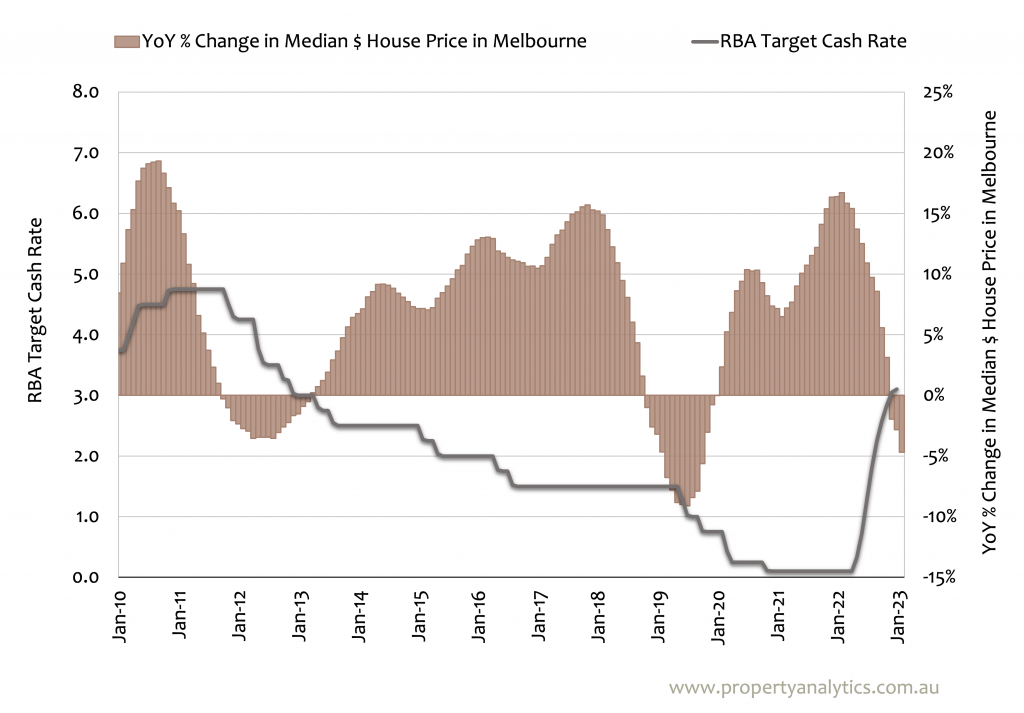

5. Have there been similar sales in the past year?

This question is invaluable as it allows you to gain real insights into the demand for properties comparable to the one you’re interested in, and the price range to anticipate. It also allows you to gauge the realism of the seller’s asking price and empowers you to make a fair offer. Another general recommendation is to enquire about the number of properties sold in the area recently, pricing trends, and any seasonal fluctuations in the market.

Property Analytics keeps a close eye on insights and studies of the Melbourne property market. To get in touch with a top buyer’s advocate in Bulleen and surrounding areas, reach out today.

6. Can you show me a recent property sales report to show what the house is worth?

This is an important but often overlooked question with three parts:

1) Enquire why the property is listed at its current price;

2) request a recent sales report;

3) and ask for a showcase of similar properties and their sale prices.

These reports make sure that you’re not overpaying and that the property is fairly priced compared to the local market.

7. How long has the property been on the market?

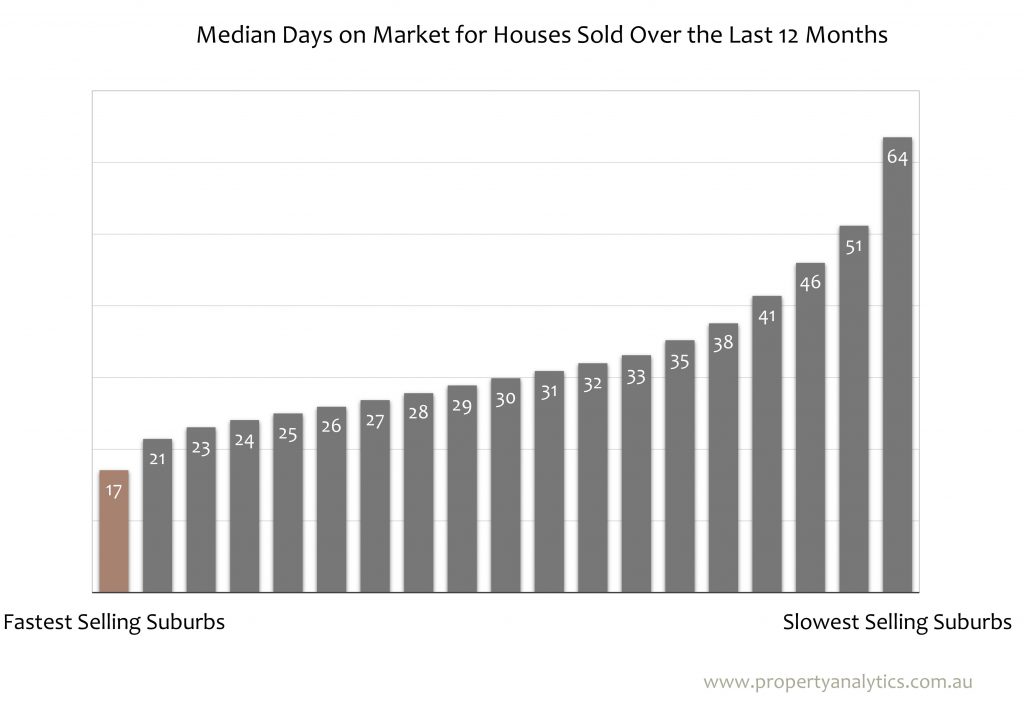

The duration a property has spent on the market tells a real story. If a property lingers for more than six weeks, it might be overpriced or have underlying issues. In Australia, the average time for a home to sell is approximately one month, so significant deviations warrant scrutiny. Here, you should ask whether the property went to auction and failed to sell, and if so, enquire about the specifics surrounding the auction, including the pass-in price.

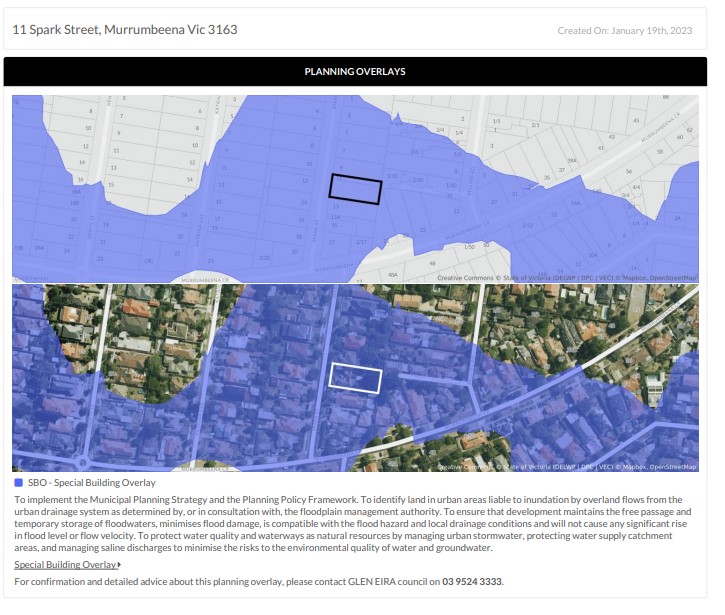

8. Are there any known issues with the property, land or neighbours’ properties?

Sometimes, unforeseen issues impact a property’s value, so it’s quite important to question the agent. While your building inspector and conveyancer are poised to identify most potential concerns, consulting with the agent before signing the contract can uncover additional insights. Buyer’s advocates in Melbourne often operate in good faith and may disclose any issues that could affect your decision.

What questions should you be asking? Start with any known issues regarding the property, land or neighbouring properties. For example, if there was a past dispute between neighbours that could result in future issues, this should be discussed. Another issue could be a neighbour’s construction project that may have an impact on your views or privacy. The agent may also know of any zoning regulations that are likely to affect your future plans.

9. Are the sellers open to negotiating on the price?

If you want to secure a property at a favourable price but the listing exceeds your budget, it’s important to gauge the seller’s willingness to negotiate. Understanding the minimum amount at which the seller would consider a sale enables you to assess your affordability and whether further pursuit is warranted. Of course, this also depends on the current demand and number of interested parties.

When negotiating the price of a property, there are several questions you should ask your buyer’s advocate in Melbourne to set you up for success. Get in touch with Property Analytics for valuable market insights.

10. And what’s the sales history of houses in this area?

Researching the sales history in the area is always advisable. This data provides a comprehensive outline of recent property values, their evolution over time, and potential return on investment, Engage with a buyer’s advocate for insights on the number of properties sold in recent years, prevailing market trends, sale prices, peak selling seasons, and other relevant information. The more thorough the investigation, the more you’re equipped with valuable market knowledge to negotiate the best price.

The Importance of a Buyer’s Advocate to Facilitate Your Property Purchase

When you are in the process of purchasing a property, there is no better resource to have on your side than a buyer’s advocate.

However, the effectiveness of their role hinges largely on your ability to ask the right questions. These questions will not only give you a clear understanding of the property market and the potential of your chosen property, but also allow you to evaluate your agent’s expertise and commitment to your cause.

Remember, it’s not just about the property; it’s about the context surrounding all aspects of the transaction – so make sure you ask. There’s no harm in taking the time to gain more clarity and take full advantage of the advocate’s wealth of knowledge.

Looking for a Buyer’s Advocate in Melbourne? Let’s Talk

By now, you should have some burning questions for your buyer’s advocate. As a proactive and inquisitive buyer, you’ll be rewarded with deeper insights into the property, the seller’s motivations, and various other considerations that will help you manage your budget effectively.

If you are a prospective buyer, reach out to Property Analytics, your trusted buyer’s advocate in Bulleen and surrounding areas of Melbourne.